TPG pulls plug on mobile network, blaming Huawei ban

TPG chief says decision stems from Huawei ban and has nothing to do with the proposed Vodafone merger.

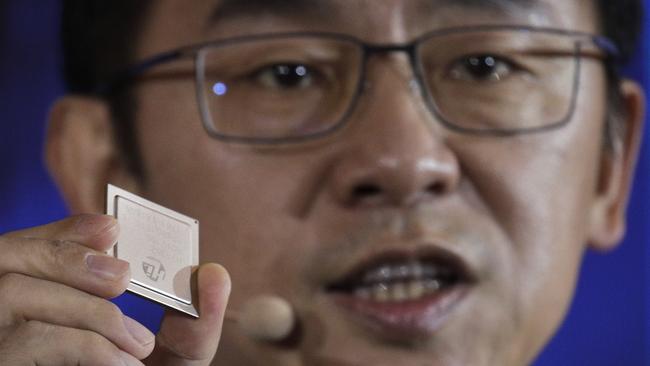

TPG Telecom has pulled the plug on its mobile network, citing the banning of Chinese equipment maker Huawei from participating in 5G mobile rollouts as the main reason for the decision.

The telco, which is looking to merge with mobile operator Vodafone Hutchison Australia, announced plans to build a $600 million mobile network in 2017, with Huawei as its principal equipment vendor.

However, TPG said on Tuesday that the federal government’s decision prohibit the use of Huawei equipment in 5G networks last year had closed the doors for the telco to push on with its network rollout.

The news came as US authorities unveiled a sweeping set of actions, including criminal charges, against Huawei.

TPG shares started the morning session 3.74 per cent stronger at $7.22 but ran out of steam quickly, falling 2.3 per cent to $6.80.

TPG boss David Teoh said that government intervention had forced the telco’s hand to rethink how much it could spend on its planned mobile network.

“It is extremely disappointing that the clear strategy the company had to become a mobile network operator at the forefront of 5G has been undone by factors outside of TPG’s control,” he said.

“Over the past two years a huge amount of time and resource has been invested in creating and delivering on a strategy that would have positioned TPG very favourably to exploit the opportunities that the advent of 5G will present.”

TPG’s announcement is extremely disappointing for Australian consumers and businesses. As predicted the Australian Government’s 5G ban on Huawei will lead to reduced competition and higher prices for Australia consumers and businesses.

— Huawei Australia (@HuaweiOZ) January 29, 2019

TPG’s ambitious plan to build nationwide mobile network was predicated on it being able to use Huawei’s equipment and the telco said that finding alternative vendors would blow out its allocated budget of $600m.

“A key reason for the selection of the vendor and the design of TPG’s network was that there was a simple upgrade path to 5G, using Huawei equipment,” TPG said in a statement.

“In light of the government’s announcement in late August 2018 that it would prohibit the use of Huawei equipment in 5G networks, that upgrade path has now been blocked.”

“The company has been exploring if there are any solutions available to address the problem created by the Huawei ban but has reached the conclusion that it does not make commercial sense to invest further shareholder funds (beyond that which is already committed) in a network that cannot be upgraded to 5G,” it added.

The telco’s decision to stop the mobile network comes at a delicate time, with its mooted $15 billion tie-up with Vodafone under a regulatory cloud.

While the Australian Competition and Consumer Commission (ACCC) has voiced concerns that the merger could hurt competition in the market, TPG’s announcement may force the regulator to rethink its position.

ACCC boss Rod Sims said last year that the regulator was keen to see the entry of TPG as the fourth mobile operator.

“Our preliminary view is that TPG is currently on track to become the fourth mobile network operator in Australia, and as such it’s likely to be an aggressive competitor,” he said in December.

“We have preliminary concerns that removing TPG as a new independent competitor with its own network, in what is a concentrated market for mobile services, would be likely to result in a substantial lessening of competition.”

“If TPG remains separate from Vodafone, it appears likely to need to continue to adopt an aggressive pricing strategy, offering cheap mobile plans with large data allowances.”

The telecom industry has had its doubts about whether TPG could actually build a fully-fledged mobile network for $600m, especially after Huawei’s ban. A merger with Vodafone would effectively remove the need for TPG to invest in a separate mobile network.

TPG said on Tuesday that it had so far spent around $100m on the network and prior to August 2018, purchased equipment for 1500 mobile sites. It added that it had fully or partially completed the implementation of just over 900 small cell sites, with an additional $30m already committed for the network.

“The board is not in a position at this time to announce any decision on its future strategy for TPG’s current spectrum holdings,” the telco said.

“While TPG remains committed to the planned merger with Vodafone Hutchison Australia, the company must continue to make independent business decisions in the best interests of TPG shareholders pending the outcome of the merger process.”

“The company does not expect any impact from this decision on its FY19 guidance and does not anticipate having to write-down, at this time, the mobile network costs capitalised to-date,” it added.

“We have made our decision on what makes commercial sense for TPG and our shareholders, given the factors beyond our control, the ACCC’s considerations are not relevant in this case,” Mr Teoh told The Australian.

The ACCC is set to deliver its final verdict on the TPG-Vodafone merger on April 11.

Meanwhile, Vodafone said that it remains committed to the merger.

“We’ve always said, increased investment requires increased scale and the merger has the potential to create a strong third player in the Australian market,” Vodafone’s chief strategy officer Dan Lloyd said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout