Chinese property developers revive Asian junk bond market

Asia’s junk bond market is slowly coming back to life, with Chinese property developers at the forefront of the recovery.

Asia’s junk bond market is slowly coming back to life, with Chinese property developers at the forefront of the recovery.

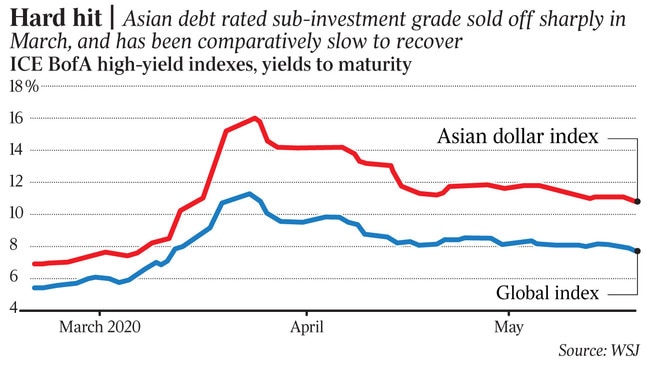

The region’s market was hit hard in March’s global sell-off, and has been slower to recover than international counterparts — particularly US high-yield, which for the first time ever is enjoying limited support from the Federal Reserve.

But investors are starting to buy new bonds from Asia’s riskier companies again, and borrowing costs relative to safer government debt have diminished slightly. That helps relieve some of the financing pressure on weaker borrowers.

New bond sales from mainland Chinese property developers, which account for most of the Asian high-yield bond market, all but ground to a halt from mid-March. Now some borrowers are returning to issue dollar debt.

Earlier this month, Zhenro Properties sold a $US200m ($306m) bond due in 2024, priced at slightly less than face value with a coupon of 8.35 per cent. And on May 19, rival Country Garden Holdings, whose credit ratings are split between investment-grade and sub-investment grade, sold a $US544m bond due in 2025 yielding 5.4 per cent.

Momentum is improving in China’s property sector, helping boost developers’ bonds. Home sales by volume for the first four months of the year contracted 16.5 per cent from a year earlier, narrower than the 22.8 per cent plunge in January-March, official data showed. Average home prices rose 0.4 per cent in April from March.

Some investors say there are bargains to be had before bond prices rise further and push yields back down to more usual levels. Until early March, the property sector’s bonds had held up well even as China went into lockdown to combat the coronavirus.

The yield on the ICE BofA Asian Dollar High Yield Corporate China Issuers Index fell to 9.8 per cent as of May 19. That is down from 10.6 per cent at the end of April, but still markedly higher than the US equivalent of 7.7 per cent.

“This is the best opportunity I’ve seen since the global financial crisis,” said Jean-Charles Sambor, the London-based head of emerging markets fixed income at BNP Paribas Asset Management.

Mr Sambor said dozens of Chinese property-company bonds shouldn’t be trading at double-digit-percentage yields. He believes investors are effectively getting yields of up to 4 percentage points more than they would for holding similarly rated US bonds.

He pointed to sector heavyweight China Evergrande Group, which has dollar bonds maturing next year yielding roughly between 10 per cent and 13 per cent. Mr Sambor said he has also bought other high-yielding debt in the region, including deeply distressed Sri Lankan sovereign bonds.

The upturn adds to evidence that sentiment is improving toward emerging-market debt more widely, after capital rushed out of developing countries in March as investors scrambled to meet redemption requests.

Some $US15.1bn flowed back into emerging-market debt in April, according to estimates from the Institute of International Finance, partly reversing March’s $US31bn of outflows.

Still, the limited recovery to date has been uneven. Many high-yield bonds in Asia continue to trade at levels indicative of financial distress, and in the coming months investor enthusiasm may not stretch to lending fresh funds to borrowers in certain countries or in struggling sectors such as natural resources.

In a report this week on investment-grade and junk debt, S&P Global Ratings said access to dollar-based bond markets was improving in Asia, but there was a split between the “haves and have nots”, with the main beneficiaries being bigger and financially stronger companies, those with government ownership, and Chinese developers. It said this uneven market access could last for three to six months.

Sameer Goel, chief Asia macro strategist at Deutsche Bank, said investors needed to be careful about buying debt even when yields were higher than usual, since that didn’t necessarily compensate for higher volatility or increased risk of default.

In some Asian countries, such as India and Indonesia, Mr Goel said it wasn’t yet clear if the pandemic had peaked and an economic recovery was on the way.

Moody’s Investors Service says the default rate for emerging-market high-yield borrowers could hit 13.7 per cent next March, up from 2.2 per cent two months ago. The figure is calculated over a rolling 12-month period.

China has been relatively restrained in introducing stimulus packages.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout