WiseTech hits the right button for investors

The boss of Australian tech unicorn WiseTech Global is confident the best is yet to come for the logistics software maker.

The boss of Australian tech unicorn WiseTech Global, Richard White, is confident the best is yet to come for the logistics software maker after its full-year numbers exceeded guidance.

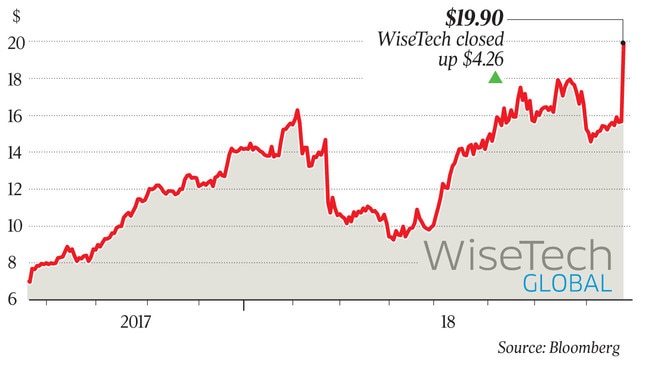

WiseTech shares roared up by almost 28 per cent to finish the Wednesday session on $19.90, as the market cheered the company’s ongoing momentum in the freight and shipping market.

It came as the company posted a 28 per cent jump in net profit to $40.8 million for the 12 months to June 2018. Meanwhile, revenue for the period was up 44 per cent to $221.6m.

The jump in share price added a handy $730m to Mr White’s personal wealth of $3.2 billion, courtesy of his 53 per cent stake in the company he founded.

While WiseTech has a reputation in the market for aggressively pursuing its peers in other parts of the world, Mr White told The Australian the bulk of the growth was coming from its CargoWise One platform.

“CargoWise One is the powerhouse for us and has been doing most of the heavy lifting,” he said.

“The unit has improved its margins from 30 per cent earnings before interest, tax, depreciation and amortisation to 48 per cent EBITDA in under two years, so it’s really the powerhouse for us.”

WiseTech acquired 22 businesses during the year but has had little problem with integration.

“Of the 22 business this year, none of them were for sale, all of the founders and senior management have stayed and will be here for the next three to five years,” Mr White said.

One reason for that goodwill, according to Mr White, is that the CargoWise One platform has become the anchor around which these companies can evolve and enlarge their global footprint.

“Most of these companies were landlocked into their little part of the market and couldn’t grow very fast, with WiseTech they have become mini, high-growth companies plugging into our architecture.”

According to Macquarie analysts, WiseTech continues to benefit from regulatory changes and the increasing complexity of global supply chains.

“The 2018 financial year result was slightly ahead of expectation with a strong fiscal 2019 growth outlook for revenue and EBITDA likely a key driver of the share price being up,” the analysts said.

WiseTech expects revenue to grow in the range of 42 to 47 per cent and EBITDA to grow from 28 to 35 per cent in the current financial year. The company declared a fully franked dividend of 1.65c to be paid on October 8.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout