China increases trade in Asia as US pushes toward decoupling

The deepening ties are a result of China’s regional heft but also Washington’s spat with Beijing.

While the US has sought to persuade countries to reduce their dependence on China, trade ties between the world’s second-largest economy and the rest of Asia are deepening as economies grow and companies refashion supply chains.

Behind the trend, economists say, are powerful economic forces that tend to bind smaller economies to bigger ones as well as China’s dominant role as a supplier of the kind of affordable goods that fast-growing countries need, such as cars and machinery.

But China’s growing trade with its Asian neighbours also reflects the ripples of the worsening spat between the world’s two largest economies that began with a fight over trade and has since widened to encompass technology, national security and foreign policy.

The trade battle that took off in 2018, along with subsequent pandemic disruptions, started a reordering of global supply chains. Manufacturers based in China have sought to shift some elements of their production lines to the Asian neighbours, either to sidestep tariffs or insulate themselves from the risk of future upheavals as relations between the US and China deteriorate.

But that reshuffling often served to enhance rather than reduce trade between China and other parts of Asia, data shows, reflecting the complex nature of manufacturing processes that commonly require dizzying numbers of components and several stages of assembly. Snapping together a smartphone in Vietnam or India, for instance, requires the manufacturer to move Chinese-made parts and basic materials within Asia before it is shipped off to its final customer.

The upshot is the US will find it hard to nudge Asia away from China without more concrete steps to boost trade with its own huge domestic market. That means signing trade deals, joining regional trade pacts or taking other steps that would grant Asian economies greater access to US consumers, economists say.

“Within Asia the US is facing a real uphill struggle,” said Rory Green, chief China economist and head of Asia research at TS Lombard in London. “They are fighting economic gravity.”

China’s total trade – exports plus imports – with 10 of its neighbours in Southeast Asia, including Indonesia, Malaysia, Singapore and Vietnam, has grown 71 per cent since July 2018, when the US first placed tariffs on a range of Chinese goods, to $US979bn ($1.45 trillion) in the 12 months to November, according to a Wall Street Journal analysis of Chinese customs data.

Chinese trade with India increased 49 per cent over the same period. Its trade with the US rose by 23 per cent and with Europe by 29 per cent, the data shows, highlighting how China’s trade with Asian economies easily outpaced that with other big markets.

US trade with China has been pinched by tariffs, and China’s share of US imports has fallen since 2018, though trade between the two countries nonetheless returned to growth during the pandemic as consumers splurged on electronics, homewares and other goods during long spells of working from home. A similar trend played out in Europe.

Part of the explanation for the outsized growth in China’s trade with other parts of Asia is China’s gravitational pull. Economists established decades ago that countries trade more with big economies and with economies nearby. China is easily Asia’s largest economy, making it a natural trading partner for most of its fast-growing neighbours, just as the US is the biggest trading partner of Canada and Mexico.

Another reason is that China’s export basket is filled with inexpensive smartphones, basic vehicles and cheap factory equipment that sell well in the fast-growing but smaller economies that surround it.

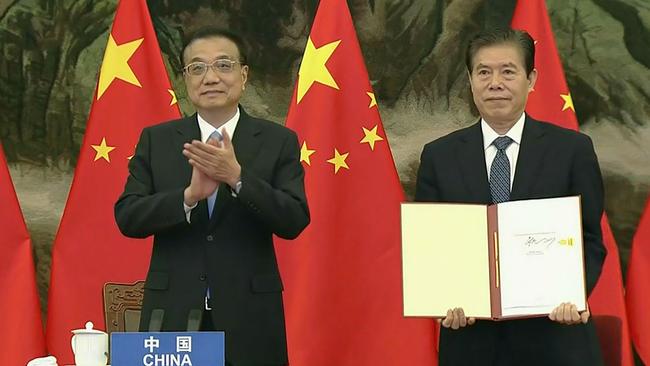

China also lowered many of its tariffs on imports from the rest of the world in response to the US’s decision to levy hefty duties on its exports to the US, making Asian-made products cheaper for its own businesses and consumers. It was a signatory to the Regional Comprehensive Economic Partnership, or RCEP, a 2020 deal that lowered trade tariffs among 15 Asia-Pacific countries.

Yet Asian economies also have been big beneficiaries of the tensions between China and the US, often experiencing big gains in trade with both antagonists.

Many Asian economies have seen an increase in trade with the US as importers searched for tariff-free alternatives to Chinese-made products, or China-based exporters set up shop in another country to get around the US trade restrictions.

South Korea after 2018 saw an increase in US imports of backhoes, textiles and television components, all of which were affected by Trump-era tariffs.

US imports from the same 10 Southeast Asian countries that saw a lift in trade with China since 2018 have also surged, rising 89 per cent since July 2018, US customs data shows. Including US exports to the same 10 countries, total trade reached $US450bn in the 12 months to the end of October, compared with $US262bn in mid-2018. US trade with the whole world increased 29 per cent during that period.

The reshuffling of global supply chains that accelerated with the trade war has been spurred on by growing tensions between Beijing and Washington over Taiwan and national security, and by the pandemic, which exposed companies that were overly reliant on China to the risk of severe disruption from China’s now-abandoned zero-tolerance approach to Covid-19 outbreaks.

Dozens of companies have in recent years moved chunks of their production out of China and into other Asian countries.

They include Japanese companies such as electronics giant Panasonic and antenna maker Yokowo, as well as Chinese companies such as GoerTek, an Apple supplier.

An October survey of 525 Taiwanese companies by the Centre for Strategic and International Studies, a Washington-based think tank, found that a third of companies with operations in China were considering moving out of the country and a quarter had already shifted some of their activities.

While other Asian countries have benefited from these new investments, their factories still require Chinese inputs to function. Economists say that is also contributing to China’s deepening links with other Asian countries, though the precise scale of the effect is hard to measure.

Apple has accelerated plans to move more of its production out of China, telling suppliers to plan more actively for assembling Apple products elsewhere in Asia, particularly India and Vietnam.

However, the tech giant isn’t ditching China altogether, and may even increase the amount of business it does with some other Chinese companies.

These cross-currents reveal a wrinkle in US policy towards trade with China. US Secretary of State Antony Blinken and US Trade Representative Katherine Tai have spoken of giving countries a choice between the US and China, rather than forcing them to choose.

But “there are a whole lot of reasons why those countries are going to trade with China anyway,” said Chad Bown, a senior fellow at the Peterson Institute. The US approach has been to warn countries that economic dependence on China can be exploited by Beijing. China stopped virtually all imports from Lithuania in 2021, for instance, when the Baltic state angered Beijing by supporting Taiwan. The island has recently faced restrictions on exports to China of products including beer and seafood.

With the rewiring of the Asian economy making nearby economies more, not less, reliant on Chinese trade, economists say that to offer a real alternative the US will need to do more to boost trade with Asia, perhaps by joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, a free-trade accord that 11 nations pursued after the US withdrew from its forerunner, the Trans-Pacific Partnership. The Biden administration has said it doesn’t support joining the pact as it stands but would be willing to renegotiate it.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout