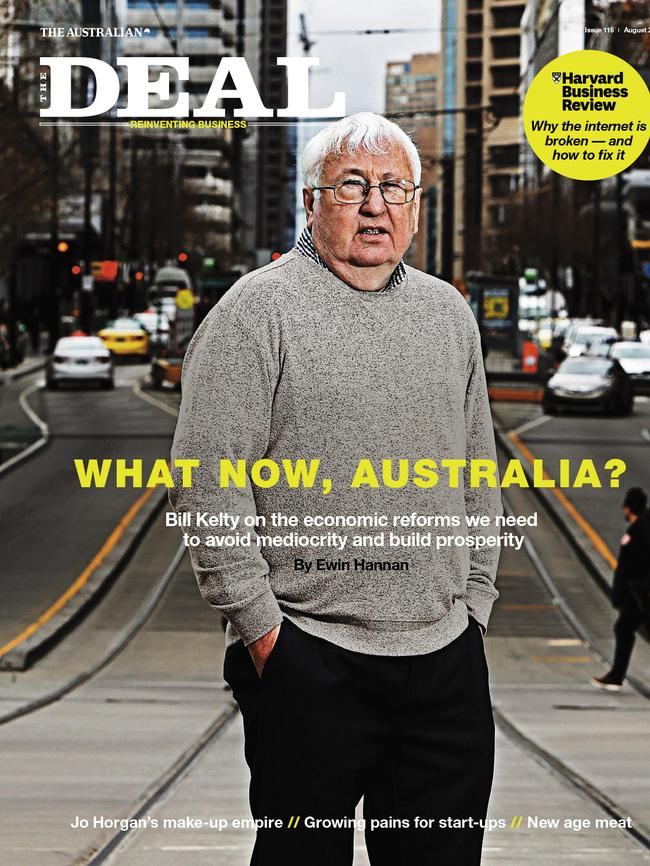

Bill Kelty’s blueprint

The former ACTU secretary has some ideas about how we can avoid mediocrity and build prosperity.

Bill Kelty is sitting at a table in the outer suburban Melbourne home he has lived in since 1970, jotting notes on an A4 pad while explaining how Labor blew the supposedly unlosable election.

“It’s like the grand final,” says the former ACTU secretary, ex-Australian Football League commissioner and co-architect of the Prices and Incomes Accord. “One minute you have got your hand around the cup and people are talking to you and behaving like you are the captain of the premiership team. And then when you get to play, you lose. It’s not only that you have lost but this was your one great chance. This is a very ordinary government, a divided government that when you look at it will defy all odds.

“I think it’s one we threw away, that’s what I think. Bill Shorten worked very hard. He would have made a very good prime minister. We all make mistakes. When you choose not to be a tax reform party but make tax the centre of your policies, it’s never been done in the history of Australia.

“I think the Labor Party didn’t win because they tried to do too much. Politics is like anything: you try and sell four or five ideas. You don’t try and sell 140 ideas. When you look at what the party was trying to do, there were many good policies, but so many policies that people couldn’t digest the key ones effectively.”

At 71, Kelty has his own handful of ideas about what policy-makers should do to set Australia up for 2040. He has been on the phone to his friend and former prime minister Paul Keating, talking about what levers would need to be pulled to fireproof the country against a future economic crisis.

With the passing of Bob Hawke, Kelty describes himself and Keating, along with former ACTU president and former federal Labor leader Simon Crean, as among “the last of the warriors”. The four men were instrumental in driving the Accord, the historic compact between Labor’s political and industrial wings during the Hawke-Keating years that was dedicated to economic growth and job creation.

The agreement covered every area of domestic policy, but critical to its success was union acceptance of wage restraint in exchange for job creation. It saw a shift in emphasis by unions from money wages to the social wage, opening the way for national healthcare and superannuation.

‘You don’t design your tax system for low-paid people. You design your tax system for middle-class Australia.’

Kelty doesn’t suggest the return of the Accord but he does support an approach to government consistent with the Hawke-Keating model. His prescriptions today include cuts to marginal tax rates, progressive increases in the superannuation levy, a new asset class to drive infrastructure investment, six-figure teacher salaries and changes to the workplace relations system to address stagnating wages and lift productivity.

Throw in decisive action on climate change, a successful republic vote and a treaty with indigenous people and “imagine Australia in 2030 or 2040 … put all those things together and the country does look fundamentally different”, he says.

“I reckon Shorten would have been up for the treaty. He said he was up for the republic. He was up for most of this I think, and the tragedy is it got too big. Too many messages, trying to please too many people and the ends got confused with the means. There was not a sufficient story and that’s because you are in a political party trying to cater for everybody. Everybody wants everything.”

Kelty believes genuine tax reform should be about fundamental changes to the taxation system, not Shorten’s agenda of hiking up taxes to fund spending increases. He says Labor’s franking credits policy financially penalised many low-paid people and insulted them by depicting them as the “top end of town”. Likening the backlash to voter opposition to John Howard’s WorkChoices, Kelty says he raised his concerns with Shorten but was “incapable of convincing him”.

For taxation changes to work, he says, “you have to have a provision that protects those people because you are taking money off them. You don’t design your tax system for low-paid people. You design your tax system for middle-class Australia. That’s Hawke and Keating lesson number one.”

‘Why not just pay teachers progressively more and get better qualified teachers? It could take five to 10 years, but get on with it.’

Aside from tax, Kelty nominates education, industrial relations and superannuation as key areas to reform. He has long argued for unions to campaign for higher salaries for teachers.

“We should be making the bold decisions,’’ he says. “Pay all teachers with masters qualifications so they all get at least $100,000 a year in the next generation. We have had Gonski one, Gonski two, and I could never bloody work out really what they were. All I knew was a very simple proposition: the best education systems in the world have the best paid teachers. Why not just pay the teachers progressively more and get better qualified teachers? It could take five to 10 years, but get on with it. It won’t cost a lot.”

Kelty remains committed to increasing the superannuation levy to 12 per cent, expressing bemusement at the recent push by some Liberal MPs to freeze the levy at 9.5 per cent.

“You would have thought that every conservative who believes in thrift and saving would be on the bandwagon of super,” he says. “Just as an ideological thing. They like the idea of super for saving but they hate the fact that the industry super funds have been so successful, by and large.”

He says superannuation funds, backed by government policy, should create new asset classes to address demands for infrastructure investment. The new investment classes would offer better returns in cash but be partially backed by government guarantees, and help fund critical infrastructure including public housing, water and roads.

Changes need to be made to the wages system to lift the minimum wage to a “living wage” for low-paid workers and encourage the return of “positive” collective bargaining between employers, unions and workers.

“The reality is the wages system is not working as well as it should,” he says.

“The gap between the (enterprise bargaining agreements) and the minimum is too high for many employers. You reach the point where you put yourself out of business and workers out of a job if you are 20 per cent above the whole market.

“Collective bargaining should be a process by which employers and unions sit down together and work out what’s in the best interests of members and what’s in the best interests of the company. It requires them to say: “You know what, our agenda is the future here.” You have not heard of that positive bargaining approach since the late 1990s

“It’s no longer just about cost offsets. It’s about adaption, how you change your jobs, how the nature of technology is changing the training required, because there are big gaps in training. We have an inadequate and ineffective training system. We have a wages system that produces an outcome that is too low, not an outcome that is too high.”

Kelty, who led the trade union movement from 1983 to 2000, says he believes trade union membership will fall further before it improves. Nine out of 10 private sector workers are not in unions but “I don’t think we have hit the bottom”. He says the membership fees of some unions are “very high” and they should consider reducing their fees to win back workers. “You don’t have to look far to get the best model for unions because we have some of the best unions in the world in the teachers and nurses unions,” he says.

“You don’t become a whinger and complain about the system. You don’t become a political organisation that says it’s all too hard. You are an industrially relevant organisation which can do things really well. Make sure there is job safety. Make sure the award is being enforced. Make sure those industrial services are being provided at the lowest possible price consistent with the economies of scale that you produce.

“You want enterprise bargains to be at 3 per cent. You want the minimum wage implemented. It means you have to put more effort into bargaining. The emphasis is too much on the process of the bargaining rather than the parties getting together, sitting down and saying: ‘Let’s have bargaining which is about your interests and our interests together.’ People have got to be talking about how you adjust to the change rather than cost offsets. Not talking about penalties on overtime shifts. Job security, not short-term job flexibility.”

Kelty retains several directorships including at companies within the Linfox Group and Luna Park. When he spoke to Keating recently, he says they talked about what they and Hawke would have thought was necessary to prepare Australia “for the worst, as well as preparing for the best”.

He says decisive action is needed to combat climate change. “Workers are trembling at the sight of their energy bills,” he says. “The price of energy is going up but we have not yet got a policy for climate change — it’s truly pathetic.

“Let the adjustment process occur but make a firm decision to accept climate change and move on. Get on with it. That will have consequences but deal with them in a rational way. Don’t get distracted by the side games.”

Identifying where Australia will be in 10 or 20 years is “the essential industrial and political question that you have to answer”, he says.

“If you have a generation of no real wage increases, 20 years where the real minimum wage is either frozen or falling, and another attempt to diminish superannuation, then you are going to end up like the United States.

“Because the market will work for some parties. Some people will do better but the gap will become greater, society will become more fractured and living standards will not have improved for a generation. Consequently, economic growth will be lower. Now the problem we have got to face up to is the problem of mediocrity. This is the consequence of living in mediocrity.

“You need a Keating or a Bob Hawke or somebody to come along and say: ‘This is not what we want.’ Instead, super goes to 12 per cent. You improve infrastructure spending and living standards improve because the economy is operating more effectively. Real wages start to improve because unions can actually bargain a bit better.

“Remember this is not some revolution that you need. The revolution is breaking out of mediocrity into prosperity. We want to achieve the most effective minimum wage rates and bargaining and have the best wages system in the world. We want the best super system in the world, the most effective taxation system and the best infrastructure system in the world.

“Suddenly Australia looks different and exciting and people respond. We would have won the election with that strategy.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout