Oil price takes historic dive below zero

US oil futures have plunged below zero for the first time, a demonstration that the world can’t store the oil being produced.

US oil futures plunged below zero for the first time on Monday, a chaotic demonstration of the dwindling capacity to store all the crude that the world’s stalled economy would otherwise be using.

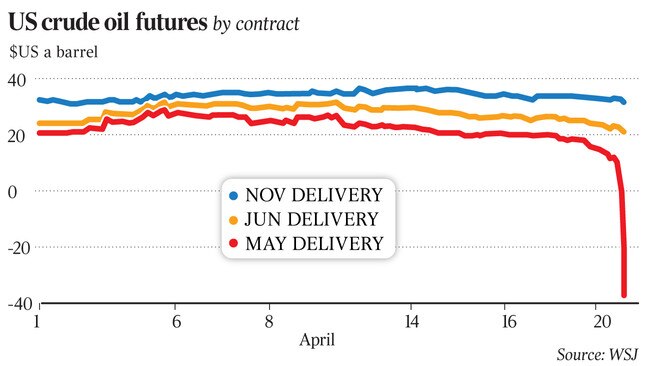

The price of a barrel of West Texas Intermediate crude to be delivered in May, which closed at $US18.27 a barrel on Friday, ended on Monday at minus $US37.63. That effectively means that sellers must pay buyers to take barrels off their hands.

The historic low price reflects uncertainty about what buyers would even do with a barrel of crude in the near term. Refineries, storage facilities, pipelines and even ocean tankers have filled up rapidly since billions of people around the world began lockdown to slow the spread of the deadly coronavirus.

Prices remain in positive territory for barrels to be delivered in June. In the most actively traded US futures contract, crude for June delivery lost 18 per cent on Monday to close at $US20.43, while oil to be delivered to the main US trading hub in Oklahoma in November ended at $US31.66.

Those higher prices, like the recent surge in stocks, reflect investor optimism that the global economy will bounce back later this year, and that sufficient demand for fuel will return to soak up some of the glut that was building even before borders closed, factories idled and billions of people stopped driving and flying.

Yet prices around $US30 a barrel, which is below break-even for many producers, still suggest economic worries ahead.

“It’s absolute bedlam,” said Chris Midgley, director of analytics at S&P Global Platts. “I hate to hear who’s on the wrong side of this (trade).”

Monday’s trading was exacerbated by the looming expiration of the May futures contract on Tuesday. The price of oil futures converge with the price of actual barrels of oil as the delivery date of the contracts approach.

Contract expiration also flushes out speculators who have no intention to take delivery of barrels of crude. Exchange-traded funds, which control a large number of futures contracts, are among those that must sell at expiration. The forced selling adds downward pressure to prices.

At a press briefing on Monday, US President Donald Trump said his administration again was exploring taking oil off the market by pumping barrels into the Strategic Petroleum Reserve. “This is a great time to buy oil,” he said.

Though producers from Canada to Texas are racing to shut in productive wells, they haven’t been able to close off the taps fast enough to avoid what energy executives have been referring to as “hitting tank tops” and running out of places to store crude and petroleum products, such as petrol and jet fuel.

Even before the price went negative, the spreads between oil to be delivered now and later were at record levels, presenting a rare opportunity for traders, who are filling up tankers with crude and setting them adrift. “If you can find storage, you can make good money,” said Reid I’Anson, economist for market-data firm Kpler.

Lease rates have soared for very large crude carriers, the high-seas behemoths known as VLCCs that can hold two million barrels.

The average day rate for a VLCC on a six-month contract is about $US100,000 ($158,400), up from $US29,000 a year ago, according to Jefferies analyst Randy Giveans. Year-long contracts are about $US72,500 a day, compared with $US30,500 a year ago. Spot charter rates have risen sixfold, to nearly $US150,000 a day.

Day rates rise as the spread between oil futures contracts widens. The basic maths is that every dollar in the six-month spread equates to an additional $US10,000 a day that can be paid for a VLCC over that time without wiping out all the oil price gains.

May delivery futures of Brent crude, the international benchmark used to price waterborne oil, ended on Monday at $US25.70 a barrel. The contract for November delivery settled at $US36.39. The $US10.69 difference is less than the record spread of $US13.45 reached on March 31 but enough to justify a $US100,000 day rate.

At the end of March there were 109 million barrels of oil stowed at sea, according to Kpler. By Friday it was 141 million barrels.

The collapse in oil prices, combined with the expectations that a lot of economic activity will resume by the northern autumn, has resulted in a market condition called contango — in which prices for a commodity are higher in the future than they are in the present.

One of the great trades in modern history involved steep contango and a fleet of oil tankers. In 1990, Phibro, the oil trading arm of Salomon Brothers, loaded tankers with cheap crude just before Iraq invaded neighbouring Kuwait and crude prices surged. The trade’s architect, Andy Hall, rose to fame, bought a century-old castle in Germany and became known for a $US100m payday. Present market conditions have inspired emulators.

In the past four weeks, nearly 50 long-term contracts have been signed for VLCCs. Jefferies has identified more than 30 of them as being intended for storage, usually because they are leased without discharge locations. The coast of South Africa offers popular anchorage since it is relatively equidistant to markets in Asia, Europe and the Americas.

Companies that own and operate pipelines and oil storage facilities could gain as well.

Consider the difference between Friday’s prices for West Texas Intermediate to be delivered in May, which was $US18.27 a barrel, and in May 2021, which closed at $US35.52: A $US17.25 spread could be locked in by buying contracts for oil to be delivered next month and then selling contracts for delivery a year later.

Assuming monthly costs for storage owners of US10c a barrel and that leaves a profit of $US16.05 a barrel.

The Wall Street Journal