Not a vintage year for the finer things in life

When the rich feel richer as stocks rise, it can drive luxury asset sales, but that wasn’t the case in 2019.

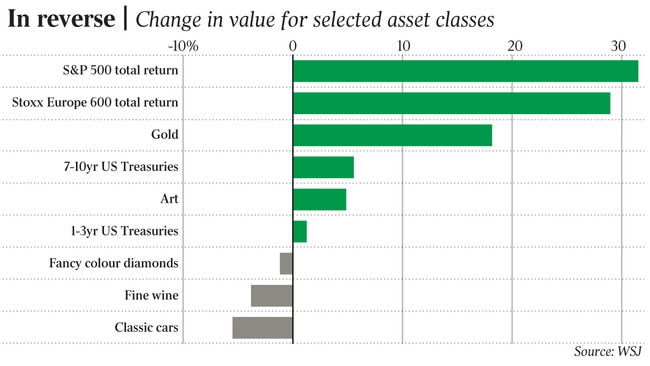

When stocks and bonds do well, the rich usually feel richer, driving sales of luxury assets such as wine, diamonds and fancy cars. That wasn’t the case in 2019.

The market for luxury assets was subdued last year, despite a record year in financial markets. Driving the decline were geopolitical tensions, including uncertainty around Brexit and the US-China trade conflict.

“The froth has gone out of the market. People have realised you can’t just buy stuff and expect the value to go up,” said Andrew Shirley, a partner at global real estate consulting firm Knight Frank and editor of the group’s Wealth Report.

Just about every financial asset did well last year. Major stockmarket benchmarks in the US and Europe hit record highs. Bond prices surged as yields tumbled, thanks to looser monetary policy from major central banks, including the US Federal Reserve and European Central Bank. Gold had its best year in a decade.

Luxury assets, however, were weighed down, partly by a lack of Asian demand. Chinese buyers account for about one-third of worldwide sales for big luxury companies.

“There is a lot of uncertainty in Chinese markets and the riots in Hong Kong didn’t make it easy for people to come spend money in Hong Kong,” said Eden Rachminov, chairman of the board at the Fancy Color Research Foundation, a Tel Aviv trade group that tracks diamond prices.

Coloured diamonds — the rarest kind — lost 0.8 per cent in value in the first three quarters of 2019, a figure that researchers say is expected to roughly stand for the full year.

Global trade tensions had a direct impact on the wine industry in October, when Washington imposed a 25 per cent import tax on most wines from the European Union as well as whiskey and liquor.

Investors who put money into fine wine at the beginning of the year saw an average loss of about 3.6 per cent by the end of November, according to the Liv-ex 1000 index, a broad measure that covers wine prices across regions.

Uncertainty around Brexit has weighed on sales of fine wine, in particular, given that Liv-ex — the London-based exchange that produces the industry benchmark — prices goods in British pounds.

“If you perceive currency volatility, you might hold off until it is resolved,” said Justin Gibbs, director and co-founder of Liv-ex.

Meanwhile, those investing in classic cars have seen a loss of 5.6 per cent, according to Historic Automobile Group International’s Top Index, which covers rare and collectors’ cars. The car market is cooling following a rise in prices after the 2008-09 global financial crisis, according to HAGI founder Dietrich Hatlapa, as investors saw cars hold their value even as financial markets tanked. The Top Index clocked double-digit gains following the GFC, rallying almost 50 per cent year-over-year at its peak in 2013.

“We are at the tail-end of a big bull market,” Mr Hatlapa said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout