Generation X are next: Some feel young, others have already retired

Retirement is neither here nor there for those born between the 60s and the 80s. Some are travelling, others work and some are eyeing cryptocurrency. Here six Gen Xers tell their story.

Retirement already? Gen X is confronting the reality – and the opportunity – that their time in full-time work may not be much longer. For some in the cohort, born between 1965 and 1979 following the baby boomers, the end of their working lives is less than a decade away.

That means planning for retirement has to begin – even if the date is still years away – with attention turning to superannuation plans and how best to protect nest eggs built up.

How will my income be taxed? Should I quit my job early? Has the pandemic meant I’ll have to work for longer to hit my savings goals?

These are the questions that millions of Australians in what was once dubbed the MTV Generation – responsible for the alternative rock movement of the 1990 and 2000s, hip-hop and the movies of Kevin Smith, Quentin Tarantino and Spike Jonze – are confronted by.

For many, work may never truly end, either as a means to keep young and productive or a way to remain financially secure.

New research from Equip Super has found just over one in four Australians fears the Covid-19 pandemic has affected their plans for retirement. According to the data, 11 per cent of Australians have paused plans to retire, with about 15 per cent over the age 55 pushing their plans back between four and five years.

The study of more than 2000 Australians found about one-third of respondents were not comfortable winding down their working life.

The Deal spoke with six members of Generation X and asked about their careers and how they are thinking about the possibility of retirement.

Here’s what they have to say.

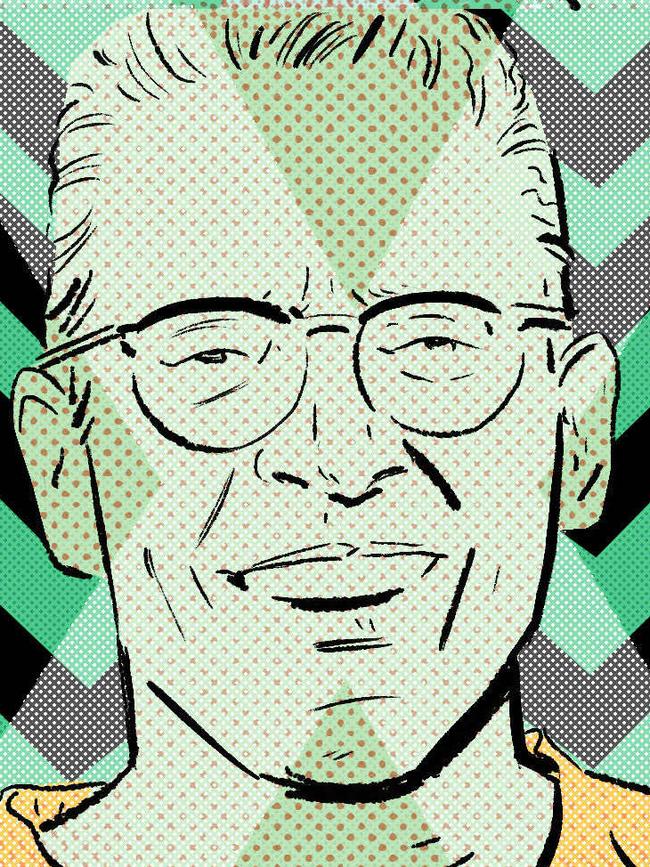

Michael de Lisle, 62, from Melbourne, retired at 58. He and wife Marie, 66, have two children, aged 33 and 31, one grandson and one granddaughter on the way.

De Lisle was a meter mechanic with the State Electricity Commission of Victoria for 41 years, with his only break a gap year after finishing his apprenticeship. After contributing 6 per cent of his salary into super since he was 23, he retired with enough to afford him and his wife $70,000 a year.––

“I was extremely lucky as I was part of a defined benefits program,” he says. “You live and learn as you watch all the old boys retire. You scratch your head at first thinking ‘how do you do that?’, and then you make a few inquiries.”

In his late 50s when he considered retiring, he walked into his super provider and asked if he had enough. “They sort of laugh at you and say ‘you’ve got a considerable amount more than other people’, and so I did it,” he says.

“We were told life would be comfortable at $60,000, but we wanted a little beyond that to travel. My wife and I wanted to do things. We wanted to do it while we were still capable of doing things.”

De Lisle says his life has been pleasant ever since. “I go out and have coffee with a couple of ex-workmates on Mondays. We sit down and solve the world’s problems and wonder why no one listens to us,” he says.

Asked what one of the most surprising parts of retirement is, he says it is observing how priorities change.

“I’m surprised that you get so hung up on things in your working life. Once you retire, you sort of sit back going, ‘oh my god, you’ve put up with a real lot of crap’,” he says. “It’s nice to be able to relax and enjoy life and do the things you want to do.”

On retirement, de Lisle says being debt-free is key.

“Owning a home is paramount if you are going to walk out early. You’ve got to be debt-free and ready to move on,” he says.

“I’ve been offered work and I must confess I was half tempted to go back, but then you consider all the stress and strain and all the bullshit that comes with it.”

Some question Gen Xers’ wealth and to that de Lisle says: “I have worked my arse off for 41 years to achieve all this and at the time we did go without things. I’m very lucky, very, very lucky.”

■ ■ ■

Claudette Younger, 62, is a laboratory technician in Gladstone, Queensland, who hopes to retire in the next couple of years. While Younger has made salary sacrifices into her super over her career, her husband, Bryan, 61 hasn’t.

She recently began transitioning into retirement with job sharing of her position. Younger says retirement age snuck up on her and her husband faster than they could imagine.

“I know children don’t want to hear about superannuation in high school but retirement really snuck up on us. We don’t feel like we’re old,” she says. Younger says she really began to prepare financially only during the past few years.

“We never really did much before then, only the last three or four years,” she says. “We’ll be right, however it would be nice if the government pension was a bit earlier.”

Asked if her friends are in a similar position, she says some people are more prepared and others haven’t really done anything at all.

Younger says she and her husband recently consolidated three debts into one. “Most of what we get for the next two years will be paying off our loan. And paying the amount we’re allowed to back in our super,” she says.

Asked if she feels comfortable with the government pension, she says: “I don’t know if it would be enough for people who don’t have superannuation behind them. Hopefully where we are, we’ll be able to have our own house. It’ll be hard for people that haven’t had good jobs.”

As for assets, she and her husband own the home they live in but they’re looking to sell up and move closer to the NSW border.

“We used to have an investment property. And in the future we will be looking to downsize. We don’t need anything huge, just something that is two to three bedrooms and close to hospital. Not in the middle of the town.”

■ ■ ■

Desmond Chu, 59, is a programmer and director of a Chinatown charity under Tiy Loy in Sydney’s Haymarket. He is married to Rebecca, 50, and has a daughter.

Uncertain about his future, he plans to continue working for about a decade more at the charity, which once was the place newcomers would go to find information about services, find a place to stay and catch up for a meal.

“It was quite like the general store except we also helped people assimilate into life in Australia,” he says. “Back in those days there was no Chatswood, no Hurstville. Everyone would come here.”

Chu says he’s not sure if or when he’ll ever retire. “I don’t think we’ll have a choice,” he says. “With the cost of living going up, it’s expensive now to go from point A to point B.”

He also believes remaining active keeps you young.

“If I go back to what I have seen with the elderly, when people retire at 65 and do nothing, that’s when they age very, very quickly,” he says.

“I have no plans to do anything like that. I want to do anything I can, maybe continue doing my directorship until 72 if I can. If not, I’ll have to find something else.

“But you got to keep working to keep young. Right? That’s the attitude I have.”

Chu says there’s an 93-year-old woman who pops by the charity a few times a week to have tea. “I think that’s how the Chinese keep young; they keep moving and they keep doing things,” he says.

Asked how he feels about retirement, he says he will slow down work but likely never truly stop. “Especially since the cost of living has gone up. I’m not sure about you, but I felt it big time.” Chu says he is concerned if he has enough to live on and enough for funeral costs. “Will I outlive my allocated pension?”

■ ■ ■

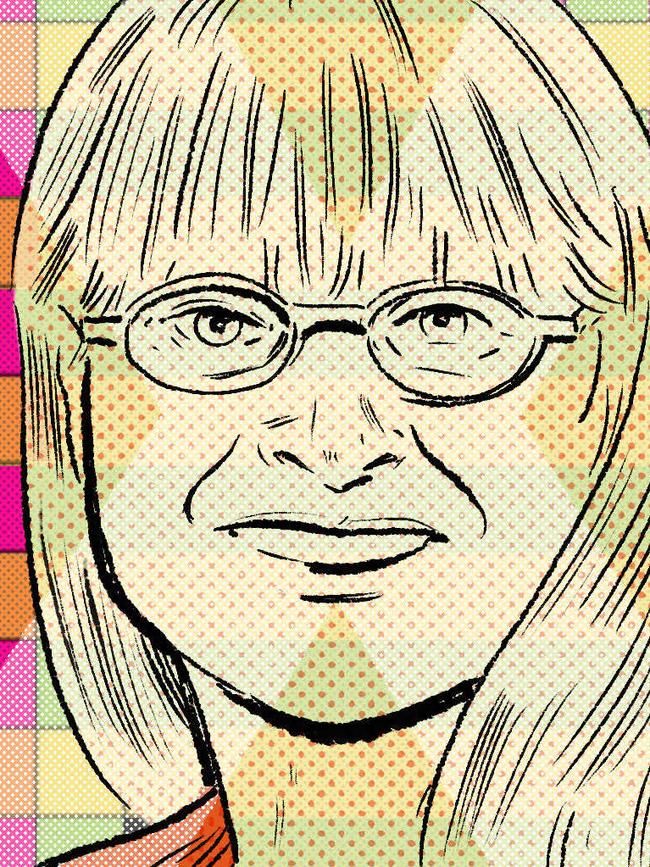

Jane Turner, 60, runs her own business helping authors get published. She had worked full time most of her life up until she was made redundant at 52.

That redundancy was quite the scare, she says.

“I had been a senior manager at the Powerhouse Museum for 15 years, I even had some runs on the board,” she says. “I am someone who is quite articulate but just could not get another goddamn job. It was really frightening. I’m glad I wasn’t trying to get another job during Covid.”

The experience turned out to be a blessing, she says. “In many ways, being made redundant was both the best and the worst thing that happened to me. Looking back on it now I found capacities in myself and joy in a way I never would have. When I get the satisfaction of passing someone the final version of the book and they say ‘you made me sound fantastic’ – I never felt anything like that. I feel fantastic.”

Asked when she thinks she’ll transition into retirement, Turner says it’ll happen in a couple of years when she moves from Sydney to regional Victoria near Sale.

“There is pressure on myself to make as much money as I can so I don’t have to dip into my super or sell my apartment,” she says.

Asked why she would like to refrain from using her super, Turner says she’d like to retain a safety net.

“That’s the thing, I do have a healthy chunk of super. It’s a smidgen under 400,000. Let’s say for whatever reason, if I can’t continue running my business – that’s the plot of money I have to stretch for the rest of my life,” she says.

“The whole thing about the pension – that does my head in completely.”

Having worked in the Commonwealth Employment Service, which made people prove they were working, Turner doesn’t think the process of getting the pension would be user-friendly.

Asked how she feels about retirement, she says: “I think people are a bit like me in as much as thinking I’m not ready, not emotionally ready, not feeling old or like I want to be put out to pasture,” she says.

Turner says her daughter, who is 21, often complains that she works so much.

“What I do with the authors I work with, who can’t be bothered doing the wordsmithing, it makes me happy. I’m happy in my little space fiddling with words. If I wasn’t doing the work I’d be compromising my eyesight watching Netflix,” she says.

“From my point of view, I was never one of those people who plans their money well … but I’ve been really lucky. I bought real estate when it was cheap.” The apartment, which she bought in Sydney’s Erskineville, cost $137,000.

Asked about the future, Turner says she feels uncertain. “I think the whole model of government doesn’t work any more, frankly,” she says.

“What really bothers me is the kind of dichotomy that exists now. My father would roll in his grave if he heard this, but usually there is something bigger to those large conspiracy cohorts that people are talking about. Sometimes I wonder should I just dabble and get a little bit of bitcoin.”

■ ■ ■

Roslyn Jan, 54, retired seven years ago at 47. Jan was one of the lucky few who did well out of the dotcom boom. Her career in IT began as a programmer and finished in computer support.

Jan began contracting in 1996 following two roles at Logica, a British company, and Pollak Partners. Her clients have included Ernst & Young, Westpac and Commonwealth Bank.

“I worked in IT as a programmer, then went into computer support and training. I mostly worked as a contractor, which gave a bit of a better rate – that helped with my savings,” she says. “I’ve always saved.

“I had an opportunity to buy a two-bedroom property from my uncle in Freshwater (in Sydney) and it sort of kicked me into getting into the property market. I was able to pay off the $210,000 mortgage in eight years and five months.”

Jan met her husband John in 2009 when he visited Australia for work.

“We had a 6½-year Skype relationship,” she says. When he moved to the country in 2015, the pair got married.

“We thought, oh well, we should probably have some quality time together while we still can,” she says. “We did bits of travel here and there and then a few months after getting married we had enough savings between us as John had been working for 30 years.”

Jan owns a house and an investment unit and John had shares.

Since retiring she has been travelling, looking after her father, World War II veteran Gilbert Jan, and more recently getting into pub trivia. “We’ll get to a different pub each week for some variety,” she says.

■ ■ ■

Michele Gennoe, 55, is a Sydney-based mindset coach. “I started off in mindfulness and moved into mindset more recently, but I’ve been coaching and training and working as what I would call a transformation specialist, all of my career,” she says.

Gennoe’s career began as a consultant, much of which revolved around contract-like work long before the gig economy was making headlines.

“I’ve been working in the gig economy all my life as I’ve been a consultant. I’ve worked with far less security and lived job to job, or contract, I should say,” she says.

Asked how she feels about retirement, Gennoe says it has become more relevant only in recent years.

“I’m like many mid-50s people. I probably never really thought about what the plan for the next steps were until recently,” she says. “And when I did, it was just as confusing as the last time I looked at financial advice.”

Gennoe says when a friend struggled to access her super it got her thinking more about her own retirement.

“It got me thinking, well, I probably need to spend some money now to find out how to structure my super because it’s such a complicated area,” she says.

She has spoken to financial planners about strategies including property. She says she was surprised to learn banks aren’t as generous when you reach your 50s.

“As a single person, the banks are less likely today to lend me money than when I first began purchasing property 15 years ago,” she says. “Back then the bank wanted to throw a million dollars at me but I was too risk adverse … now I’m more willing.”

Gennoe owns two properties. One is in Sydney that she says is “the cash cow” and the other was the result of “bad investment advice”.

Gennoe isn’t planning to ease back on work until she’s at least 65, when she’ll go travelling. “I don’t know if you can be Zooming into a board meeting while camped by a billabong.”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout