China Eastern plane crash complicates Boeing’s China relationship

The crash of a China Eastern 737-800 aircraft after it dropped from the sky comes at a precarious time for Boeing amid the ongoing fallout of its MAX crisis and the China-US trade war.

The crash of a China Eastern Airlines Corp. 737-800 comes at a precarious time for Boeing Co. in China, with the plane maker working to revive its standing in the key aviation market after years navigating the fallout of the MAX crisis and a China-US trade war.

On Monday, a Boeing aircraft carrying 132 people suddenly fell from the sky, and rescuers on scene have yet to find any survivors among the plane’s debris. China Eastern Airlines grounded its entire fleet of 737-800 aircraft in response affecting some 224 in-service aircraft across the airline group, according to aviation consulting firm Cirium.

For Boeing, the crash comes as it was closing in on the return to service in China of the 737 MAX — a different model to the aircraft in Monday’s crash. The aircraft’s fixes had been approved by China’s regulator with Boeing saying in January it was prepared to resume deliveries of the aircraft as early as the first quarter of this year.

Boeing shares rose 2.6% Tuesday to $190.66 after falling 3.6% Monday following news of the crash.

China has been an increasingly important market for Boeing as the country rapidly built up its aviation industry over the past three decades. The company has delivered 1,736 jets to China, according to Boeing’s own data, with 143 more on order. Boeing believes there is far more to come. It forecasts that China will buy 8,700 new jetliners — from all suppliers, but chiefly from Boeing and Airbus SE — over the next two decades, accounting for nearly a fifth of global demand.

The key to realising that potential, however, will likely be Boeing’s ability to restore Chinese confidence in its aircraft.

Boeing cancelled a senior executive meeting due to take place this week in Miami in response to the crash, according to a person familiar with the matter, while representatives from the company will serve as technical advisers to the investigation being led by the Civil Aviation Administration of China, its safety regulator.

It can typically take months or more for investigators to determine the cause of an air crash. The reasons for the crash will likely play a large role in determining the length of China Eastern’s 737-800 grounding and any delay in the MAX’s return to flying, analysts said.

Boeing Chief Executive David Calhoun last year said the company needed new orders from China’s airlines, the biggest buyer of aircraft in the world, to compete as air travel recovers quickly from the pandemic. The U.S. plane maker hasn’t secured a new jetliner order from China in over four years.

Mr. Calhoun, in a message to staff on Monday evening, said the company is closely communicating with China Eastern and regulatory authorities following the crash. “Trust that we will be doing everything we can to support our customer and the accident investigation during this difficult time,” he said.

China Eastern’s rapid reaction to Monday’s disaster calls back China’s response in the wake of the Ethiopian Airlines tragedy in March 2019, which led to the worldwide grounding of the 737 MAX, a later generation model to the 737-800 involved in Monday’s crash. China’s aviation authority was the first to ground the MAX, with Western safety officials initially expressing concern that it had acted prematurely and without sufficient evidence before ultimately following suit.

Boeing’s business in China has been buffeted over the past few years by the souring of U.S.-China relations, the grounding of the 737 MAX and the coronavirus pandemic, which continues to depress Chinese travel demand and with it demand for new jetliners.

“We would now expect further delays to Chinese reinstatement of the 737 MAX while this accident is investigated, at least until a likely cause is identified,” Robert Spingarn, an equity analyst with Melius Research said in a note to clients. He added that investors are watching to see if the cause is attributed to an aircraft fault, pilot error, a maintenance issue, or to an external event — such as weather.

A rupture with Boeing would have severe costs for China, too, given its reliance on the company’s aircraft.

Boeing’s importance was illustrated by Beijing’s response to President Trump’s tariffs. As the U.S.’s biggest exporter, Boeing was an obvious target for Chinese reprisals. Instead, Beijing in 2018 slapped a 5% levy on small U.S.-built aircraft, while leaving the larger jets which Boeing produces unscathed — a sign, analysts said, that China had decided against disrupting the supply of Boeing aeroplanes to protect the growth of its aviation sector.

China is also a major customer for Boeing’s rival Airbus, but Airbus’s huge order backlog makes it hard for Beijing to shift orders to the European company and expect an uptick in Airbus deliveries.

The state-run Commercial Aircraft Corp. of China, or Comac, has been developing a 737 rival, which, after years of delays, will be ready to enter service in 2022, the company has said. China Eastern will be the first customer for the new C919 jet.

In China’s centrally planned system, Beijing can force China Eastern and other state-owned airlines to buy the C919, potentially depriving Boeing of some new orders. Yet while some analysts believe that Comac will eventually become a serious rival for Airbus and Boeing, most downplay the homegrown plane’s chances of challenging the established duo any time soon.

Boeing opened its first production facility outside the U.S. near Shanghai in 2018. However, the so-called finishing centre only fits and paints 737 jets built at Boeing’s factories in Renton, Washington, and — unlike Airbus, which manufactures jets in Tianjin — the company has said it has no plans to make aircraft in China or anywhere else outside the U.S.

Airline had rapid growth without safety incidents

China Eastern Airlines Corp. has grown over the past three decades to become one of the world’s biggest carriers by catering to a vast new market of Chinese travellers.

Until this week, its rapid rise — like that of China’s broader aviation industry — had also been largely without safety incidents.

That record was challenged Monday when China Eastern Flight 5735 dropped from the sky and slammed into the mountains of southern China with 132 people on board. The crash was China Eastern’s first since 2004 and abruptly ends the country’s record of 12 years without a deadly air disaster.

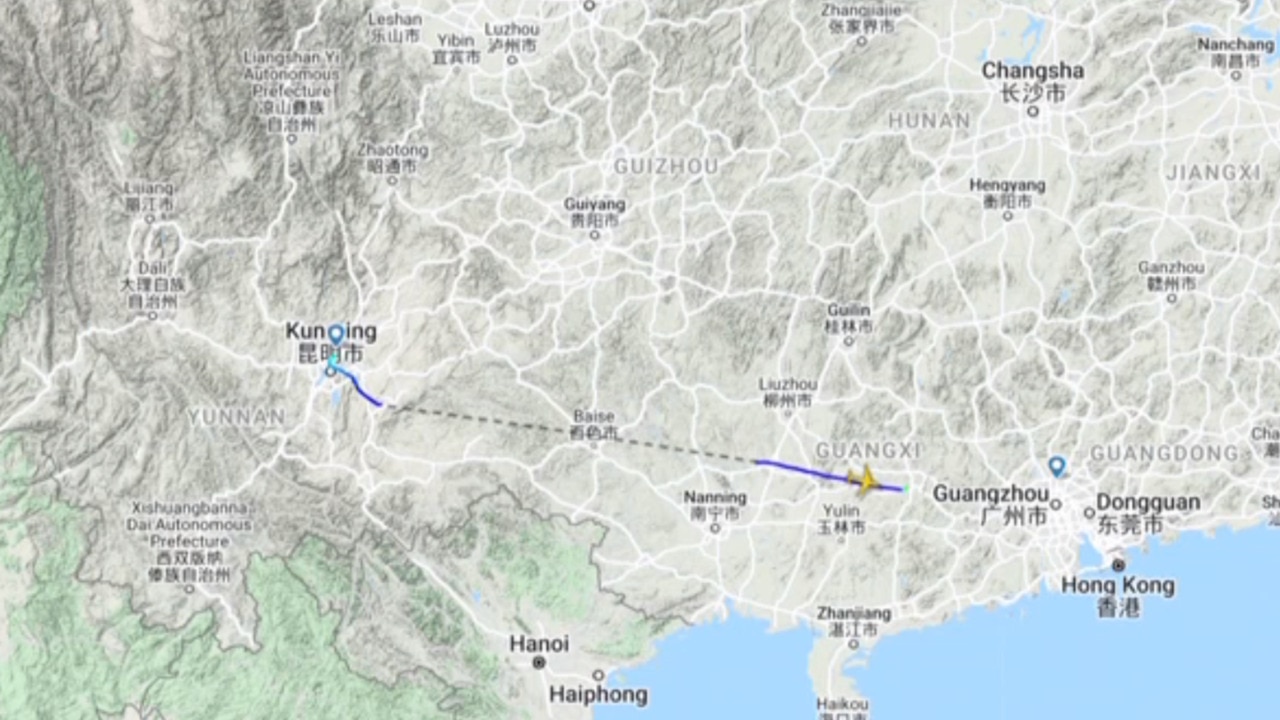

The company said it lost contact with the Boeing 737 during its journey from the southwestern city of Kunming to the southern metropolis of Guangzhou, and that it had sent teams to the accident site. China Eastern said the cause of the crash was under investigation and that it would co-operate with the relevant probes.

Founded in 1988, China Eastern is one of three big state-owned airlines, together with Air China Ltd. and China Southern Airlines Co., which dominate Chinese air travel.

Based in Shanghai, China Eastern is the main link between China’s financial capital and other cities both inside and outside the country — a role that has made it a key beneficiary from an explosion in demand for air travel in the country.

Growing from a low base of around 62 million in 2000, China logged 660 million air passenger trips in 2019, as millions of Chinese embraced travel for the first time.

That growth rate had put the country on track to overtake the U.S. as the world’s biggest aviation market by as early as 2022, the International Air Transport Association forecast, before the coronavirus pandemic hit travel demand globally.

China Eastern carried 130.3 million passengers in 2019, making it the world’s eighth busiest airline that year, just behind Germany’s Lufthansa AG and just ahead of the parent company of British Airways. A decade earlier, China Eastern carried 44 million passengers.

Still, passenger numbers have dropped over the past two years amid the pandemic, with China Eastern logging 78.5 million passenger journeys last year. In January, the company said it would likely report a loss of about $2 billion for 2021 because of the slump in demand.

Like other airlines, China Eastern had said it was expecting a better 2022, though that was before the new lockdowns in China, and any potential knock-on effect of this week’s crash.

Even as pandemic-era restrictions ease elsewhere, China has kept strict curbs on international travel in place, all but wiping out demand for international flights. Domestic air travel has largely continued over the last two years, although demand has remained below pre-pandemic levels as the government has battled sporadic outbreaks of the virus with tough lockdowns.

China Eastern operated a fleet of 734 aircraft in 2020, according to its most recent annual report, including 400 built by Airbus SE and 322 by Boeing Co. At the time, the airline said its wide-body fleet had an average age of 5.6 years, while its narrow-body fleet was 7.4 years old, making its jets among the most modern in the world.

As Chinese aviation expanded, China Eastern became intertwined with the global air transport system. Delta Airlines Inc. acquired a 3.55% stake in China Eastern in 2015 for $450 million, as the U.S. carrier sought to capitalise on the huge growth in travel between the U.S. and China.

“Delta’s relationship with China Eastern is longstanding,” Delta’s then-chief executive Richard Anderson at the time. “We share a vision that will create the most profitable, enduring franchise between the U.S. and China.” Delta’s stake in China Eastern has since dropped to about 2%, according to a recent filing.

The airlines are both members of the SkyTeam alliance alongside Europe’s Air France-KLM SA, in which China Eastern is the second-largest shareholder after the French state with a 9.58% holding. Adding partners in Europe and the U.S. has enabled China Eastern to expand its global network and offer its customers more choice, the airline has said.

While Monday’s crash is China Eastern’s first in almost two decades, the airline did suffer several accidents in its early years, with four fatal crashes occurring between 1989 and 2004.

In the 2004 crash, 55 people died after a China Eastern Bombardier CRJ200 crashed shortly after takeoff from Baotou in Inner Mongolia.

The induction of increasingly modern aircraft and flight protocols then delivered a long run without any tragedies.

The U.S. government has helped China to improve its aviation safety standards for two decades through the U.S.-China Aviation Cooperation Program overseen by the Federal Aviation Administration.

Even so, foreign pilots working in China have expressed concerns about practices which they say are common to local carriers and increase the risk of accidents. After a string of non-fatal accidents in mid-2018 involving Chinese airlines, the country’s civil aviation authority acknowledged that the “excessive expansion” of Chinese aviation had weakened its safety regime and it pledged to identify and remove unqualified personnel.

The Wall Street Journal