Our energy future: The resources rich list

These Australians are building their fortunes on conventional energy generation, with at least one having a bet each way.

It has been the deal that proves there is still plenty of mileage in investing in old-style energy assets.

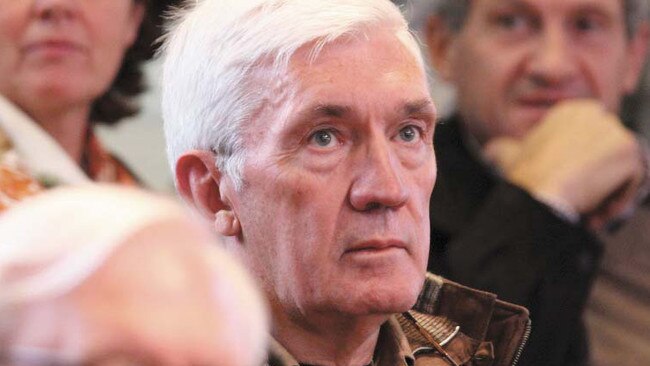

Energy maverick Trevor St Baker has an eclectic list of holdings, ranging from his ERM Power electricity retailer which previously built a string of gas-fired power stations, to the electric vehicle-charging startup Tritium, and plenty of other energy startups as well.

But it was the deal that saw St Baker and his business partner, coal baron Brian Flannery, pay just $1 million — small fry for two members of the country’s wealthy elite on The List - Australia’s Richest 250 — that has turned out to be one of the canniest in recent memory.

The duo stumped up the token $1 million for the Vales Point power station on Lake Macquarie in NSW in 2015, the very asset at which St Baker began his career as an operations manager in the late 1960s, and got a bargain even if they were taking on $30million of liabilities as well.

At the time of the sale, then NSW treasurer Gladys Berejiklian said the $1 million price was “above its retention value”, but the two members of The List made a contrarian call that has well and truly paid off.

Surging electricity prices delivered the pair a huge profit and a bumper $41 million dividend last year, with the asset making a strong $113 million net profit from $505 million revenue, compared with a $35 million net loss from $382 million revenue in the previous year.

Now there is talk of extending the life of the 1320 megawatt Vales Point, and St Baker has even contemplated buying his partner out, so confident is he in the investment.

Vales Point supplies about 4 per cent of power for the national grid, and could receive a $750 million injection to ensure it runs until 2049, which would make it the nation’s last standing coal-fired station, with just about all of the country’s other facilities due to be closed over the next 30 years.

St Baker and Flannery have cashed in on the east coast’s fragile power grid following the abrupt closure of Victoria’s Hazelwood coal-fired plant in March 2017. That closure exposed the frailties of the national electricity market while providing a lucrative source of profits for the three big “gentailers” — AGL, Origin Energy and EnergyAustralia — and smaller operators such as their privately held Sunset Power.

St Baker has also revealed a $6 billion Chinese-backed plan to develop Australia’s first high-efficiency, low-emissions coal plants in NSW and Victoria.

Many other members of The List have made good money from energy asset investments.

Perth mining billionaire Angela Bennett has energy assets in her diverse investment portfolio held in AMB Capital Partners, which also includes real estate and funds management holdings, while Perth education magnate Rod Jones owns 20 per cent of the electricity retailer and power plant owner Perth Energy.

That business has been up for sale and is said to be worth at least $150 million, while Jones also owns about half of the privately held Merredin Energy, which operates an 82Mw

open-cycle gas turbine power station near Merredin, 260km east of Perth.

The plant runs on average for around 100 hours a year, mainly during periods of extremely hot weather in Perth and surrounds, and is expected to have an operating life of approximately 25 years.

Paul Fudge, meanwhile, made his fortune from the 2009 sale of the Ironbark coal seam case project in Queensland to Origin Energy for $660 million and spends much of his time exploring for oil and gas in Queensland and the Northern Territory.

Then there’s another member of The List in Ian Malouf, the so-called “richest garbo” in Australia who has made his estimated $550 million fortune from the Dial-a-Dump waste business he sold to the ASX-listed Bingo Industries earlier this year.

But that deal left out some key assets, including a massive waste-to-energy incinerator Malouf still wants to build in Sydney’s west, although it was knocked back by an independent planning commission before last year’s NSW election.

Malouf, who sold his stake in Dial-a-Dump for almost $500million, has lodged an appeal which will be heard by the Land and Environment Court — and is confident he will win backing for the project in the future.

It is certainly a big plan with a $700 million value that saw it touted as the biggest waste to energy plant in the world, while claiming to have the capability to divert more than 500,000 tonnes of residual waste from landfill and use it to provide enough power for 100,000 homes.

While he has been stymied for now, Malouf would like to take the idea on a smaller scale to regional centres with the idea of powering local towns with waste-to-energy plants.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout