PepsiCo in $4.3bn bid for Israel’s SodaStream

PepsiCo will buy one of its fiercest critics, SodaStream, in a move to broaden its offerings beyond sugary sodas and salty snacks.

PepsiCo has agreed to buy one of its fiercest critics, seltzer-machine maker SodaStream International, for $US3.2 billion ($4.3bn), the latest move by the beverage-and-food giant to broaden its offerings beyond sugary sodas and salty snacks.

Israel-based SodaStream makes countertop machines that allow consumers to carbonate tap water at home by filling a reusable bottle and adding flavours if desired. As consumers have shifted from sugary soft drinks to bottled water, the Nasdaq-listed company has pivoted to promote itself as a maker of homemade seltzer rather than a maker of homemade soda.

The deal creates somewhat of an awkward pairing. SodaStream has singled out PepsiCo and other beverage companies in public statements and advertising campaigns criticising bottled-water makers for polluting the environment.

“Shame on PepsiCo,” SodaStream CEO Daniel Birnbaum said last year when the soda giant launched its premium bottled-water brand LIFEWTR.

“I’ll say it till I’m blue in the face: The bottled-water industry is the biggest marketing scam of all time,” he said.

In an interview, PepsiCo finance chief Hugh Johnston said: “SodaStream’s point of view is that they want a healthier, more sustainable planet,” a goal the soda giant shares.

He added, “There was a good cultural match here in terms of the values.”

In discussions between the two companies over the past several years, “we got more comfortable that, in fact, we think about things in the same way”, Mr Johnston said.

PepsiCo has been under pressure this year to restructure its North America beverage business amid weak sales of its core brands Pepsi-Cola, Mountain Dew and Gatorade.

The sales slump came after the company last year shifted too much shelf space and advertising money to new, healthier products including LIFEWTR.

Shares in PepsiCo rose after the announcement but later fell, closing US12c down at $US114.84. SodaStream’s shares rose 9.4 per cent to $US142.11 in New York.

Wells Fargo analyst Bonnie Herzog offered a sceptical view of the deal, saying it was questionable whether buying SodaStream would do much to help PepsiCo’s efforts to improve volumes in its North American drinks business.

Mr Johnston said the deal wasn’t a response to the company’s flagging North America beverage sales, but rather an opportunity to expand SodaStream’s sales around the world and to give PepsiCo better reach into markets such as Germany and Japan, where SodaStream is strong. It also gave PepsiCo entree into what Mr Johnston called “in-home beverage creation”.

Under departing CEO Indra Nooyi, PepsiCo has expanded from its cola roots into hummus, kombucha and other healthier products, although results have been mixed.

The company has set a target for sales growth of nutritious products to outpace the rest of the portfolio by 2025.

PepsiCo built a relationship with SodaStream under Ms Nooyi, selling its cola with SodaStream machines in 2015 as an experiment in a few dozen stores across the US.

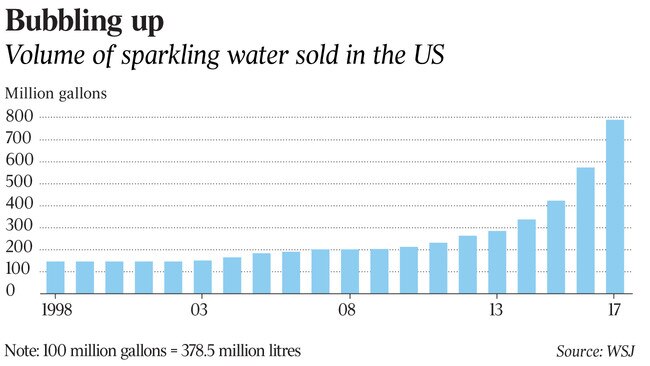

Sparkling water has grown more quickly than the overall bottled water category in the US, clocking volume growth of 38 per cent last year, according to industry tracker Beverage Marketing Corp.

That compares with 7 per cent growth for the overall packaged-water industry.

Jennifer Maloney

Saabira Chaudhuri

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout