Telstra loses its shine after network outages

Telstra’s network outages last year and increased reliability among its rivals are taking its toll on the nation’s biggest telco.

Telstra’s network outages last year and increased reliability among its rivals are starting to take its toll on the nation’s biggest telco, which is losing its shine among customers in terms of operating a premium mobile service.

That is the finding of the latest snapshot of telco customers by investment bank UBS, which revealed that Telstra’s customer perceptions are at the most negative levels in the four years the investment bank has been conducting the survey.

Negative fallout from the NBN could also be taking it toll on the retail operators with Vodafone, which has only minor market share in selling NBN services, experiencing a surge in customer promoter scores, at the expense of rivals Telstra and Optus.

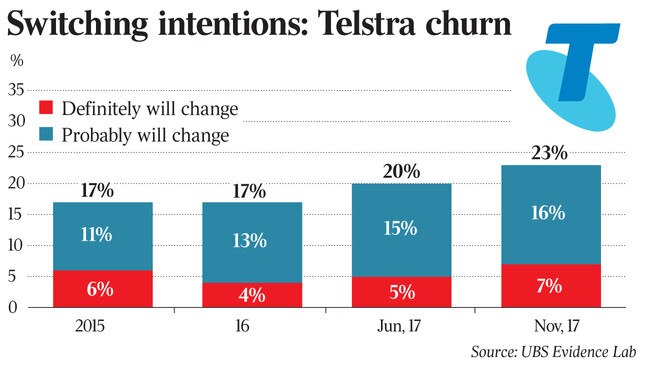

Continued negative perception among customers could point to a looming slowdown in Telstra’s mobile earnings, said UBS analyst Eric Choi. “These indicators include: a higher percentage of Telstra users intending to switch to other carriers, a lower percentage of users which see network superiority as a key differentiator for Telstra (and) a fall in mobile net promoter score,” he said.

In its fourth review of telco customers, UBS found that Telstra’s net promoter score — a measure of whether a consumer is prepared to advocate for a brand, something which is often regarded as an indicator of future growth — dipped to a figure of 13, from 14 previously.

Optus also saw a significant fall in its net promoter score, which came in at 12, from 17 previously. Vodafone’s net promoter score increased significantly from 20 to 27.

Telstra is still recovering from last year’s disruption in which customers were hit with seven major outages within five months. The disruption led to a shake-up in executive ranks and prompted Telstra to fast-track a $250 million investment to upgrade the network. Still, the UBS findings add further concerns around the headwinds surrounding Telstra’s mobile business.

Indeed, Telstra’s mobile margins have been coming under pressure as prices drop in Australia. Meanwhile, data inclusions are becoming more generous as mobile operators compete to sign up customers. Both trends are hurting mobile revenues and last month Telstra chief executive Andrew Penn said there were no signs of an immediate uplift.

“One of our critical objectives is to achieve growth in mobile services revenue, which have been under pressure from these competitive dynamics over the last two years,” Mr Penn told the company’s investor day last month. However, he added there had been some improvement in revenue momentum in recent months.

In a further headache, UBS also found that Telstra’s newly launched low-cost mobile brand Belong threatened to cannibalise its existing subscriber base, shifting existing customers to a lower average revenue product.

Belong offers 4G coverage to 95 per cent of the population, where Telstra’s 4G coverage extends to 99 per cent. At the same time, Belong does not offer the high-speed 4.5G services, whereas the core Telstra network does.

Mr Choi noted that this was the first time the impact of Belong was surveyed, “but of our respondents we estimate more than 10 per cent of future Belong mobile subscribers could be existing Telstra mobile subscribers”.

Telstra last month told investors the launch of its low-cost Belong service would help it recover some ground in the budget segment of the market.

Telstra shares closed on Friday at $3.66, down from a little above $5 this time last year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout