MyWave prepares for ASX

This start-up from SAP’s former boss is eyeing a public listing.

Welcome to The Download, The Australian’s technology blog for the latest breaking tech news.

David Swan4.10pm: MyWave prepares for ASX

The Australian software company behind an intelligence business platform is planning to list on the ASX next year, with MyWave boss Geraldine McBride confident that businesses are ready now more than ever to ramp up their digital operations.

Speaking to The Australian, Ms McBride - the former president and CEO of SAP North America and SAP Asia Pacific Japan - said that MyWave’s app had been listed as an ‘SAP Endorsed App’, meaning tech giant SAP will now promote and sell MyWave’s personalisation platform.

It’s one of only a handful of SAP endorsed apps globally, and Ms McBride, who started the business with her daughter, said it would be a boon for her young company.

“We’re really delighted by this news,” the executive said. “With this new COVID era, what we’re finding is a very strong demand for technology like ours. It’s being applied in many different ways, we’re finding people are not wanting to come to stores quite as much, and our tech can be applied to existing websites and apps, and act as a personal shopper, or a personal banker.”

She pointed to statistics showing platform makes businesses more efficient in reducing costs, delivering a 10 per cent year-on-year improvement in annual customer service costs and substantial improvements in sales, with an 8.1 per cent improvement in customer lifetime value, a 6.6 per cent improvement in cross sell and up sell, and a 6.5 per cent improvement in return on marketing investment

MyWave is now gearing up for a likely ASX listing, which potentially would have been this year but is now slated for 2021.

“We are scaling up this business, and launching in to North America,” Ms McBride said. “Scaling up is definitely keeping us busy for now, but our plans are definitely to look at listing in 2021.”

David Swan2.40pm: Telstra gets new cyber security boss

Narelle Devine has joined Telstra as its new Chief Information Security Officer for Asia Pacific.

Devine is currently the Chief Information Security Officer at the Australian Government Department of Human Services, now known as Services Australia, which she joined in 2016.

“Devine is responsible for protecting the personal and financial security of 26 million Australians, managing 280,000 authentications every day and protecting the $190 billion in payments the department makes every year,” Telstra said in a statement to investors.

“As Telstra’s CISO Asia Pacific, Narelle will help shape the cyber security landscape and drive Telstra’s policy, governance and incident response for cyber security across the organisation. Most importantly, she will play a leading role in protecting the privacy and security of Telstra, its customers, and the services it provides.

“Narelle will start with Telstra on Monday 27 July. Based in Canberra, she will report to Craig Hancock, Telstra’s Operations, Security & Enablement Executive and Global CISO.”

The appointment comes just one week after Prime Minister Scott Morrison announced Australia was under significant cyber attack from a nation state, thought to be China.

2.10pm: Huawei ‘one of 20 firms backed by Chinese military’

Chinese companies including Huawei Technologies, China Mobile Communications Group and Hikvision Visual Technology could face US sanctions after a finding by the Trump administration that they are owned or controlled by China’s military, Reuters reported.

The US Defence Department has found 20 Chinese companies that operate in the US are backed by the military, Reuters reported, citing an internal document.

While the findings themselves do not trigger sanctions, President Donald Trump has the authority to sanction companies on the list, Reuters said.

The list will likely add to tensions between China and the US, which has already black-listed Huawei over national security concerns.

Australia has banned Huawei from the rollout of its 5G network because of security concerns.

Dow Jones

12.10pm: US watchdog investigating faulty Tesla displays

The US National Highway Traffic Safety Administration (NHTSA) said Tuesday it had opened an investigation into 63,000 Tesla Model S cars after reports of media-control unit failures that led to the loss of the use of touchscreens.

The auto safety agency said the preliminary evaluation, covering 2012-2015 model year vehicles, comes after it received 11 complaints alleging premature failure of the media-control unit due to memory wear-out.

A complete unit failure results in the loss of audible and visual touchscreen features, such as infotainment, navigation, and web browsing, and loss of the rear-camera image display when in reverse gear, the agency said.

Tesla did not immediately respond to a request for comment.

NHTSA said the failure does not affect vehicle-control systems.

Tesla used the same unit in 159,000 2012-2018 Model S and 2016-2018 Model X vehicles built by Tesla through early 2018.

The memory control unit uses an Nvidia Tegra 3 processor with an integrated 8GB eMMC NAND flash memory device, NHTSA said. Nvidia did not immediately respond to a request for comment.

The flash devices have a finite lifespan based on the number of program or erase cycles, NHTSA said.

Failures resulting from memory wear-out “are likely to occur after periods of progressively degraded performance (e.g., longer power-up times, more frequent touchscreen resets, intermittent loss of cellular connectivity, loss of navigation),” the agency said.

Some complaints said the failure could result in a loss of charging ability and that other safety alerts could be impacted. One driver said he could not clear fogged windows because he could not change climate controls.

Another complaint said the failure disabled safety monitors associated with Tesla’s driver-assistance system Autopilot.

The complaints said Tesla requires owners to pay to replace the unit once the warranty expires.

Reuters

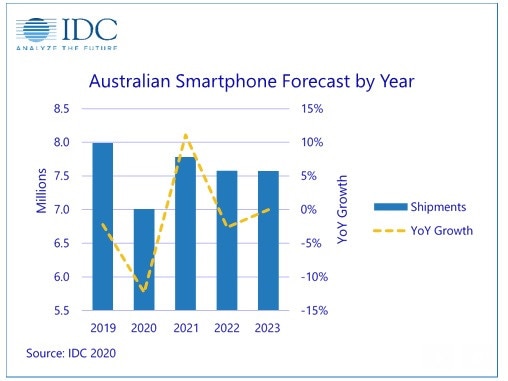

Chris Griffith 12.00pm: Australian smartphone market in decline

IDC predicts a 12.3 per cent year-on-year decline in shipments of smartphones to Australia this year.

IDC in a statement says newly released research from its Quarterly Mobile Phone Tracker shows the smartphone market is likely to suffer from a range of factors.

First, there was the decline in the manufacture and supply of smartphones as experienced in Q1/2020, however persistent economic uncertainty and higher levels of unemployment and underemployment would signal a further decline in Q2.

“The Australian smartphone market may experience a shift in the average selling price of devices,” says John Riga, associate market analyst at IDC A/NZ.

“A likely bi-product of consumer caution will be a preference for lower-cost devices in coming quarters.

“We’ve already seen a trend of consumers turning to mid-range devices in increasing numbers over past quarters. Current conditions, as well as the vast range of lower-cost devices being released each quarter will likely exacerbate this trend”.

IDC says some vendors may delay product launches until year’s end, which further will impact shipments in Q2 and Q3. However the research firm expects the market to rebound in 2021.

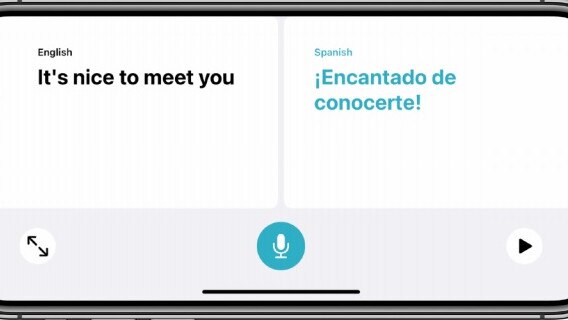

Chris Griffith 11.00am: Apple primes on-device translation

Apple has confirmed that its coming translation feature will work on iPhones in remote areas without 4G or internet connectivity.

The upgrade to Apple’s software iOS14 will allow iPhones to perform conversation translations directly without any data being sent to the cloud.

Users will need to download language packs beforehand. So far 11 languages are supported: Arabic, Chinese, English, French, German, Italian, Japanese, Korean, Portuguese, Russian and Spanish.

Apple is among companies seeking to move some functionality on phones away from the cloud and back onto devices for security reasons.

You’ll also be able to ask the phone’s personal assistant Siri on iPhones and Apple Watches to translate phrases, and this will be available in more than 65 language pairs. However these Siri translation will be performed in the cloud.

Rival Google already offers language packs for offline translation.

Chris Griffith 9.00am: Multibillion dollar Wirecard scandal broadens

Germany’s Wirecard scandal is gathering more momentum with investigators seeking the arrest of Jan Marsalek, Wirecard’s former chief operating officer, the German publication Handelsblatt reports. It is believed Marsalek is very likely to be in the Philippines. CEO Markus Braun is already under arrest.

Wirecard – a payments process and financial services provider that works with the banking system – was once the darling of German investors but this month has reported that €1.9 billion ($3.112bn) is missing.

Wirecard dismissed Marsalek on Monday after the company said last week that its auditors couldn’t approve its 2019 financials due to accounting irregularities.

Recently departed chief executive, Markus Braun, was arrested by police, days after the German payments company revealed a multi-billion hole in its books. It was a swift turn of events, but followed years of German regulators ignoring red flags about the once-promising company.

Munich city prosecutors said Mr Braun turned himself in to authorities late Monday and accused him of “inflating Wirecard AG’s sales volume with fake income.” Prosecutors said he was also under suspicion of making the company look more attractive to investors and customers than it actually was, and possibly co-operating with other perpetrators.

Wirecard began to unravel last week when its auditors said that it couldn’t verify the existence of the missing funds which are meant to be held in trust accounts on behalf of the company. There is a belief the money was probably an accounting fiction.

Concerns about Wirecard however have been long running and questions have been asked about the local Wirecard operations in Australia.

With the WSJ

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout