BHP plans more electric Land Cruisers as trial expands

BHP is expanding its trial of electric versions of the iconic 70-series Land Cruiser as miners look for diesel alternatives.

The next boom in electric vehicles could be the world’s mining fleet.

From rural Canada to Australia’s dusty outback, companies are swapping out diesel-fuelled drills, loaders and utility vehicles for equipment powered by lithium-ion batteries. They are looking to reduce emissions and eliminate the exhaust fumes that foul the underground air and risk miners’ health.

Around 35 electric vehicles are at work at Newmont Goldcorp’s Borden mine near Chapleau, Ontario, unearthing ore or ferrying workers around the site, which began producing commercial volumes in October. Newmont wants the mine to go all-electric. An electric production drill would arrive early next year, a spokesman said, and diesel haul trucks were likely to be phased out.

READ MORE: EV drivers under pressure | Land Rover’s Defender of the faith | Rio Tinto plan to extract lithium from waste rock

“The Holy Grail is a haul truck,” said Kirsten Rose, who oversees low-emission technologies at BHP, the world’s largest mining company by market value. These heavy-duty trucks carry tonnes of ore out of the bottom of pits, and with current technology, matching the power of their diesel engines would require an enormous battery pack.

BHP has been testing a light electric vehicle based on the Toyota Land Cruiser 70-series over the past year at Olympic Dam, Australia’s largest underground mine, and this month it will add another. The company intends to expand the trial to other Australian mines. In Canada, workers planning BHP’s Jansen potash project are assessing how many electric vehicles could be deployed if it goes ahead.

The aim was one day to eliminate all diesel-powered machines from mine sites, Ms Rose said.

Smaller rivals are also stepping up efforts to go green. Among them, Nouveau Monde Graphite is planning an all-electric open-pit graphite mine in Quebec.

At Fortescue Metals Group, one of the world’s top suppliers of iron ore, CEO Elizabeth Gaines said: “We’re always looking at opportunities to replace diesel.” But “the technology — the battery life — isn’t quite there yet for our operations,” she said. The technology is advancing rapidly, but that can present another challenge: “It’s like laptops,” said Drew O’Sullivan, who is leading BHP’s trial at Olympic Dam. “By the time you get it home, it’s outdated.”

The purchase price is a further hurdle. Electric vehicles for use in mines cost from 40 per cent more than to three times as much as diesel-powered ones, experts say.

Proponents counter that running costs are lower. Borden’s annual energy expenses should be lower by roughly $US9m — possibly more — than a traditional mine’s, the Newmont spokesman said. One factor in that: As much as 40 per cent of an underground mine’s energy costs are tied to powering giant ventilation systems to extract pollutants from tunnels.

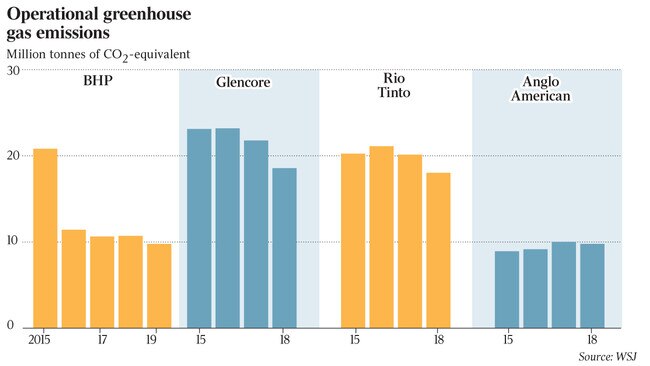

Customers and investors are pushing for global resources companies to clean up their act. With a growing focus on the social impact of investments, many big pension funds and asset managers, as well as project financiers, are pressing miners to disclose and reduce their carbon footprints. Diesel is a ripe target: it accounted for more than one-third of BHP’s direct operational emissions, Ms Rose said.

Regulators may soon join in the push. In July, the Western Australia’s Mining Department of raised concerns about the health of workers who spend up to 12 hours a day guiding heavy machinery underground.

“Diesel-engine exhaust is a known hazard for mining operations, especially in underground mines,” said Andrew Chaplyn, the department’s director of mines safety. A government committee is drawing up recommendations for the state’s mines minister.

Within a few years, diesel machinery would probably no longer be used at new underground mines in Australia, while being phased out at others, said Sherif Andrawes, global head of natural resources at accounting and advisory firm BDO.

“I think what we are seeing now is the start of something quite big,” he said.

Rio Tinto, the world’s second-biggest miner by market value, is even studying the potential for hybrid engines on its heavy-haul railway trains.

Still, electrifying mine fleets won’t do much to cut the industry’s overall emissions without a shift away from fossil fuels to renewable power. Some miners are moving in that direction.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout