Kenya’s tax u-turn shows political realities of Africa’s debt burden

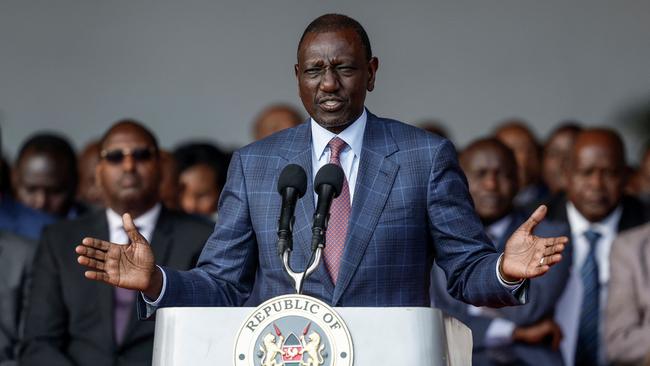

President William Ruto says he will seek budget cuts after dropping bill to raise taxes.

Kenyan President William Ruto said overnight on Wednesday that he would withdraw a proposed law on large-scale tax increases, a day after nationwide protests against the measures turned deadly.

The move highlights how the burden of repaying near-record high debts is increasingly running up against political realities in African countries.

Standing in front of rows of MPs, Mr Ruto said he would seek new austerity measures, including in his own office, to make up for the public’s rejection of the finance bill, which was meant to raise an extra 200 billion Kenyan shillings ($2.33bn) in taxes.

The funds — including new levies on everyday items like imported nappies and sanitary pads — were meant to help East Africa’s most developed economy pay off a mountain of loans and bonds.

The surprise announcement came a day after crowds of protesters, led mostly by young Kenyans, stormed the country’s parliament minutes after MPs voted to pass the bill. Police opened fire on demonstrators, a move that Mr Ruto and other members of the government defended as necessary to protect public infrastructure, but which was widely criticised by Western governments and rights groups.

Mr Ruto said six people lost their lives in the clashes and more than 200 were injured. Earlier in the day, the Kenya Medical Association said it had counted at least 23 dead.

‘The people have spoken,” he said, adding that he would seek “engagement with the young people of our nation”.“It has become evident that members of the public still insist on the need for us to make more concessions.”

It was a marked shift from his tough-talking late-night address on Tuesday when Mr Ruto called the incursion of parliament a “treasonous” act and pledged to move forcefully to clamp down on further unrest.

However, prominent protesters dismissed his comments, with one, Hanifa Adan, labelling it a “PR” move after the violence at rallies earlier in the week.

Like many other African countries, Kenya public debt has risen sharply over the past decade, as successive governments sold billions of dollars worth of bonds and took out infrastructure loans from China.

Mr Ruto said his government now spends 61 of every 100 shillings it raises in taxes on debt service. Across sub-Saharan Africa, debt service on average ate up 47.5 per cent of government revenue last year, more than double the level a decade ago.

Since he was elected last year, Mr Ruto has won plaudits from international investors for staving off a default, including by signing a bailout deal with the International Monetary Fund and pledging to increase government revenue. In February, Kenya successfully tapped international debt markets, albeit at much higher interest rates.

But a growing number of Kenya’s 54 million citizens -- more than a third of whom still live in poverty, according to the World Bank — have balked at his government’s funding plans.

Over the past week, thousands had marched through the streets of Nairobi and other Kenyan cities and called for nationwide strikes, demanding that Mr Ruto and parliament drop the planned tax measures.

Shani Smit-Lengton, an economic analyst with Oxford Economics Africa, said the withdrawal of the finance bill would make it hard for Mr Ruto’s government to cut its deficit to the targeted 3.3 per cent of gross domestic product in the current fiscal year, from 5.7 per cent the previous year.

“The withdrawal of the finance bill was our less likely scenario, so we will need to reassess the magnitude of this decision on the economy,” she said. “The government will also need to consult the IMF, as its staff level review was completed earlier this month.”

Mr Ruto said that his government would be forced to delay plans to hire more teachers and support coffee and sugar-cane farmers and that he would seek dialogue with opposition parties and civil society on how to manage spending going forward.

The Wall Street Journal