Treasury, RBA hold crypto meetings on the down low

Global executives have been flown into Australia this week to speak with Treasury and the Reserve Bank on cryptocurrency reforms and regulation.

The Reserve Bank and Treasury have held a number of private meetings this week with international executives from cryptocurrency exchanges on the future of digital assets and regulation in Australia.

The conversations are taking place in relation to Treasury’s token mapping consultation paper which it released last month, calling for input from industry.

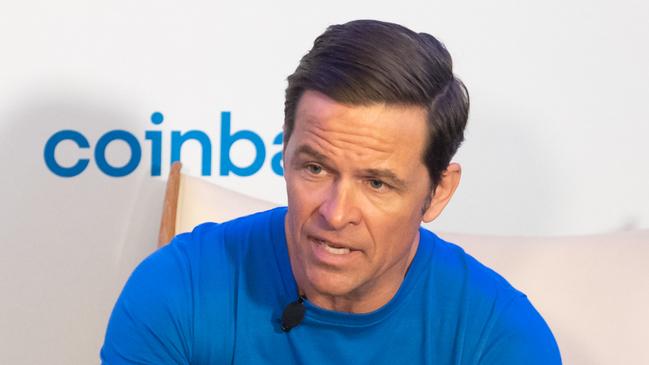

Among those to submit a submission was Nasdaq-listed exchange Coinbase, with the company’s vice president of international policy Tom Duff Gordon flying in from London specifically for the meetings.

Mr Gordon and his local counterpart, John O’Loghlen, Coinbase Asia Pacific managing director, say Australia had been quite forward and “sensible” in its approach to regulation, but they fear the nation may fall behind other jurisdictions and end up playing “catch up”.

“For us, it’s really about making sure that we can keep the momentum moving and making sure that we can move this up the totem pole of priorities in Canberra,” Mr O’Loghlen said.

Both Treasury and the RBA, led by Philip Lowe, have different roles to play in the cryptocurrency space, and their initial focuses remain separate.

“From a central bank perspective, they’re interested in financial stability and the links between a fiat traditional financial system and the crypto system,” Mr Gordon said.

“As a payment regulator, they’re also interested in the role that crypto, stable coins and central bank currency can play in the payments sector.

“The Treasury in Australia is more interested and involved in setting the framework and we believe the RBA will increasingly get more involved as we move forward.”

Coinbase was co-founded by US billionaire Brian Amrstrong in 2012, a former Airbnb technical product manager. The company listed on the NASDAQ in April 2021, and closed on Tuesday at $US62.65 ($93.41) per share.

The company’s submission to Treasury was described as “academic’s look under the hood” which would help set the guidelines on Treasury’s token mapping consultation paper which looks to define what cryptocurrency is, how it can be measured and how regulation can serve the industry while not limiting innovation.

It largely considered the divide between making room for innovation and consumer protection, Mr Gordon said.

“Our submission talks about how important disclosure is so that when consumers look at financial information, they’re not being misled and that people have the information that they need to make informed decisions,” he said.

Mr Gordon and Mr O’Loghlen will also meet with the House Economics Committee, Cybersecurity Minister Clare O‘Neill and the Tech Council of Australia over the next few days.

Mr O’Loghlen said after the crash of FTX, Coinbase’s Australian market hadn’t shrunk, it had just seen less trading.

The market also benefited from a number of mature investors who, unlike their younger counterparts, wasn’t as affected by crashes as they typically diversified their portfolio.

“When we look at our user data, we see that this isn’t just a younger generation of Gen Y and Gen Z investors. There are 50, 60 and 70-year-olds here that have a much higher net worth and much higher deposits and balances,” Mr O’Loghlen said.

“Their crypto portfolio is not the majority of their funds, it’s usually a small discretionary amount, but for us as an exchange, they have a healthy amount compared to let’s say a 20-something or 30-something user who is earlier along in that kind of wealth and prosperity cycle.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout