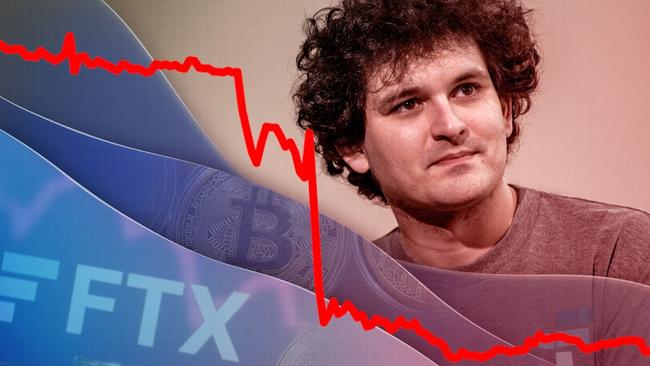

FTX founder Sam Bankman-Fried sentenced to 25 years

The 32-year-old has been sentenced to 25 years in prison for fraud tied to the collapse of his digital exchange, capping the onetime crypto king’s meteoric rise and fall.

FTX founder Sam Bankman-Fried was sentenced Thursday to 25 years in prison for fraud tied to the collapse of his digital exchange, capping the onetime crypto king’s meteoric rise and fall.

Less than two years ago, the moptop millennial hobnobbed with heads of state, soaked up Caribbean views from his $US30 million penthouse and vowed to use his wealth to better humanity.

A jury last year found the 32-year-old guilty of stealing billions of dollars from FTX customers and defrauding investors and lenders to his crypto investment firm Alameda Research.

U.S. District Judge Lewis Kaplan, who also imposed more than $11 billion in financial penalties, said he weighed the brazenness of Bankman-Fried’s actions, his lack of remorse and the possibility he would commit future crimes.

“There is a risk that this man will be in a position to do something very bad in the future,” Kaplan said. “And it’s not a trivial risk at all.” Bankman-Fried stood stoically as Kaplan handed down the sentence. His mother, grimacing, looked out a courtroom window while his father put his head down in his hands.

Before he was sentenced, Bankman-Fried told the judge that he was haunted every day by what he had thrown away.

“I’m sorry about what happened at every stage,” the FTX founder, who wore tan jail garb, said during his 20-minute statement. “At the end of the day, I failed everyone I cared about.” Federal prosecutors said Bankman-Fried committed one of the greatest financial frauds in U.S. history. Fueled by greed and hubris, he used other people’s money to fund his lavish lifestyle, make risky investments and pursue his political agenda, according to prosecutors.

Prosecutors had asked Kaplan to sentence Bankman-Fried to 40 to 50 years in prison.

While Bankman-Fried said he made mistakes, he didn’t acknowledge committing crimes, Assistant U.S. Attorney Nicolas Roos told the court. “What we did not hear is accepting responsibility for lying, for stealing and for fraud,” said Roos.

Bankman-Fried’s lawyers had said a sentence of no more than six years in prison was more appropriate, arguing that he still had much to offer to society. They pointed to his autism, his deep remorse and his charitable works as reasons for a lenient sentence.

Marc Mukasey, his lawyer, told the judge that Bankman-Fried wasn’t a “ruthless financial serial killer” who sought to hurt people.

“Sam Bankman-Fried does not make decisions with malice in his heart,” said Mukasey. “He makes decisions with math in his head.” His lawyers plan to appeal.

Bankman-Fried is unlikely to serve the full term, due to credits, including for good behavior, that can shave off roughly a third of a defendant’s sentence, prison consultants said.

Bankman-Fried, the son of Stanford Law School professors started FTX in 2019 with a fellow Massachusetts Institute of Technology graduate. The company had a quick takeoff, riding a tide of growing popularity in crypto trading.

Millions of customers joined his exchange, drawn to Bankman-Fried’s image as a shaggy-haired genius and to FTX commercials starring NFL star Tom Brady and comedian Larry David. As the exchange soared in value, Bankman-Fried crisscrossed the globe on private jets and hosted dinners with guests such as Bill Clinton and Tony Blair. He became a top political donor in Washington, holding himself out as a trustworthy figure seeking legislation to clarify the rules around crypto.

That world came crashing down in early November 2022 after the crypto website CoinDesk published what purported to be a leaked Alameda balance sheet, causing a run on FTX customer funds. Soon after, the exchange filed for bankruptcy protection. The Manhattan U.S. attorney’s office charged Bankman-Fried a month later.

During a monthlong trial in the fall, jurors heard testimony from three of Bankman-Fried’s top lieutenants, including his ex-girlfriend, who said the FTX founder directed them to commit crimes alongside him. Bankman-Fried took the unusual step of testifying in his own defense.

He told jurors that he never committed fraud, yet he struggled under cross examination, saying dozens of times that he didn’t recall specifics.

Kaplan said Thursday that Bankman-Fried committed perjury during his testimony, including when he told jurors that until fall 2022, he had no knowledge that Alameda had spent FTX customer deposits.

In the weeks before the sentencing, Bankman-Fried’s supporters wrote letters to the judge, saying that his struggles with depression, autism and anhedonia -- the inability to feel happiness -- weigh in favor of a lighter sentence.

Carmine Simpson, the ex-police officer, said that the FTX founder was a selfless person who adhered to his beliefs, even in jail. “Even though twelve out of every fourteen of Sam’s weekly meals are just undercooked rice, a scoop of disgusting-looking beans and week-old brown lettuce, Sam has stayed true to his commitment to not participate in the maltreatment of animals,” he wrote. Simpson pleaded guilty last year to sexual exploitation of a child, according to court records.

Bankman-Fried’s mother, Barbara Fried, said in her letter to Kaplan that her son had sought to do good in the world from a young age. When he was 4 years old, she said, he tried to help a fallen toddler. He was precocious as well, she said, independently reading complex moral and philosophical literature in middle school. In high school, he counseled classmates who were depressed, despite battling depression himself, she said.

“But this is not just a personal tragedy,” she wrote to the judge. “The ease with which we consign young lives with so much promise to the trash heap is a societal tragedy as well.” Kaplan asked that federal prison officials assign Bankman-Fried to a medium- or low-security facility, ideally near his parents in the San Francisco Bay Area. In making the recommendation, the judge cited Bankman-Fried’s low risk for violence and noted that his autism and association with wealth make him a target for other prisoners.

Prosecutors said Bankman-Fried’s fraud amounted to $10 billion in losses, placing him alongside the country’s most notorious white-collar criminals. They likened him to Bernie Madoff, the Manhattan financier who orchestrated a Ponzi scheme that led to $13 billion in losses. Madoff received a sentence of 150 years and died in prison at 82 in 2021.

Current FTX Chief Executive John Ray said in a filing to the judge that customers are expected to be repaid the value of their claim on the date the exchange filed for bankruptcy protection. However, many cryptocurrencies have surged in value since that time, meaning customers will miss out on the financial gain, he said.

One of the victims, Sunil Kavuri, told the judge that he lost money he was saving for a house and his children’s education.

“It’s a continuous lie that we are all made whole,” said Kavuri, adding that he had spoken to many other victims.

Lawyer Adam Moskowitz, who represents some FTX creditors, told Kaplan that Bankman-Fried had recently been helpful to his efforts.

Kaplan said Thursday that in determining the sentence, he wasn’t weighing whether customers would get their money back.

“A thief who takes his loot to Las Vegas and successfully bets the stolen money is not entitled to a discount on the sentence,” the judge said.

-Caitlin Ostroff contributed to this article.

The Wall Street Journal