New Payments Platform beginning of a revolution

A new transfer system could revolutionise – and reduce – the role of financial institutions in how we pay for goods and services.

Payments and banking have been synonymous for centuries, but there’s no reason the two need to be provided by the same firms. The New Payments Platform could be the beginning

of a revolution in the way we pay for things, loosening banks’ longstanding grip on the payments system.

The NPP, still in a pilot stage and offered by a handful of banks, will allow immediate transfer of funds between bank accounts using mobile phone numbers or email addresses as identifiers. “This system has the potential to be transformational and will allow many transactions that today are conducted with banknotes to be conducted electronically,” said Reserve Bank Governor Phillip Lowe in a recent speech.

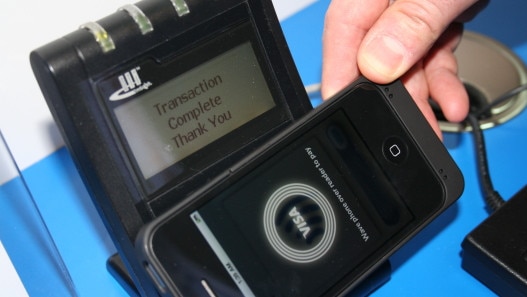

When we transfer money to friends and family, or pay for goods and services, we typically instruct the bank, often with the help of a card scheme such as Visa or MasterCard, to authorise the transaction – unless we’re paying with cash. But there’s no reason for banks to be involved.

As Lowe says: “In China and Kenya, non-bank entities have been at the forefront of recent strong growth in electronic payments. A lesson here is that if financial institutions do not respond to customers’ needs, others will.”

Payments between bank accounts in different currencies have been disrupted already, and firms such as Transferwise and OFX have slashed the cost of sending money to foreign bank accounts without sacrificing timeliness. The NPP could be the next phase of payment disruption in Australia.

Banks will still be attractive places to stash lazy savings, because deposits are insured by the government up to $250,000 at no cost to the depositor (or the bank). But firms specialising in payments will be able to connect to the NPP, and offer consumers and businesses easy-to-use digital apps to pay each other faster.

‘Wrenching the public away from cash could prove difficult.’

According to Lowe, “another possibility that is sometimes suggested for encouraging the shift to electronic payments would be for the RBA to offer every Australian an exchange settlement account with easy, low-cost payments functionality. To be clear, we see no case for doing this”. It’s interesting that he raised and ruled out such a possibility. In principle, why restrict the services of the central bank to commercial banks?

Reducing the cost of the payment system is ultimately in society’s interest, even if it isn’t in the interest of some financial service providers. A few years ago the Reserve Bank estimated the total cost of the payments system, shared across consumers, banks and merchants, at $11 billion, or 0.71 per cent of annual economic output.

Seemingly ordinary transactions can still be quite expensive. It’s hard for consumers to see because the cost of payments is typically embedded into the prices of goods and services.

While they can do so, businesses tend not to charge customers different amounts for using different forms of payment.

For example, “tap and go” electronic payment has made paying with credit cards, for even small items, increasingly the easiest choice for everything from a cup of coffee to a dishwasher. That’s how I pay for everything, maximising “points” and convenience, and minimising interest by paying in full and on time. It’s a win-win for me, but credit cards are in fact the most expensive way to pay overall. The business accepting the card pays a merchant service fee of about 0.75 per cent of the value of a purchase to its bank; that includes the cost of paying Visa or MasterCard for facilitating the payment. Even if you’re using a debit card, which has no borrowing facility, tap and go functionality routes the payment through the credit card system rather than the clunkier EFTPOS system that costs a few cents.

Cash might seem a cheap option, but given it needs to be created, stored and distributed, it is the next most expensive way to pay after cards. The cheapest is payment via direct credit and/or debit between bank accounts, and that’s what could increase significantly thanks to the NPP. For instance, a payment provider could allow customers to transfer money directly to Coles’ bank account when they shopped. The NPP could even threaten the card schemes by ultimately taking out the middle man.

While digital currencies and transfers are bound to proliferate, wrenching the public away from cash could prove difficult. The share of transactions made in cash has fallen from 70 per cent in 2007 to 37 per cent in 2016, according to RBA survey data, but the amount of cash in circulation is at its highest level in more than 50 years. The same trend is seen across almost every rich country. Whether it’s stashed under the under the bed or a haven for anonymous transactions, cash will be in demand whatever technology develops.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout