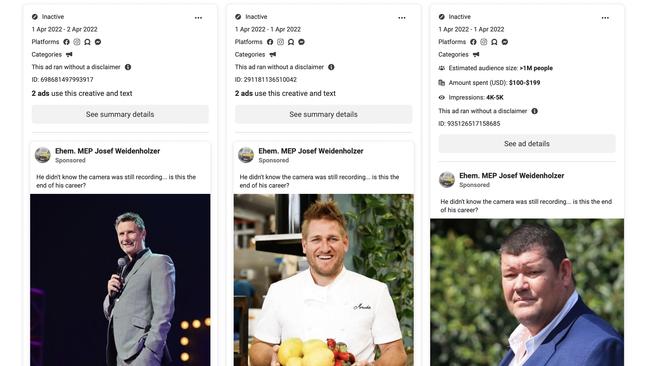

Phony billionaires on Facebook are scamming Americans out of their life savings

A fake Bill Ackman, a bogus Cathie Wood and a false Steve Cohen are among impersonators luring victims on social media, and their real-life counterparts can’t get rid of them fast enough.

Bill Ackman is fighting a losing battle against Bill Ackman. Impostors posing as the billionaire hedge-fund manager on Facebook keep luring hapless investors into stockmarket scams — and the real Ackman has been powerless to stop them.

Ackman’s Pershing Square Capital Management has found more than 90 different ads impersonating him. Many of the ads remained visible for weeks after the company flagged them to Facebook, said Pershing Square spokesman Fran McGill. One ad promised annual returns of 125 per cent, another a 25 per cent return in a week and told victims to “hold these three stocks and you’ll be a millionaire.”

As soon as each was removed, others popped up.

“It’s like a game of Whac-a-Mole,” McGill said. “It’s been a huge problem and all social-media companies need to do more to prevent people from being scammed like this.”

Ackman isn’t the only titan of finance to meet his match on social media.

Cathie Wood’s ARK Investment Management has spotted thousands of ads that impersonate her. Fake versions of Peter Lynch of Fidelity Investments, Ray Dalio of Bridgewater Associates and hedge-fund manager Steve Cohen, owner of the New York Mets, peddled variations on the same scam in recent months.

The ads lure victims into joining WhatsApp groups to get stock tips from supposed associates of the big-name investors. In reality, they are just a new take on the classic pump-and-dump scheme. Small-time investors have collectively lost millions of dollars.

“They were sophisticated and well-organised, but it’s still embarrassing to be taken by any scam,” said Peter Bourget, a construction-company owner in Atlanta who lost $US45,000 ($68,558) when the penny stocks he was told to buy nosedived.

Regulators have sounded alarms. Finra, a securities-industry regulator, issued a warning Jan. 11 that it “has seen a recent significant spike in investor complaints resulting from recommendations made by fraudulent ‘investment groups’ promoted through social media.”

The Federal Trade Commission, which polices deceptive business practices in the US, says reported impostor scam losses tripled between 2019 and 2023 to $US2.7 billion. The trend is “increasingly prevalent and harmful,” FTC marketing practices attorney Christopher Brown said.

Facebook parent Meta Platforms said in September 2021 that it had 40,000 people including outside contractors working on safety and security issues, and that Facebook uses artificial intelligence to block fake accounts. However some experts say such efforts have since flagged amid several rounds of job cuts at Meta.

A group of nine scam victims sent a letter February 28 to Facebook detailing 21 times scam ads of Ackman, Cohen or Wood were reported to Facebook in January and February. The letter said Facebook support replied to all the complaints that the ad “doesn’t go against our standards.”

People working for ARK’s Wood signed her up for a “Meta Verified” account in December in hopes that having one would spur Facebook to take down the fake ads more quickly. Ackman signed up for one earlier this month.

In a statement, a Meta spokesperson said, “Scammers use every platform available to them and constantly adapt to evade enforcement. We invest heavily in our trained enforcement and review teams, have specialised detection tools to identify fraudulent activity — including to find celeb-bait — and ban ads that use public figures to try to scam people.”

Facebook has said that company policies encourage reporting of fake accounts and scam ads, and last year the company said it removed 1.1 billion pieces of spam content in the second quarter, 95.3 per cent proactively before they were reported.

The pitch

The fake ads range in sophistication but use the same formula and sometimes similar language asking investors to join a WhatsApp group and to get in contact with a supposed member of their team. Ads for Ackman, Wood and Dalio gave an identical name.

Some ads feature deepfake videos, such as one that falsely depicts former Fidelity Magellan Fund manager Lynch on CNBC’s “Squawk Box” show saying “join us and you will get the opportunity to double your income and achieve financial freedom more easily.”

A bogus ad for Steve Cohen that appeared on Facebook on January 17 was headlined “Steve’s Wealth Sharing,” and boasted: “A stock I shared in the group last month rose by 45 per cent.” Bogus ads of Wood on Facebook also touted a 45 per cent gain — sometimes in a week, and sometimes in a month.

And ads showing Wood and Dalio both talked of their stock picks returning 87 per cent in a week, and use the same heated language to predict their future success: “The best of these companies will unleash nuclear-like growth in 2024,” Dalio’s ad says.

In real life, Wood’s flagship ARK Innovation fund has actually had such stratospheric returns — 153 per cent in 2020 and 68 per cent in 2023. But it also suffered serious downturns of 23 per cent in 2021 and 67 per cent in 2022. The real Bridgewater flagship has been a lot less nuclear, losing 7.6 per cent in 2023 after gaining 9.4 per cent in 2022. Dalio relinquished ownership control in 2022.

Some of the fake Facebook ads drew sceptical comments, with one noting that the real Cohen didn’t need to get involved “in some sketchy operation to ‘help’ ordinary folks gain wealth.” Another joked, “Hopefully things will fare better with this group than how Stevie is managing with the Mets.”

Staffers at Cohen’s Point72 Asset Management have been frustrated at how challenging it’s been to get the bogus posts taken down. The January 17 post remained up for more than a month on Facebook, and another popped up soon after it was taken down.

Matt Burton, a venture-capital investor who formerly worked at two ad-tech start-ups that were sold to Google and Facebook, said scammers may choose Facebook because its members are generally older than those on Instagram or TikTok and thus wealthier and less sophisticated. What’s more, he added, “Facebook has look-alike audience targeting for people who have clicked on ads like these.”

How the scam works

Some of the victims of the Cathie Wood scam ads were directed to a Facebook page asking about their investment history and then into a series of WhatsApp groups, often moderated by two fictitious people who claimed to be associates of Wood at a separate make-believe company called Red Sea Fortune Investment.

The victims were later urged to join a “VIP room” to get specific stock picks. One victim said a fake assistant, who went by the name Ava Evans, would share pictures of her breakfasts and flowers and ask personal questions as she encouraged her to invest more with each trade.

Cathie Wood’s ARK issued an alert about such scams, and its director of operations William Scherer posted a notice on LinkedIn in January that he had been impersonated. “Any WhatsApp messages that may seem to be coming from me are a scam,” he wrote.

Bourget, the construction-company owner, said he joined a group last fall after clicking on a Cathie Wood Facebook ad partly because he was disillusioned by conventional banks and stockmarket advisers who say “we might be able to get you 5 per cent or 10 per cent on your money if the market doesn’t tank” — as it did in 2022.

Bourget said the WhatsApp group texts “all sounded very legit at first and they put a lot of effort into building your confidence, you think it’s part of an investment club and they have in-depth market analysis.” Some of the scammers in the group encouraged victims to “liquidate their 401ks, mortgage their homes, borrow from friends” in hopes of doubling their money on the group’s stock picks.

He lost half his savings on penny stocks on the Hong Kong exchange, but kept in touch with the group leaders because they had promised to cover 80 per cent of the losses. When he learned this would require more trades, he declined.

The Hong Kong stock losses resulted from an apparent pump-and-dump scheme. In such scams, perpetrators increase the price of a penny stock by orchestrating purchases by the victims and then sell the stock, profiting at the victims’ expense.

Josh Kons, an investor lawyer in Hartford, Conn., who represents a Nashville couple who lost $US1.3 million, said that in hindsight, it is clear that no more than a handful of the roughly 30 members of their WhatsApp group were real people. The rest appear to have been fakes who praised the group leaders and said their stock picks had been profitable.

“I’m amazed at how sophisticated the operators were,” Kons said.

Kons’ Nashville clients made profits on four of five US stock picks in October and November, then had a 15 per cent gain in four days on a Hong Kong stock in early December.

But as they ramped up the size of their bets, they were urged to buy two more Hong Kong penny stocks near the end of December, DreamEast Group and Super Strong Holdings, which quickly fell by 90 and 98 per cent respectively on the same day. They lost most of their savings, had to file early for Social Security and are considering going back to work.

Several investors eventually compared notes on the social-media platform Reddit and formed a victims’ group. The group now has 29 members who are hoping to recover some of their estimated $US3.2 million in combined losses.

Blake Snyder, senior director of Finra’s financial intelligence unit, said through a spokesman, “we believe a majority of this activity is being orchestrated by individuals outside of Finra’s jurisdiction, and who may be located outside of the United States.”

Whether Facebook and other social-media networks could be liable for this type of scam is unclear, Kai Falkenberg, a media lawyer, said. Courts have recently split on whether a 1996 federal law absolving web platforms of liability for deceptive content created by others applies to unauthorised use of a celebrity’s likeness.

Section 230 of the Communications Decency Act gives immunity to platforms for claims arising from content the platforms didn’t create or develop, including ads. But the immunity doesn’t apply to intellectual-property claims, which could be brought by the impersonated celebrities for violation of their rights to publicity, Falkenberg said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout