Hot US economy, fresh supply disruptions pressure world’s factories

The strongest U.S. expansion in 30 years is making for long delivery delays and price increases, exacerbated by Suez disruption, factory fires.

Resurgent economies, led by the US, and a burst of demand for consumer goods are heaping pressure on already strained supply chains, with a series of acute disruptions — including this week’s blockage of the Suez Canal — set to worsen shortages and further push up prices.

The shortages have been most pressing in the car industry, where manufacturers have been forced to cut back production in response to limited supplies of semiconductors. But difficulties in securing raw materials and other inputs have recently been worsened by a series of significant disruptions.

The latest of those came with the blockage of the Suez Canal by a grounded container ship Tuesday. That followed a fire on Friday at a factory of one of the world’s leading auto chip makers in Hitachinaka, northeast of Tokyo.

Last month’s freeze in Texas triggered mass blackouts that closed plants that make up the world’s largest petrochemical complex, many of which remain offline.

The Federal Reserve expects the US economy to recover more quickly than projected by officials a few months ago, anticipating that the COVID-19 vaccination campaign and trillions of dollars of fiscal stimulus will propel the US economy to its fastest expansion in more than 30 years.

That is piling pressure on the globe-spanning supply chains that multinationals rely on to make everything from exercise bikes to furniture.

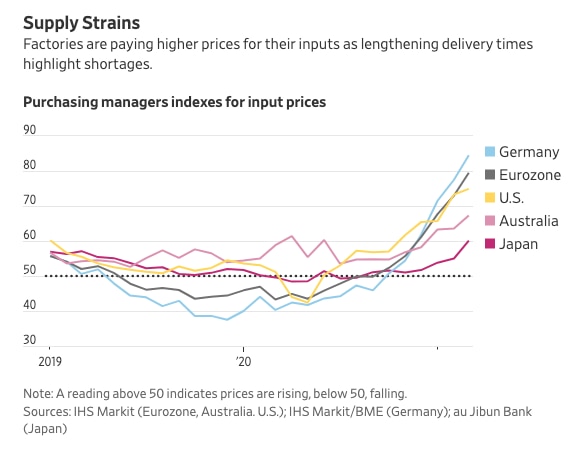

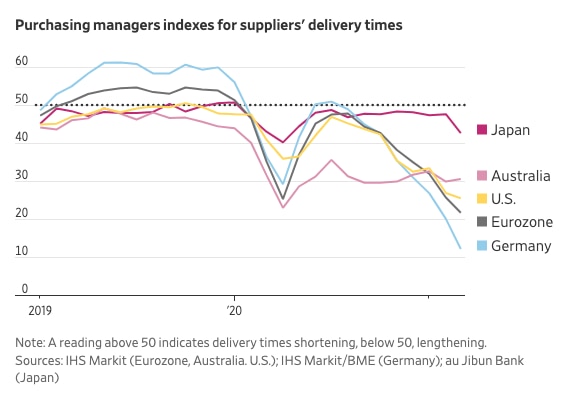

In a series of surveys around the world released Wednesday, manufacturers reported lengthening delivery times for raw materials and other inputs, rising production backlogs and a sharp pick-up in input prices.

In the US, there were also signs that shortages were squeezing factories, with output rising at the slowest pace in five months — in part because of a lack of raw materials — while new orders rose at the fastest pace in almost seven years.

Data firm IHS Markit said US executives reported the most severe supply disruptions since it started the national survey in 2007. It also said that firms “commonly reported slower output growth due to a lack of raw materials to fulfil new orders.”

There are some signs that those shortages are modestly slowing growth.

“I wouldn’t say supply disruptions are necessarily a risk for the recovery, just that they will at least temporarily limit how fast the economy can grow,” said Andrew Hunter, senior US economist at Capital Economics.

Economists and central bankers say the shortages are likely to prove short-lived, with makers of semiconductors and other parts that have become relatively scarce increasing their capacity. The reopening of hospitality and other services as vaccination programs progress will likely divert consumer spending away from goods that have been in particularly high demand, such as laptops and other home electronic devices.

“There will be a little bit slower growth and maybe some modest upward pressure on prices,” Federal Reserve Chairman Jerome Powell said in testimony to politicians on Wednesday. “But that should be something that is temporary. You know, a bottleneck by definition is temporary as the supply side adjusts.”

The recovery in global factory output from a pandemic-inspired collapse started in May, and output had returned to its pre-lockdown level by December. That rebound was much faster than in the aftermath of the global financial crisis, and the speed of the recovery appears to have caught many manufacturers and their suppliers off guard.

Price pressures have been building in the US for the past four or five months, as fiscal-relief packages supported household income and business investment picked up, said Citi economist Veronica Clark.

Rising consumer prices and expectations of continued increases could contribute to a broader inflation pick-up that could prompt the Fed to raise rates. However, many economists expect the Fed to pay little notice to pricing pressure created by recent supply-chain disruptions.

“They’re not looking for excuses to tighten — right now they’re looking for excuses not to tighten,” said Joshua Shapiro, chief US economist at consulting firm Maria Fiorini Ramirez. “So to the extent you can point to whatever driving inflation as being temporary, it feeds into that.”

US auto dealerships are already running thin on trucks and cars because of a parts shortage that has interfered with production. Buyers as a result are paying more, waiting longer and have fewer models to choose from. Meanwhile, US consumer spending on goods was up nearly 10 per cent in January from a year earlier, according to the Commerce Department. Surging demand has left US ports suffering backlogs of ships carrying tens of thousands of containers and long delays unloading freight.

“Producers were increasingly unable to keep pace with demand, due mainly to supply chain disruptions and delays,” said Chris Williamson, IHS Markit’s chief business economist. “Higher prices have ensued, with rates of both input cost and selling price inflation running far above anything previously seen in the survey’s history.”

In Germany, one of the world’s manufacturing powerhouses, the survey of purchasing managers recorded the sharpest increase in output since the series began in 1996. That is good news for the European economy, which continues to be held back by rising coronavirus infections and a faltering vaccination campaign.

Over the past six months, Europe’s economy has moved at two speeds. While manufacturing has expanded at an increasingly rapid pace, activity in the larger services sector has declined. Overall, in the previous five months the result was a contraction in output that likely saw the eurozone slide into recession during the final three months of last year and the first three months of this year.

But to the surprise of most economists, that changed in March, with manufacturing proving so strong that it more than offset the decline in services, setting the stage for overall growth.

That return to growth may not be sustained, since both France and Germany have imposed new restrictions on consumers and businesses in recent weeks and there are few signs of an imminent pick-up in vaccinations.

For much of the rest of the global economy, the recovery is less lopsided. But in most places, manufacturers have rebounded more strongly than service providers, reflecting the fact that most goods can be consumed with relatively little risk of infection, while a range of services led by hospitality and entertainment remain risky.

But as the pace of vaccinations ramps up around the world, supply chain logjams will gradually dissipate and related price pressures will likely fade, said Oren Klachkin, lead US economist at Oxford Economics.

“These disruptions are likely to persist in the immediate term, and won’t meaningfully dissipate until we move past the Covid crisis at the global level,” he said.

In Australia, manufacturers reported the sharpest rise in import prices in the survey’s history, and attributed that to bottlenecks in their supply chains.

Across the eurozone, factory managers reported the fastest rise in input prices in a decade, and reported the longest waiting times for inputs to be delivered in the survey’s 23-year history. In particular, German manufacturers highlighted lengthening waiting times for supply from Asia.

In the US and Europe, manufacturers have responded to increased demand by recruiting additional workers, which should help aid the services sector’s recovery when businesses are allowed to reopen fully. But the rise in raw-materials costs points to higher prices for consumers over coming months, a problem central bankers see as short-lived for now.

John McCormick contributed to this article.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout