Officials call for quick stimulus deal to forestall lacklustre US economic recovery

Some fear return to slow expansion that followed 2008 crisis, when Congress cut back on spending.

Federal Reserve officials and some other policy makers are stepping up calls for a quick jolt of stimulus spending as recent economic data point to uneven growth.

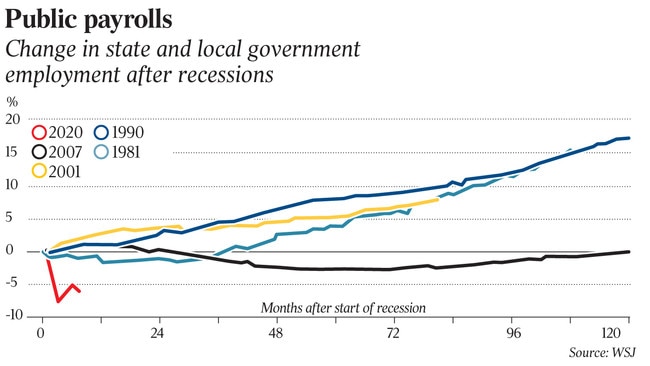

Their concern: Even if the current recovery is self-sustaining, a delay could lead to a repeat of the lacklustre rebound from the 2008 financial crisis, when a burst of spending was followed by an abrupt reversal.

“This is not a good time to have fiscal policy switch from being accommodative to creating a drag,” former Fed Chairwoman Janet Yellen said in an interview. “That’s what happened, and it retarded the recovery.”

While there is broad agreement in Washington on the need for more spending, there are big differences on the magnitude of the next aid package.

White House officials and House Speaker Nancy Pelosi (D., Calif.) are closing in on a nearly $US2 trillion deal to provide another round of stimulus checks, reinstate extra weekly unemployment benefits and extend aid for small businesses, airlines and state and local governments.

“I’m not happy about the cost associated with it, but I do think the cost of not doing something is potentially even higher,” Sen. Marco Rubio (R., Fla.) said Thursday. “In the end, I think we run the risk here of structural damage to components of our economy if we don’t do something.”

Senate Republicans, citing concerns about record budget deficits, have proposed $US500 billion in targeted aid for hard-hit businesses, such as hotels and restaurants, more money for schools and liability protections from coronavirus-related lawsuits.

If the White House and Mrs. Pelosi reach an agreement, a vote would likely have to wait until after the Nov. 3 election, which could imperil the passage of more stimulus for months if the election results change the political calculus for either party.

Meanwhile, money from stimulus checks that households received this spring has largely been depleted. Emergency small-business loans are no longer available. Airlines that received federal assistance have started furloughing or laying off employees. And unemployed workers are pulling back on spending after an extra $US600 a week in jobless benefits expired July 31.

Another cliff looms as the enhanced unemployment benefits Congress approved in March for millions of contract workers and long-term unemployed will expire Dec. 31.

“The damage done in three or four months of not having enough money is really large,” said Louise Sheiner, a senior fellow at the Brookings Institution.

The worry is that as long as the coronavirus pandemic saps consumer spending, especially in high-contact service industries, policy makers will be less successful in staving off traditional recessionary forces, in which rising lay-offs, falling incomes and a pullback in lending lead to lower demand, more lay-offs and tighter credit.

“Premature withdrawal of fiscal support would risk allowing recessionary dynamics to become entrenched,” Fed governor Lael Brainard said Wednesday.

Failure to learn the lessons of the past decade could be more costly to the government over the longer run, Ms. Yellen said. A weaker economy means less tax revenue and more spending on jobless benefits and other safety net measures.

In the early months of the coronavirus pandemic, Congress and the Fed took aggressive steps to prop up businesses and households, and positioned the economy for a strong rebound this summer, when businesses began reopening with new health and social-distancing protocols in place.

But now, as in the aftermath of 2008, political gridlock has dragged out efforts to replenish waning fiscal support, and the central bank is out of room to lower interest rates, which are pinned near zero.

There are some important differences with the last recession, which started with a damaging housing-debt bubble. Households and banks entered the current shock in better shape. The Fed also moved faster to cut interest rates and keep credit flowing to households and businesses.

A roughly $US2 trillion aid package would help lift gross domestic product to its pre-pandemic level by the middle to end of 2021, according to an analysis by Ms. Sheiner and economist Wendy Edelberg, also a senior Brookings fellow.

If Congress doesn’t reach an agreement on additional spending, it would take more than a decade to return to that level, the Congressional Budget Office projects. Even spreading out $US2 trillion over several years could lead to long-term economic damage, as people leave the labour force and lose their skills and businesses close permanently, Ms. Sheiner said.

“It’s costly to stay below full potential,” she said.

Fed officials have been especially outspoken. With interest rates at historically low levels, there is less they can do to spur activity. They have also raised worries that the nature of the current shock will exacerbate longstanding economic inequality, something their policies are also poorly suited to fix.

For example, the bottom fifth of all income earners account for just 9 per cent of consumer spending, which helps explain why retail sales have held steady in recent months despite reduced support for the unemployed.

“Even after the worst of the crisis passes, the scarring of families’ balance sheets may weigh on spending and leave them further behind over the longer term,” said Chicago Fed President Charles Evans last month.

Fed officials have been surprised by the pace of the rebound, with unemployment falling last month to 7.9 per cent, from nearly 15 per cent in April. But after accounting for workers who stopped looking for jobs or are misclassifying their status due to pandemic-related furloughs, a more realistic measure of joblessness is running around 11 per cent, Fed Chairman Jerome Powell said earlier this month.

While most workers who initially lost their jobs were placed on temporary lay-off, Labor Department data show a steady rise in the number of permanent job losers who have a much lower job-finding rate than those on temporary furlough.

People are taking “too much comfort in how quickly the unemployment rate has fallen,” said Boston Fed President Eric Rosengren. These gains reflect the low-hanging fruit of reopening more of the economy, he said.

“The hard part is from here on out because the virus is still there,” he said.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout