Elon Musk wants clarity for Twitter deal to progress

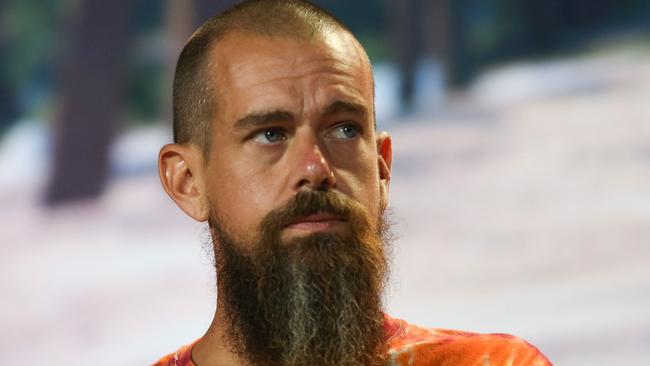

The billionaire’s fresh salvo against the social media giant over fake accounts comes as Twitter’s board backs his offer, revealing he contacted co-founder Jack Dorsey, another director in March.

Billionaire Elon Musk says his $US44bn ($63bn) purchase of Twitter can’t move forward until the company is clearer about how many of its accounts are fake, casting fresh doubt on his planned takeover of the social-media company.

Mr Musk’s latest comments add to questions about whether he is committed to concluding a deal that was struck amid a steep sell-off in technology stocks.

Last week, he said the deal was “on hold” over concerns about fake accounts on the platform – a problem that has long dogged social-media companies.

In a tweet early Tuesday, Mr Musk said that Twitter’s chief executive had refused to show proof that less than 5 per cent of Twitter’s accounts were fake.

“This deal cannot move forward until he does,” he said.

Mr Musk said his offer was based on Twitter’s filings with the Securities and Exchange Commission being accurate, and added: “20 per cent fake/spam accounts, while 4 times what Twitter claims, could be *much* higher.”

Mr Musk’s tweet was in response to an article covering his own estimate, made at a conference a day earlier, in which he estimated that fake users make up at least 20 per cent of all Twitter accounts.

Mr Musk’s figure roughly matches one in a new report from a market-research firm, SparkToro.

The firm says it includes in its figures automated accounts that could be considered legitimate, such as ones that post a feed of news headlines.

In securities filings, Twitter has long estimated that false or spam accounts represent less than 5 per cent of its total number of active users, but has also said that the actual number “could be higher than we have estimated.”

In a statement to the US Securities Exchange Commission, Twitter said it “is committed to completing the transaction on the agreed price and terms as promptly as practicable.”

Twitter’s board said in a separate statement that Mr Musk agreed to pay $US54.20 a share for Twitter.

“We believe this agreement is in the best interest of all shareholders,” it said.

“We intend to close the transaction and enforce the merger agreement.”

The developments come a day after Twitter chief executive Parag Agrawal defended his company’s efforts to fight spam.

“First, let me state the obvious: spam harms the experience for real people on Twitter, and therefore can harm our business,” Mr Agrawal said as part of a series of posts on Monday. “As such, we are strongly incentivised to detect and remove as much spam as we possibly can, every single day. Anyone who suggests otherwise is just wrong.”

He said Twitter suspends more than half a million spam accounts a day and locks millions of accounts suspected of being fake weekly if they can’t be verified by humans.

Last week, Mr Musk, the CEO of Tesla, said he would try to verify Twitter’s numbers and said others should do the same.

Mr Agrawal suggested that external estimates of spam accounts wouldn’t be accurate.

“Unfortunately, we don’t believe that this specific estimation can be performed externally, given the critical need to use both public and private information [which we can’t share],” Mr Agrawal said.

“Externally, it’s not even possible to know which accounts are counted as mDAUs on any given day,” he added, referring to monetisable daily active users.

Mr Musk responded with a number of tweets, with one showing a poop emoji.

Twitter’s regulatory filing early on Tuesday that detailed how the deal came together, said that Mr Musk had raised the prospect of a takeover early on in discussions with its board, well before his stake in the firm became public.

Mr Musk initiated outreach on March 26, according to the filing, separately contacting Jack Dorsey, Twitter’s former CEO and current board member, and another director, Egon Durban, co-CEO of private-equity firm Silver Lake.

That led to a meeting the next day with Mr Agrawal and Bret Taylor, Twitter’s chairman, in which they discussed Mr Musk potentially joining the board.

Mr Musk also said he was considering taking Twitter private or starting a rival service, according to the filing.

That meeting came more than a week before Mr. Musk first publicly disclosed his Twitter stake, on April 4, when it had grown to around 9.2 per cent of the company’s stock.

He declared himself a passive investor, signalling he had no intention to change or influence control of the company.

The disclosure, which came days after a required filing deadline, is now subject to a Securities and Exchange Commission probe.

Mr Musk on April 9 said he wouldn’t join the board, and instead planned to make an offer to take the company private, which led to a deal on April 25 for him to buy the company.

Tuesday’s filing, which runs to 235 pages, contains no mention of discussions between Mr Musk and Twitter officials about fake, spam or bot accounts.

Twitter stock closed up 2.49 per cent at $US38.32, leaving shares still well below the $US54.20 a share at which Mr Musk had agreed to buy the company, and below where Twitter’s shares traded before he first disclosed his stake in the company.

Mr Musk’s insistence on the issue of fake accounts has raised speculation that he may try to renegotiate or walk away from the purchase – though he has already signed an agreement and waived detailed due diligence on the deal.

Mr Musk and Twitter would each owe the other $US1bn if either walks away from the deal in certain circumstances, according to securities filings, but such a clause wouldn’t preclude a renegotiation – or a lawsuit.

Some outside analyses have found that Twitter may have more fake accounts than it discloses – though they use different methodology than Twitter and include accounts that the company excludes from its estimates.

SparkToro says its analysis of a representative sample of active Twitter accounts found that 19 per cent fit what it calls a conservative definition of fake or spam accounts.

But SparkToro specifies that its definition of fake accounts includes all accounts that don’t regularly have a human composing their tweets, which are common on Twitter for sending such information as news updates, inspirational quotes and stock-price changes. Twitter offers tools for developers to build automated bots.

– With Alison Prang

– The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout