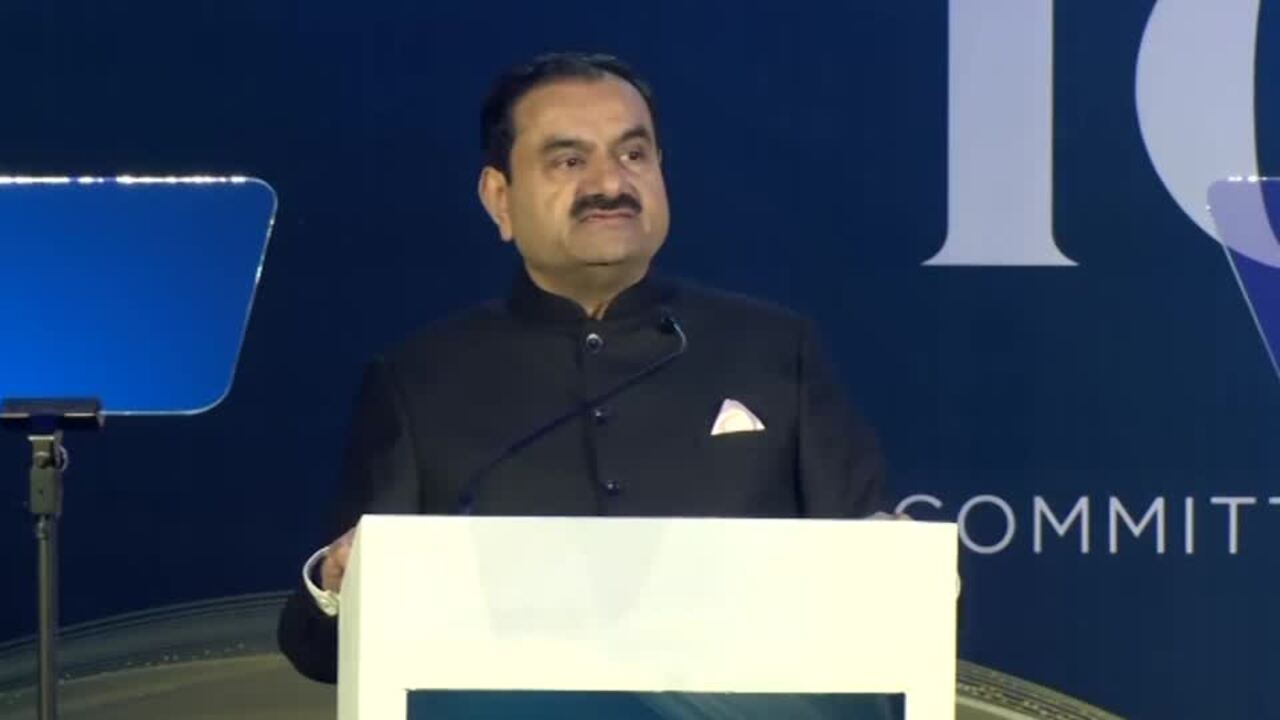

Indian billionaire Gautam Adani comes under new scrutiny from US prosecutors

Justice Department is investigating whether Adani’s companies violated US sanctions on Iran, after charging him in bribery case last year.

Gautam Adani, Asia’s second-richest man, is trying to get the Trump administration to drop foreign bribery charges against him. Instead, he is facing a new front in his fight with prosecutors: a probe into whether his companies are buying Iranian petrochemical products.

U.S. prosecutors are investigating whether Adani’s companies imported Iranian liquefied petroleum gas, or LPG, into India through the company’s Mundra port. A Wall Street Journal investigation into tankers that regularly traveled between Mundra and the Persian Gulf found their behavior often exhibited traits seen by ships seeking to evade sanctions.

“Adani categorically denies any deliberate engagement in sanctions evasion or trade involving Iranian-origin LPG,” a company spokesman said in a statement. “Further, we are not aware of any investigation by U.S. authorities on this subject.” The expanding scrutiny by the U.S. Attorney’s Office in Brooklyn could prove problematic for Adani’s rehabilitation effort. President Trump is rolling back enforcement of longstanding laws punishing overseas bribery, but has also taken aim at purchasers of Iranian oil and gas products.

“Any Country or person who buys ANY AMOUNT of OIL or PETROCHEMICALS from Iran will be subject to, immediately, Secondary Sanctions,” Trump wrote on social-media platform Truth Social last month. “They will not be allowed to do business with the United States of America in any way, shape, or form.” Adani is a close ally of Indian Prime Minister Narendra Modi and sits atop a group of infrastructure companies bearing his name that has been integral to India’s recent economic growth. The public companies have a valuation around $150 billion, yielding Adani and his family one of the world’s largest fortunes.

In January 2023, short-selling firm Hindenburg Research published a 33,000-word report alleging the Adani Group had violated Indian securities laws by having Adani family members secretly control swaths of shares through offshore vehicles. The companies’ stocks plunged but have recovered some of their losses.

In November, the group faced a new headwind when U.S. prosecutors charged Adani with fraud, alleging he orchestrated roughly $250 million in bribes to Indian officials to secure lucrative solar-power supply contracts in India.

Adani Group called the short seller’s report “nothing but a lie,” and the government allegations against it “baseless.” Adani has hired high-powered legal firms Kirkland & Ellis and Quinn Emanuel, according to lobbying disclosures. Adani’s lawyers also met with prosecutors in March in hopes of having the case dropped, according to people familiar with the matter.

Six Republican members of Congress have publicly argued Adani’s indictment is at odds with Trump’s foreign-policy priorities, including a strong trading relationship with India. Trump also issued an executive order “pausing” prosecutions under the Foreign Corrupt Practices Act.

While the case grew out of an FCPA investigation, Adani was charged with conspiracy and securities fraud over alleged bribes, not with violating the act itself.

The investigation into shipments

Prosecutors are reviewing the activities of several LPG tankers used to ship cargoes to Adani Enterprises, the people said.

The Adani spokesman said that importing LPG has been a small but growing part of the company’s business, contributing 1.46% of its $11.7 billion in revenue last fiscal year.

A Journal investigation into a group of LPG tankers making journeys between the Adani-run Mundra port and the Persian Gulf since early 2024 found they showcase signs that ship trackers say are typically evidence of ships attempting to obscure their activities.

A common tactic includes manipulating the ship’s automatic identification system, or AIS, which shares a ship’s position, according to Tomer Raanan, a maritime risk analyst at Lloyd’s List Intelligence who tracks LPG tankers.

One journey in April of last year undertaken by a ship that carried an LPG cargo for Adani, the Panamanian-flagged SMS Bros, demonstrates some of the patterns.

The ship was docked at Khor al Zubair in southern Iraq on April 3, 2024, according to its AIS, which the Journal analyzed using Lloyd’s List’s Seasearcher platform.

Satellite images from April 3 don’t show the SMS Bros at its reported berth in Iraq. But a satellite did capture images of a ship matching the SMS Bros’s characteristics and length docked roughly 315 miles to the southeast at an LPG terminal in Tonbuk, Iran.

The ship docked in Tonbuk was the SMS Bros, according to Samir Madani, whose service TankerTrackers.com has indexed more than 9,000 ships from satellite imagery.

By April 7, the SMS Bros’s AIS data showed it off the coast of the United Arab Emirates. Its data was adjusted at that time to show it riding lower in the water, which would indicate it had taken on cargo. Its AIS data shows that it departed the night of April 8, heading south, and by the following day anchored offshore near Sohar, Oman.

On April 10, documents purport that Adani Global PTE contracted the ship to load roughly 11,250 metric tons of LPG at Sohar and ship it to Mundra in India. The ship never appears to have docked in Sohar’s port, according to the Journal’s analysis of AIS data.

From there, the SMS Bros sailed to Mundra, where customs records reviewed by the Journal show that on April 17, Adani Enterprises imported a load matching the cargo described in the shipping documents with a declared value just over $7 million.

Purchasers of Iranian oil and gas products often use forged documents from Oman and Iraq, according to several people familiar with the trade.

The Adani spokesman said the SMS Bros shipment was handled through a third-party logistics company and documentation identifies the shipment as originating from Sohar. Adani companies check the vessels they contract for red flags but don’t own, operate or track vessels and can’t comment on the activity of vessels they don’t control, he added.

“Whatever the duties of and responsibilities of a bona fide importer are, we have fulfilled those,” the spokesman said.

Other discrepancies

The SMS Bros, which changed its name to the Neel last year, has shown other discrepancies.

A Bangladeshi port record from last June shows the SMS Bros as importing a load of LPG originating in Iran for an unknown importer, yet its AIS data reports making the same journey to Iraq that it did in April.

At several other points over the past year, satellite images don’t show the SMS Bros at its reported AIS position, according to Bjorn Bergman, a data analyst who tracks AIS spoofing at the nonprofits Global Fishing Watch and SkyTruth.

Three other LPG tankers show some elements of obfuscation while making runs between Adani’s Mundra port and the Persian Gulf, according to the Journal’s review of their data.

One tanker operated by the same company that managed the SMS Bros showed similar signs of spoofing its AIS. That ship was also named on a list of tankers suspected of shipping Iranian oil and gas by a bipartisan group of U.S. senators.

The company operating the ships, as well as the captain of the SMS Bros on its April 2024 journey, didn’t respond to requests for comment.

A third ship appears to have used similar tactics around its trips to Mundra, broadcasting via AIS a stop in Khor al Zubair that can’t be seen on simultaneous satellite images of the port.

A fourth tanker in the group often making deliveries to Mundra was listed in a 2024 report by the U.S. Energy Department as being involved in the export of Iranian petroleum products.

In May, the Journal found that ship was reporting its position on the railroad tracks of the port in Khor al Zubair.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout