Wirecard files for insolvency after revealing accounting hole

The German fintech’s shares have crashed by 70 per cent, days after it revealed more than $US2bn missing from its balance sheet probably didn’t exist.

Battered German fintech company Wirecard AG has filed for insolvency proceedings, days after revealing that more than $US2 billion ($2.9bn) in cash missing from its balance sheet probably didn’t exist.

The move is the latest in a startlingly swift unwind for a company that until recently was a shining star in Europe’s tech scene. Wirecard is the first insolvent company in the DAX 30, Germany’s premier stockmarket index.

Shares in Wirecard crashed 70 per cent after the announcement Thursday, meaning the company’s market value has all but evaporated to less than EUR500 million from almost EUR13 billion a week ago. The collapse began on June 18, when Wirecard said its auditors couldn’t confirm the existence of EUR1.9 billion meant to be held in trust accounts. The company later said the money probably didn’t exist.

For years, Wirecard’s shares skyrocketed under the leadership of former Chief Executive Markus Braun, who touted the company as a money-making machine whose payments-processing business would be essential for global commerce. While the shares rose, investors who bet against Wirecard’s stock and the media repeatedly raised red flags about the company’s finances. German authorities did little to check on the accusations.

Days after resigning as CEO, Mr Braun was arrested, with Munich city prosecutors accusing him of “inflating Wirecard AG’s sales volume with fake income.” Prosecutors said he was also under suspicion of making the company look more attractive to investors and customers than it actually was, and possibly co-operating with other perpetrators. He was released Tuesday on EUR5 million bail.

Mr Braun has consistently denied any wrongdoing at the company, attacking allegations about its accounting practices as false and misleading.

Wirecard’s longtime auditor, Ernst & Young GMBH, said Thursday that it was given false statements related to the trust accounts while it was completing its 2019 audit, adding “there are clear indications that this was an elaborate and sophisticated fraud, involving multiple parties around the world in different institutions, with a deliberate aim of deception.” At the centre of the scandal is a trio of third-party partner companies that have for years provided a large share of Wirecard’s reported revenue and the bulk of its profits. The revenue, however, was deposited in the escrow accounts held by trustees, rather than being paid directly to Wirecard itself. Wirecard said Monday that these parties may never have provided any business to the company.

The company said Thursday that if negotiations under way with lenders failed, it would trigger EUR1.3 billion in loan repayments by July 1.

“The management board has come to the conclusion that a positive going concern forecast cannot be made in the short time available,” it said, adding that it would try to go through a reorganisation once an insolvency administrator is appointed by the court.

Under German insolvency law, a court will appoint an administrator who will look into the company and decide whether it can be restructured as a viable business or should be liquidated. In the meantime, the company is protected from creditors.

Wirecard has a EUR1.75 billion credit facility with several lenders, EUR900 million in convertible bonds — first sold to an affiliate of Japan’s SoftBank Group Corp. that were then in effect packaged up and resold by Credit Suisse to other investors — and a EUR500 million corporate bond.

Wirecard’s fall from grace has proven an embarrassment for BaFin, Germany’s markets’ regulator. It also raises questions about Germany’s efforts to become the European Union’s leading financial centre as the UK leaves the bloc.

“The bankruptcy filing from Wirecard is a fiasco for Germany as a financial centre,” said Fabio De Masi, deputy floor leader of Germany’s Left party and a member of the Bundestag finance committee. “Heads have to roll in financial supervision.” A BaFin spokeswoman declined to comment.

The alleged missing cash was supposedly being held in trustee accounts in the Philippines. Philippine authorities are looking for Jan Marsalek, Mr. Braun’s right hand and Wirecard’s chief operating officer until his dismissal Monday, amid reports he flew there to look for documents that could help shed light on the case.

Ferdinand Lavin, deputy director and spokesman of the Philippines National Bureau of Investigation, said he had information Mr. Marsalek had been in the country, but had no hard proof yet. “We are investigating the Wirecard fraud,” he added.

Mr Marsalek couldn’t immediately be reached for comment.

Wirecard said Thursday that it is also evaluating whether insolvency applications have to be filed for its subsidiaries. One of them, Wirecard Bank, which had EUR1.7 billion in deposits, isn’t part of the proceedings. BaFin has appointed a special representative to handle the bank, the company added.

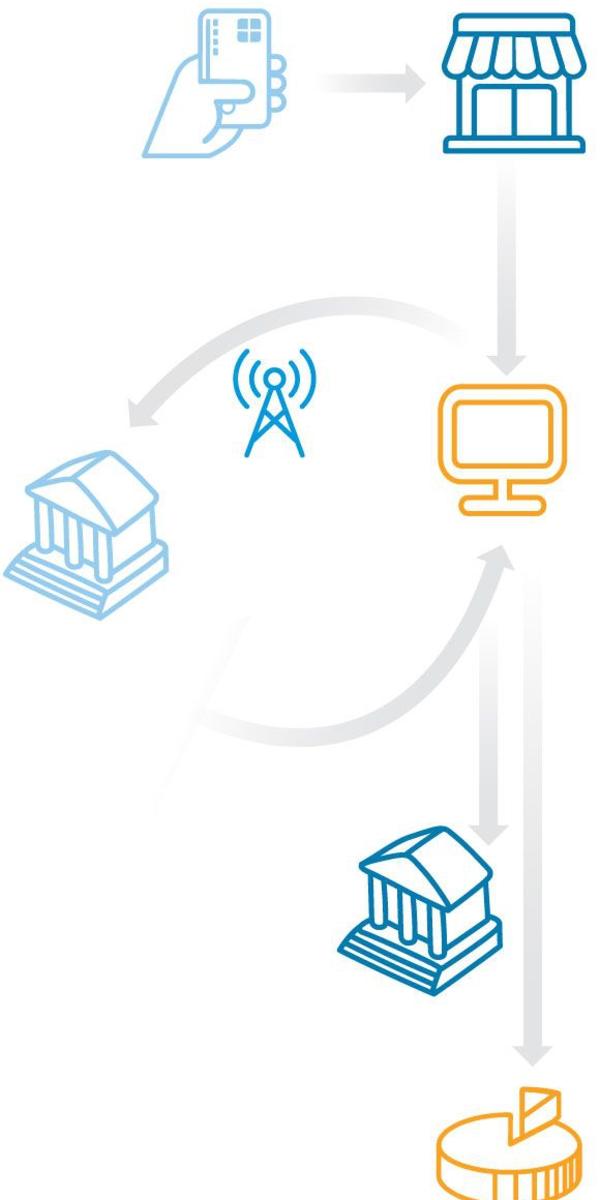

Wirecard’s unravelling is the most prominent in the digital-payments space, which exploded along with online shopping and gambling. The industry has created a number of profitable businesses that mostly sit in the background of billions of transactions.

Wirecard’s fall would represent one of the biggest corporate scandals in Europe since the collapse of Portuguese lender Banco Espírito Santo amid allegations of fraud in 2014.

The problems with Wirecard’s books may stretch back years. The company withdrew its results for 2019 and the first quarter of 2020, and warned that its financial results for previous years could also be affected.

The likely fictitious EUR1.9 billion is equivalent to all the net income Wirecard has reported over more than a decade.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout