TPG always wanted a super-fast 5G network: Teoh

TPG’s reclusive billionaire founder David Teoh has insisted ultra-fast mobile broadband was always part of the telco’s strategy.

TPG Telecom’s reclusive billionaire founder David Teoh has insisted that ultra-fast mobile broadband was always part of the telco’s strategy, telling a courtroom he was aiming to deliver full-scale 5G services to customers by next year.

Mr Teoh, who has a personal fortune of $2.53bn, made a rare public appearance on Wednesday as TPG and Vodafone Hutchison Australia attempt to overturn the Australian Competition & Consumer Commission’s opposition to their proposed merger at the Federal Court.

Mr Teoh has a history of going to great lengths to avoid being photographed, even in his current role as executive chairman of the fast-growing telco.

But his company’s legal challenge to the competition regulator has come with a twist, forcing Mr Teoh to give evidence as part of closely watched court case.

While TPG’s initial investment was focused on rolling out a mobile network using the existing 4G standard, Mr Teoh told the Federal Court in Melbourne the telco was looking to be one of the first to offer 5G services in Australia, which was also one of the main reasons why it opted to buy Chinese vendor Huawei’s equipment.

“In July 2017, Huawei told us they could give us 4G equipment that could be upgraded to 5G. We picked them a few months later,” Mr Teoh said.

However, he said in “that early stage” of talks Huawei did not have 5G-standard wireless technology available to switch on the network.

Mr Teoh said TPG’s 5G road map became clearer by April 2018.

He said while TPG did not have the 5G spectrum at the time, Huawei’s 4G equipment offered a “high possibility” that the mobile network could be upgraded to 5G.

“We believed then that there was a possibility that we could offer 5G by 2020,” he said.

Having already bought 4G spectrum for $1.2bn in 2017, TPG teamed up with Vodafone Australia, to buy 3.6 gigahertz (GHz) 5G spectrum for $263 million in December 2018. The 3.6GHz spectrum is widely seen as the key band for the delivery of 5G services.

Mr Teoh’s comments came in response to questioning from the ACCC’s legal counsel Michael Hodge QC, who contends that 5G was never part of TPG’s original mobile plan.

“The reason why you selected Huawei in 2017 was not because Huawei provided you a 5G upgrade path,” Mr Hodge told the court.

According to Mr Hodge, TPG’s mobile plans, which started to take shape in 2016, were squarely looking at rolling out a 4G network.

TPG has cited the federal government’s decision to ban Huawei’s 5G equipment as the main reason for its decision to ditch its mobile rollout. According to TPG, the absence of Huawei’s 5G equipment means that it will not be able to upgrade the network it has already rolled out.

However, the ACCC is contesting that point, with the regulator maintaining that TPG is more than capable of building a viable and competitive 4G mobile network without the help of Vodafone Australia.

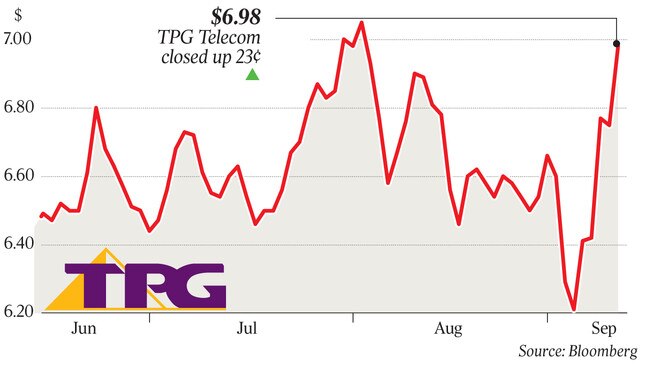

Stopping its mobile rollout has taken a toll on TPG’s balance sheet, with the company posting a 56 per cent slump in net profit to $173.8m for the 12 months to July 2019, with revenue for the period flat at $2.48bn.

In arguments so far, the ACCC’s legal team has homed in on the financial position of both TPG and Vodafone, contending that the telcos had deliberately talked down their prospects to justify the merger.

Earlier on Wednesday, Vodafone Australia boss Inaki Berroeta delivered most of his testimony in a closed session of the Federal Court.

The initial focus of the ACCC’s arguments was on Vodafone Australia’s 5G rollout plans and its financial position, with the regulator’s legal team contesting Vodafone’s claim that it couldn’t compete with Telstra and Optus on its own.

Mr Berroeta told the court on Wednesday that without the merger, Vodafone Australia would have to get more funding from its two parents — Britain’s Vodafone and Hong Kong’s Hutchison Telecommunications.

“To increase my capex I would have to present a case that justifies that,” he said.

“I don’t think presenting a plan to my shareholders to increase the debt would be very wise.”

Under questioning, Mr Berroeta said that the ghosts of the “Vodafail” affair of extensive network dropouts were still an issue for Vodafone, despite the progress made by the telco over the past few years. “I believe it’s still an issue in the mind of customers,” he told the court.

TPG can’t do anything with the 4G and 5G spectrum for the time being and the eventual fate of its spectrum holdings hinges on the federal court’s ruling.

If the ACCC’s objections to the deal are upheld, TPG will have to either build a mobile network of its own or sell the spectrum.

TPG on Tuesday told the court that it would have to restart its mobile network rollout from scratch, which would leave it a long way behind rivals.

In the telco’s opening statement to the court on Tuesday, TPG counsel Ruth Higgins SC said the ACCC was forcing TPG to commit to a network that it did not want to build.

“The ACCC requires TPG to bring a complex nationwide infrastructure into operation,” she said.

“The ACCC’s case creates an impression that all that is required is for TPG to finish what it has started, but the partial network can’t be upgraded to 5G.

“It will have to roll out a brand new network … the market and TPG have moved on.”

The case will enter its third day on Thursday, with Mr Teoh set to come under considerable questioning to further elaborate on TPG’s mobile aspirations and why it decided to close the operations.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout