Courting the Middle Kingdom

The country’s huge middle class is hungry for sport — and travel — and it’s proving a winner for Tennis Australia.

It is a record sponsorship deal with a previously unknown liquor brand, and it represents a huge breakthrough for Tennis Australia in its quest to do major business in China. But the deal, which almost had an inauspicious beginning on the eve of January’s Australian Open, encapsulates how corporate and sporting leaders from each country are still learning how to do business with each other.

Last October, TA officials clinched the sponsorship deal with Chinese liquor brand Luzhou Laojiao, which signed as an associate partner of the Open for the first time in 2019. It was a deal at least on par with major sponsor Kia’s minimum $16 million-a-year arrangement.

It was a huge contract that took a year to negotiate. Australian tennis officials and Luzhou Laojiao executives, who run a company that dates to 1573 and is a leader in Chinese baijiu drinking culture, were extremely excited about it.

According to TA director of international business Ben Slack, Luzhou Laojiao was mainly concerned with appealing to its domestic audience, Chinese who tune into tennis coverage on the national CCTV, across several regional dialect channels and the IQIY digital streaming service.

But the Chinese company also has aspirations to take its brand to the world and figured courtside signage based on its 1573 start date would help spark awareness in potential export markets. Which presented a problem.

“It is a two-way learning curve,” Slack tells The Deal. “I’d like to think we’re learning a lot from our Chinese partners but we are also teaching them some things too. A few days out from the Open we found out if you googled 1573, which was going to be on the court, nothing came out. It just said what happened in 1573.

“If you put it into [Chinese search engine] Baidu then everything would have come up. So what we quickly said to them is ‘you need to do a Google ad buyout’, which I think was pretty cheap, and at 10am in the first match of the tournament we just watched these Google searches going bang, bang, bang. So it is proof of how a brand can use our platform as an awareness piece.”

It is also proof of how quickly China has become an important part of TA’s corporate strategy in its quest to make the Open the biggest sports and entertainment event in the world, and how the sporting body has accelerated its business focus on the region, and particularly China, in the past few years.

Geographically, Australia is in an ideal time zone to broadcast primetime tennis into Asia and it is an ideal tourist destination. While the event is usually a ratings winner locally and crowds flock to Melbourne Park, the Open’s status as one of only four Grand Slam tennis events points to growth opportunities abroad.

“We can’t keep growing the Open at the rate we have been in a country of only 25 million people, so we have to be outwardly focused,” says Slack, who adds that half the spectators at Melbourne Park already come from interstate or overseas.

“It’s still a strong enough proposition for people to travel here, so how do we grow that from an international point of view? About 85 per cent of our broadcast viewers are offshore.” Slack says China and Japan typically vie with each other for biggest single overseas audience.

He notes that next year’s finals weekend coincides with Chinese New Year, a time of huge travel for a middle class rapidly embracing tennis. Travel plans are usually made from around September onwards, a time when TA usually steps up its Chinese marketing campaign.

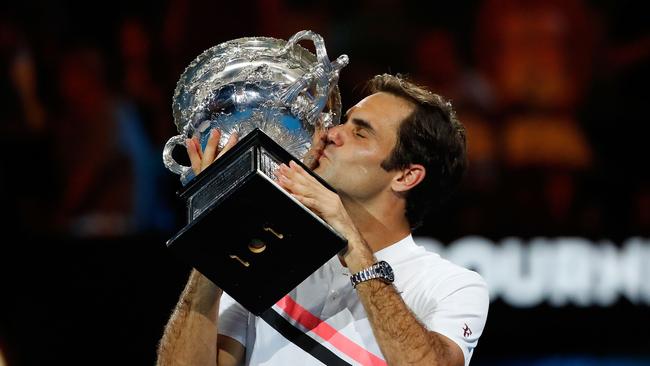

Chinese star Li Na’s Australian Open victory in 2014 was also a significant moment and her win remains the second most watched broadcast in the event’s history, behind Japanese player Naomi Osaka’s triumph this year.

“We can’t keep growing the Open at the rate we have been in a country of only 25 million people, so we have to be outwardly focused”

In China alone, the hours viewed of the Australian Open are more than double that of the French Open, three times higher than Wimbledon and more than four times higher than the US Open, according to research by Futures Sport & Entertainment. Where eyeballs go, commercial interest generally follows, hence the decision to put considerable resources on the ground in China.

“We’ve been calling ourselves the grand slam of Asia Pacific for at least since [2005], but if we are being honest with ourselves that has been more about proximity and geography,” says Slack.

“Then we started running events that were mostly PR-based, liked trophy tours over a couple of weeks. But we knew if we were going to have a proper impact we couldn’t do that with a fly in-fly out business.

“So that is when we decided to start a business over there, with local market expertise. Like other businesses, scale is a big reason. You’re looking at a middle class of more than 550 million people in China. They are interested in and have time for sport [and] 150 million of them are travelling every year. They have a higher propensity to spend and there is rapid urbanisation and moving into cities as well.”

TA now has 10 permanent staff working on the Chinese mainland and in Hong Kong, most of them in Shanghai. It has also opened an office in Chengdu, which is about an hour from Luzhou in the Sichuan province and the closest main commercial centre.

The Australian Open has a partnership with Ctrip, the nation’s biggest online travel agent, and three big Chinese sponsors in Luzhou Laojiao, Shenzhen water company Ganten and furniture and bedding company DeRUCCI. Combined they pay upwards of $25 million annually to associate their brands with the event. One court was even renamed the 1573 Arena for the 2019 tournament.

TA has put considerable effort into its Chinese social media presence. Five special hashtags on Weibo generated 803 million views for the Open this year, including 24 million views of actor Hu Ge at the men’s final.

There are also more than one million followers of the Australian Open Weibo account.

Technology has also helped from a broadcasting and sponsorship point of view, with TA now producing the broadcast so it can tailor vision for viewers in particular countries, showing courts and action meeting their specific interest, and for sponsors.

‘TA has put considerable effort into its Chinese social media presence. There are also more than one million followers of the Australian Open Weibo account’

Ganten, the Chinese water brand, is a case in point. Now the Open’s official water partner, the brand first sounded out TA for sponsorship opportunities three years ago. With the water category already taken, tennis officials offered Ganten virtual signage by placing its brand on the umpire’s chair in a feed shown only on its Chinese broadcast. Viewers and spectators in Australia were none the wiser.

“It was a great stepping stone in bringing Ganten in [as an overall partner] and eventually they became a global partner,” says Slack.

“They loved the umpire’s chair so much they took it physically [as sponsorship signage] as well.”

It was a similar story with the courtside sign showing the speeds of players’ serves. TA sold virtual signage packages to sponsors such as Mastercard, which wanted a China-specific message, through to Ctrip.

From next year onwards, TA wants to introduce the virtual signage sponsorship potential across all of its courts for its coverage across the world. Big names like Kia, Mastercard and Rolex may want to be seen in every market, Slack says, but there are plenty of other opportunities in other categories to tailor the branding to specific markets such as China.

The Luzhou Laojiao deal came through via more traditional sporting diplomacy — though there was also a technological twist.

In 2016 Victoria entered into a sister-state agreement with Sichuan, one of China’s fastest-growing regions. Government officials asked TA for some help with the relationship, which led to the introduction of the junior training “Hot Shots” program into Chengdu schools through the federal government’s Asian Sport Partnership.

“Someone from that introduced us to someone else who introduced us to Luzhou Laojiao,” says Slack.

“And that’s where that relationship began. It proved something to us, because sometimes when you’re trialing a couple of different things and thinking should we do a schools program or something else, you’re wondering where this is going to lead. As long as you limit your exposure you’ve got to jump in on some stuff and it proves to us that these things could lead to this.”

After months of talks, the deal was clinched when TA hired out a Shanghai ballroom and flew Luzhou Laojiao management in for a pitch with LED screens all around the room and a huge virtual presentation of what the Australian Open’s mixture of sport, entertainment and music looked like. It proved to be a successful sales strategy.

The deal is also about making Luzhou Laojiao more relevant in China. While the company has a 500-year, baijiu-based heritage, Slack says it needed to start shifting away from a consumer who has been part of the predominately older, male business-room drinking culture to a modern tennis fan.

“The modern consumer in China is 25 to 35 years old, young family, wanting to travel and digital-savvy,” says Slack. “It’s very different. They need to be contemporary and modern so there’s this shared value where, while we’re not 500 years old, we’ve got this heritage and culture of a sport but also we need to be contemporary and modern to the consumer as well.”

TA has funded a series of Chinese sport and executive events in the lead-up to the Open, led by the Australian Open Asia-Pacific Wildcard playoff each year in Zhuhai that grants the winners a place in the main Open draw.

There is also the Belt and Road Chengdu-Australian Open University Tennis Championship held annually in Chengdu, the winners of which travel to Melbourne for a cultural exchange. The new Australian Open China Challenge is a 10-city, 500-player amateur event for corporate tennis teams, held in cities such as Xi’an, Beijing and Chengdu. It will see tournaments run with TA staff culminating in the 10 winners competing for an overall prize in Melbourne during next year’s Australian Open.

“So it’s about what events or touchpoints we have to extend out what is effectively a two-week event in Australia,” says Slack. “How do we tell a story around the rest of the year? It doesn’t have to be shouting from the rooftops in June, but you can do things along the way.”

But it is the Luzhou Laojiao deal that is the most important move in China for tennis yet. More commercial deals are in the offing, but Slack says of the partnership with the liquor brand: “It was a big moment for our China operations and proof of what we were doing.”

John Stensholt writes on the business of sport for The Australian

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout