Factories shut as companies begin exodus from Ukraine

Companies operating in Russia and Ukraine confront a host of challenges and sliding share prices following Moscow’s attack.

Companies operating in Russia and Ukraine have begun putting contingency plans in place as they confront a host of challenges and sliding share prices following Moscow’s attack.

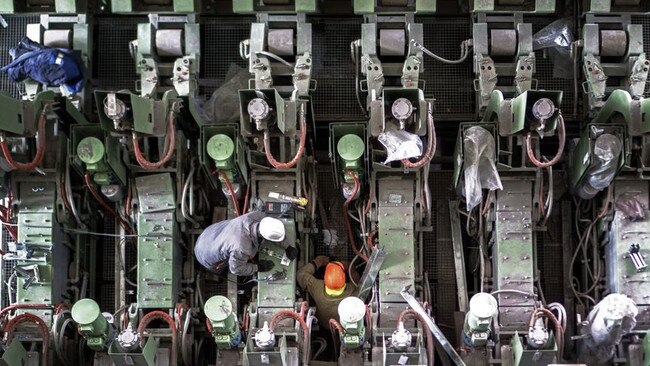

Executives began closing offices and factories on Thursday, ensuring staff were safe and sending some to the Polish border, while weighing factors likely to hit their businesses, including soaring commodities prices and the potential impact of further sanctions on Russia. Some faced additional challenges that made work difficult, including the closure of the rail network and ports and problems with gas supplies.

The invasion rippled through boardrooms around the world.

“Today is a dark day for all of us. The attack on Ukraine represents a turning point in Europe; a war was simply unthinkable for many people, especially the younger generations,” Christian Bruch, chief executive of Siemens Energy, told shareholders at their annual meeting.

Danish brewer Carlsberg said it was closing down three breweries in Ukraine and asked employees to stay at home and await instructions from local authorities. One of its breweries in Lviv was temporarily closed because of disruption in the supply of natural gas.

The company, which has 1300 employees in Ukraine and a large business in Russia, said it was following the situation with concern. “As of this morning, we have implemented several measures to ensure the safety and wellbeing of our employees in Ukraine,” a spokeswoman said.

Nestle said it had temporarily closed factories, warehouses and supply chains in Ukraine, and recommended employees stay home. The company, which has three factories and about 5000 employees in Ukraine, added that it had contingency plans in place to ensure it could restart the supply of its products when safe to do so.

ArcelorMittal, the world’s second-largest steelmaker, said it was slowing production at its large plant in Ukraine and has halted production at its underground mines. The company has a series of contingency plans should the situation escalate.

Germany’s Hamburger Hafen und Logistik, which runs a large container terminal at Ukraine’s Odessa port, said authorities had closed the port and its 480 employees had left the site.

Elsewhere, cigarette maker Imperial Brands suspended operations in Ukraine, where it has 600 employees across a Kyiv factory and a sales and marketing team. German software provider SAP said it had closed its Kyiv office and taken safeguarding measures to support its employees.

French food maker Danone, which has two manufacturing plants in Ukraine, said it was taking action to ensure the safety of its employees.

As Russian tanks rolled in, Global Guardian, a US firm that advises businesses on security risks, used buses to take 200 workers from international financial services, legal and other companies operating in Ukraine to Poland.

Dale Buckner, the company’s chief executive, said it had evacuated around 1500 mainly foreign nationals ahead of Thursday’s incursion. The US Special Forces veteran said his clients had a further 2800 Ukrainian and foreign nationals who could also be evacuated, depending on whether the conflict escalates.

Irish construction materials business CRH, with five manufacturing plants in Ukraine, is yet to trigger contingency plans.

Shares of companies with operations in Ukraine and Russia traded lower, with ArcelorMittal down more than 6 per cent, Danone finishing more than 4 per cent lower and Carlsberg off nearly 2 per cent.

Investors also sold off shares of oil major BP, which fell more than 4 per cent, despite rising commodity prices. The British energy giant holds a 19.75 per cent stake in Russia’s Rosneft Oil. A spokeswoman for BP said the company was monitoring the situation. BP executives earlier this month played down the potential risks of sanctions as tensions escalated.

Other major oil companies, including Shell and Exxon Mobil, also have large investments in Russia. “The safety of all our staff is Shell’s highest priority. We are monitoring the situation closely,” a company spokesman said.

Companies said they were also on alert for any disruptions to operations in Russia. Volkswagen said the impact was “continuously determined by a crisis team”, while Mercedes-Benz said it was in constant contact with its manufacturing plant near Moscow.

Businesses said uncertainties abounded, including the extent of Russia’s incursion and the scope of potential sanctions.

Western leaders have pledged sanctions that will place export controls on key technology to Russia, hit its banking sector and target its biggest businesses and wealthy individuals. These could also hurt Western companies that have joint ventures with, or investments in, Russian companies.

German home and personal care products company Henkel said it was viewing the situation “with great concern”.

“The exact extent, including that of the further sanctions to be expected, is still difficult to estimate,” a spokeswoman said. The company employs about 2500 people in Russia and 600 employees in Ukraine at four production sites, two of which are in the southeastern part of the country.

The Eastern Committee of German Business, a lobby group representing German firms with investments in Russia and eastern Europe, said it had cancelled a planned meeting with Russian President Vladimir Putin.

Ukrainian businesses expect the greatest hit. Ferrexpo, one of the world’s largest exporters of high-grade iron ore pellets to the steel industry, said that its mining and process facilities were still operating but that the government had suspended rail services.

For Larissa Boden, one of the many farmers whose business make up the largest part of Ukraine’s economy, war came with a loud explosion in the early hours of Thursday.

“We can’t work on the fields today and are scared,” she said. Her Agro-focus asparagus farm is Ukraine’s largest and based in the south of the country, near Crimea. Last week, it was planting its new crop, much of which would usually be exported.

Any disruption to Ukraine’s agricultural industry will be economically painful. Agricultural products are Ukraine’s largest export, and the sector accounted for 14 per cent of gross domestic product in the third quarter of 2021.

Disruptions to Ukrainian corn exports, in particular, could be felt by Chinese pork producers and in countries like Egypt, Indonesia, Turkey and Pakistan, which are big buyers of the crop.

Ms Boden’s business had already been affected by tensions. The price of the fuel it uses was up 30 per cent. A bank that Agro-focus had been negotiating a loan with has put talks on hold. Even before the bombing began, Ms Boden was concerned seasonal workers would leave to work in more stable countries.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout