Fears over global property slowdown

Housing markets across the world, from the UK to China, are losing steam, holding back prospects for the global economy.

Housing markets across the world, from the UK to China, are losing steam, holding back prospects for the global economy that last year grew at its slowest rate since the financial crisis.

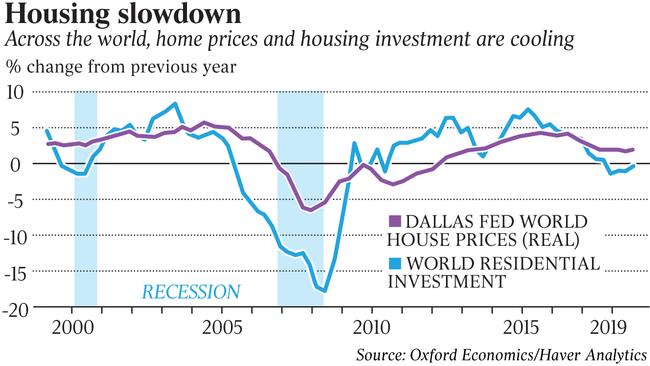

Across 23 countries, an index of inflation-adjusted home prices compiled by the Federal Reserve Bank of Dallas grew 1.8 per cent in the third quarter of 2019 from a year earlier, down from a recent peak of 4.3 per cent in 2016, according to an Oxford Economics analysis. In 18 large economies, worldwide residential investment dropped on a year-on-year basis for four consecutive quarters through September, the longest stretch of declines since the 2008-09 crisis, according to the Oxford Economics’ analysis of national accounts.

A key catalyst is the global slowdown over the past two years that kept a lid on housing demand and home-price gains. In large cities affordability constraints are deterring many would-be buyers, and foreigners’ appetite for overseas properties has cooled.

Heightened uncertainty over the US trade war with China, Brexit and protests in Hong Kong, continue to weigh on home-buyer sentiment.

“It matters because … the housing market is a big asset market which has quite large potential impacts on consumer spending,” said Oxford Economics economist Adam Slater. “It tends to be a sector when it booms, it booms; when it busts, it busts.”

The slowdown isn’t showing signs of turning into a bust. Experts say that hinges on growth and uncertainty. The International Monetary Fund on January 20 projected global growth would lift from 2.9 per cent last year to 3.3 per cent this year and 3.4 per cent next year, although that is still below the post-crisis average.

Even though homes aren’t easily tradeable, like soybeans or car parts, home prices across the world have become increasingly synchronised. This reflects a variety of factors, according to the IMF, including the increasing tendency for economic growth and interest rates to move in parallel across nations.

For global cities like New York, London and Vancouver, another factor is at work, according to the IMF. In the period of low interest rates following the global financial crisis, wealthy investors seeking better yields swooped in to buy properties in major financial hubs. In effect, residential prices in those cities have become globally synchronised, much as stocks and bonds are.

Now home prices in large cities are pulling back, according to an index of high-end markets in 45 cities maintained by Knight Frank, a London-based real-estate consulting firm. The index grew 1.1 per cent in the third quarter of 2019 from a year earlier, down from 3.4 per cent in the same period in 2018 and 4.2 per cent in 2017.

Lower housing investment subtracts from gross domestic product growth. Oxford Economics estimates that the housing slowdown cut growth in advanced economies by 0.3 percentage point between 2017 and 2019.

Homes, like stocks, are a part of consumers’ overall wealth, meaning the housing slowdown could further eat away at global growth if homeowners feel less well-off and curb their spending.

This appears to have happened in some nations. Spending growth in Canada and Sweden slowed by more than 1 percentage point in 2018 as home prices declined, the Bank for International Settlements said in its 2019 annual report.

A flurry of property-market regulations is another factor chilling home-price gains. Vancouver introduced a foreign-buyer tax of 15 per cent in 2016 and raised it to 20 per cent in 2018. Seoul tightened mortgage regulations and announced a price cap on residences. New Zealand banned overseas investors from buying existing homes in 2018.

Cooling home prices could have a positive effect, with pricey markets becoming more affordable and making a collapse in the property market less likely.

The current slowdown looks different from the lead-up to the 2008-09 crisis, when a global credit boom went bust and real home prices declined as much as 6.6 per cent across the world’s major economies, according to Oxford Economics. Policymakers are more alert to the risks of housing bubbles, and banks have made it more difficult to access mortgages. Although rising household debt presents risks in some countries, BIS said that in many nations at the centre of the crisis, household debt-to-GDP ratios were below pre-crisis levels.

Dallas Federal Reserve economist Enrique Martinez-Garcia said home prices were outpacing income gains in many countries, but not by nearly as much as in the pre-crisis years. “The housing market is not giving us red signals of danger as it did,” he said.

Should the slowdown turn into a more serious bust, it would test central banks, many of which cut interest rates last year to buffer their economies. In theory, interest-rate cuts should spur demand for housing by making mortgages cheaper. That appears to have happened — to an extent — in the US. Since the Federal Reserve cut interest rates last northern summer, US home buying is up. But, interest rates around the globe are near record lows. Mr Martinez-Garcia said there was a point at which lowering long-term interest rates could no longer effectively prop up residential investment.

And lower interest rates may be less effective given long-run restraints on housing such as the slower global growth expected over the next few years, property regulations and declining fertility rates. Supply is constrained in many cities where workers want to live. These factors are common to many countries, another reason the housing market is now globally synchronised.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout