‘They are building small machines’: PsiQuantum board member downplays local quantum computing concerns

Local quantum computing industry and the opposition have raised concerns about the almost $1bn taxpayer-backed investment in the California-based tech company.

The Australian investor who hired a 19-year-old Elon Musk decades ago and now sits on the board of a US quantum computing company promised almost $1bn by Australian governments has defended the “extraordinarily detailed and very sophisticated” tender process.

The Australian has previously reported on disquiet in the domestic industry over the transparency in the tender process and the opposition’s concern about a lack of public information.

Peter Barrett, who sits on the board of PsiQuantum and co-founded Playground Global, the Silicon Valley venture capital that led early investing for the quantum computing company, said Playground Global was PsiQuantum’s largest shareholder.

Wahroonga-raised and James Ruse Agricultural High School-educated in Sydney’s northwest, Mr Barrett justified the $940m taxpayer-backed investment by likening the advent of quantum computing to reaching the moon and downplayed accusations from local firms.

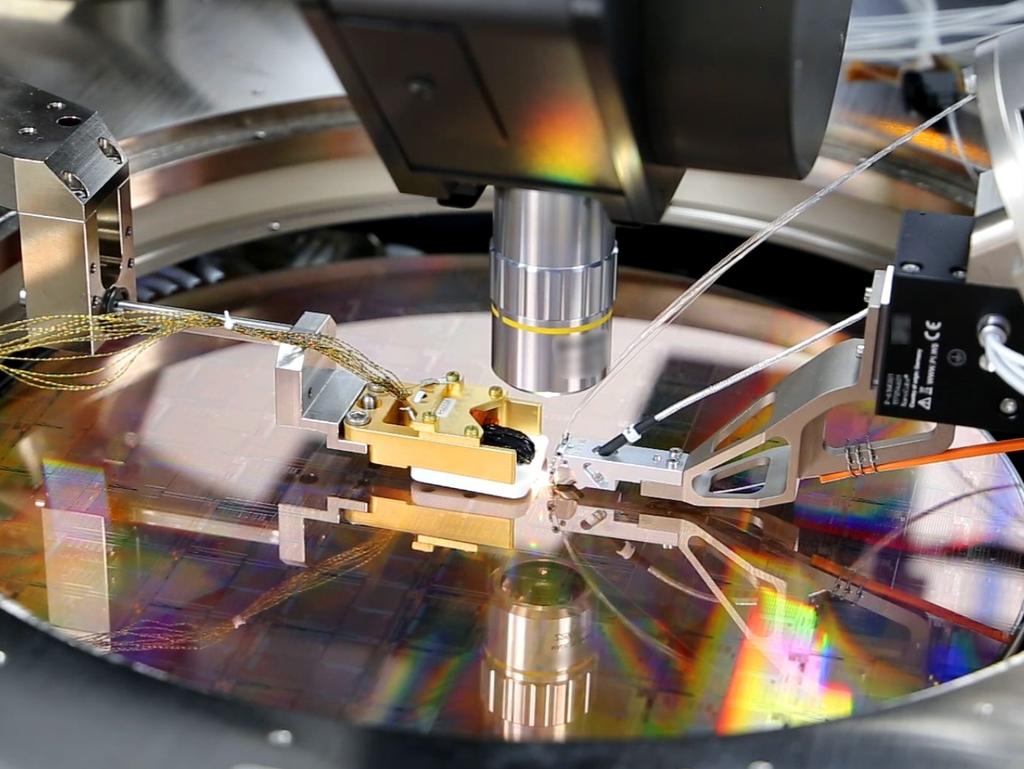

“Australia has a wildly disproportionate collection of quantum talent, both in software and algorithms, in quantum sensing,” he said. “But they are building small machines. This machine is 1000 times bigger than anything that’s been built. And many of these other techniques are like trying to get to the moon by climbing successively tall trees. You need an architecture, you need a rocket.”

Mr Barrett said the company aimed to bring the computer into production in Brisbane in 2027 and its first task would be to compute existing problems previously not reasonably feasible on classical computers.

While he could not disclose the terms attached to the $940m government funding, he said “it is clear there is real value in preferential access to the machine from Australia”.

He said PsiQuantum was otherwise working on a series of deals to queue up algorithms to be computed the moment the computer was online and functional.

When asked about the revenue flow behind such agreements, Mr Barrett said there were different business models. “This is something that happens in pharma – if you develop a drug on a platform, the platform gets some share of the value of the drug and the pharma company gets the rest,” he said.

“So depending on whether it’s an optimisation algorithm for logistics or a financial services algorithm, there will be some bespoke relationship where there is share in the value that’s created.”

Mr Barrett defended the tender process. “The Australians did an extraordinarily detailed and very sophisticated diligence process with that team,” he said. “They understand how it works, they understand that it will work, and they spent a tonne of time and a tonne of energy on it.”

Responding to doubts cast by the Coalition – in opposition in the Queensland and federal parliaments with elections due within a year – about the funding, were they to come into power, Mr Barrett said he thought the matter “transcends politics”.

“I think it is incredibly valuable to have an anchor for a completely new class of technology in Queensland,” he said. “Silicon Valley has created trillions of dollars of value because that’s where it started. Queensland has the same opportunity.”

Mr Barrett said he was in Australia to pitch to superannuation funds about investing in deep tech. “Three and a half trillion dollars in super funds – that can only buy so much real estate,” he said.

“There is a unique intersection of talent, natural resources, and capital here that I want to translate into economic diversity and complexity.”

Mr Barrett entered the world of Silicon Valley venture capital after a career in software engineering. He reminisced about hiring a 19-year-old Musk to write software at a video game company he created with a few friends after leaving Microsoft and another startup.

“We hired this 19-year-old South African kid who we got writing software drivers for our games,” he said. “Super sweet kid. Very, very, very bright. Great systems thinker.”

He said Mr Musk – a college student on summer break from Stanford University at the time – had shown interest in the internship by responding to a pre-world wide web forum post asking: “Do you have a sense of destiny?”

“We weren’t that picky, but he showed up and showed a lot of enthusiasm,” Mr Barrett recalled.

He praised Mr Musk’s approach to innovation.

“No incrementalism at all, and he’s willing to make mistakes,” he said. “Why he’s wasting time on X is beyond me, but Tesla is a great company. He accelerated electrification of automotives by a decade. What they are doing at SpaceX is unbelievable.”