UK plans tax on locally-generated revenue by tech giants

Britain has made the most concrete bid yet by an industrialised nation to increase taxes on global tech giants.

The United Kingdom said it will move ahead with plans to introduce a first-of-its-kind tax on locally generated revenue by large technology firms -- the most concrete attempt yet by an industrialised nation to rewrite the world’s tax code for the digital era.

The new tax comes as dozens of other countries are contemplating similar levies on digital services sold by companies such as Alphabet’s Google and Facebook. These governments are hoping to capture more revenue from such services as economic activity increasingly shifts online.

At issue is how governments collect taxes from the handful of tech firms, many based in the US, that have morphed into global, digital consumer-services giants. As they have grown, governments outside their home jurisdictions have struggled with the digital nature of their wares in coming up with an appropriate level of local tax to levy.

Big American tech firms have been criticised for reporting relatively little of their profit in local jurisdictions, opening them up to scrutiny.

An international effort among rich nations to help standardise how and where to tax these digital services has been progressing slowly.

The UK overnight said it could no longer wait. As part of its annual budget, it said it was moving ahead with a plan to begin a digital tax for large tech firms by 2020.

The government of Spain proposed a similar digital-services tax this month, but that measure requires parliamentary approval.

The new UK tax puts pressure on big countries, including the US, to speed up the global effort. The Organisation for Economic co-operation and Development, a forum of wealthy countries, has been leading the international digital-tax talks.

Opponents of digital taxes, which include lobbyists for multinationals, say a patchwork of new rules that vary by country will hurt smaller firms. They say the initiatives could lead to double taxation of corporate profit that will stifle international trade and discourage investment.

The tech industry opposes the proposals. After the UK announced its plan, the Information Technology Industry Council, a Washington, DC-based lobby group that represents tech firms including Google and Facebook, said that “imposing a digital tax could create a chilling effect on investment in the UK and hinder businesses of all sizes from creating jobs.”

The UK’s Chancellor of the Exchequer, Philip Hammond, said the tax would only target large, profitable companies, with global revenue of at least £500 million ($A906 million). The new levy would constitute 2 per cent of such a company’s revenue in the UK. Mr Hammond said it could eventually raise some £400 million annually.

The proposal would affect businesses generating UK revenue from services including search engines, social-media platforms and online marketplaces. That makes the ad-selling businesses of Google and Facebook particularly vulnerable. The tax wouldn’t impact sales of digital music or movies.

For giants like Alphabet, Amazon.com and Facebook, the UK tax would amount to a relatively small amount of additional tax. But it represents the first concrete step among several governments globally to increase the tax burden of these and other large, global tech-services companies.

“It’s clearly not sustainable, or fair, that digital-platform businesses generate substantial value in the UK without paying tax here,” Mr Hammond said. He said that while a global agreement “is the best long-term solution,” progress has been “painfully slow.” The UK said its new tax would only be in force until a global solution is found, but Mr Hammond said “we cannot simply talk forever.”

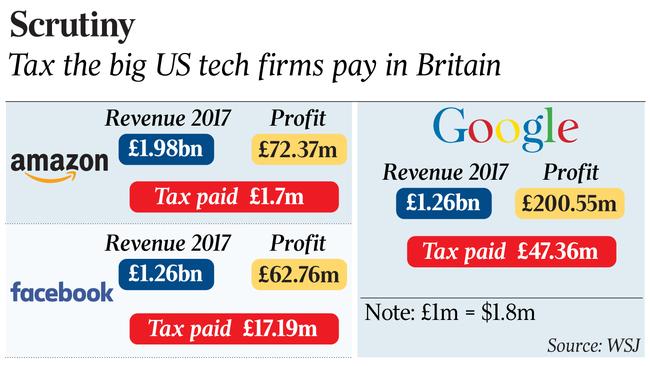

Big US tech firms have been subject to intense scrutiny in Britain for how much tax they pay. Amazon UK Services, one of online retailer’s major British units, in 2017 reported revenue of £1.98 billion and a profit on ordinary activities before taxation of £72.37 million, but paid only £1.7 million in UK taxes, according to Companies House, a register of corporate information.

Facebook’s British subsidiary that year reported revenue of £1.26 billion and a profit of £62.76 million in 2017, paying £17.19 million in taxes. Google UK for the year ended June 31, 2017, booked revenue of £1.26 billion and profit on ordinary activities of £200.55 million. It paid £47.36 million in British taxes.

Spokespeople for Amazon, Facebook and Alphabet had no immediate comment on the new tax. Amid criticism of their tax practices, all three companies have said they pay their fair share.

Critics here also said the British government’s move may result in retaliatory taxes in the US. They also said tech companies may simply pass the tax onto its customers.

The US Treasury didn’t immediately comment on the new tax.

Some smaller British-based tech businesses, however, welcomed the proposal as a way to remain more competitive against Silicon Valley giants.

The UK first said it had justification for a new tax in November 2017, arguing users of digital services help make the product that tech companies sell to advertisers and other customers. That principle has influenced the rest of the European Union, which is working on its own tax proposal.

Inspired by separate European Union proposals to impose a tax based on the revenue of tech companies rather than their profit, South Korea, India and at least seven other Asian-Pacific countries are exploring new taxes. Mexico, Chile and other Latin American countries too are contemplating new taxes aimed at boosting receipts from foreign tech firms.

The UK effort underscores the complexity of such a tax. The Office for Budget Responsibility, the UK’s fiscal watchdog, said the Treasury’s estimate of how much tax the new levy will raise is highly uncertain. Among the questions as yet unanswered about the new tax’s structure are whether it will be deductible against corporation tax, for instance. The watchdog also flagged a range of ways the new levy could affect corporate behaviour in an effort to minimise any liability, such as reclassifying revenue as income not covered by the tax.

Still, the OBR said it is also possible the digital-services tax could prove a bigger money-generator for the Treasury than its preliminary estimates suggest, given that online activity accounts for a growing share of the overall economy.

Dow Jones Newswires

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout