Telstra climbs after announcing $1.35bn buyback announced

Telstra shares climbed by more than 4 per cent to their highest point in two years after CEO Andy Penn said the group has ‘reached an important turning point’.

Telstra shares climbed by more than 4 per cent to its highest point in two years, after chief executive Andy Penn said the group has “reached an important turning point”, as he announced a $1.35bn share buyback from shareholders and forecast a return to underlying growth in the current year.

His comments came as the Telstra boss weighed in to the charged debate around workplace vaccinations, flagging potential mandatory Covid shots for some workers, given the telco has thousands of employees in customer-facing roles including at its retail outlets and technicians that need to enter people’s homes.

“Firstly, I absolutely pro-vaccines. Vaccines for all sorts of conditions and illnesses and diseases have been a fundamental part of making society that we live in today a healthier and safer society, Mr Penn told The Australian.

“Ultimately, I don’t think you can force people to have an vaccine, because obviously everybody’s got their own individual health circumstances, and so that’s important that people have the opportunity to get their own health advice and understand what it means in their particular situation”.

“Having said that, there is no doubt that certain people fulfil certain roles where they come in contact with lots and lots of other people, whether they’re in stores, people like field techs, out there in the field or going into homes, and it’s really important we need to think very carefully about their safety and the safety of customers. I can certainly see that certain roles should require a vaccine”.

“There’s quite a bit of complexity involved in that and we’re considering that very carefully,” he said.

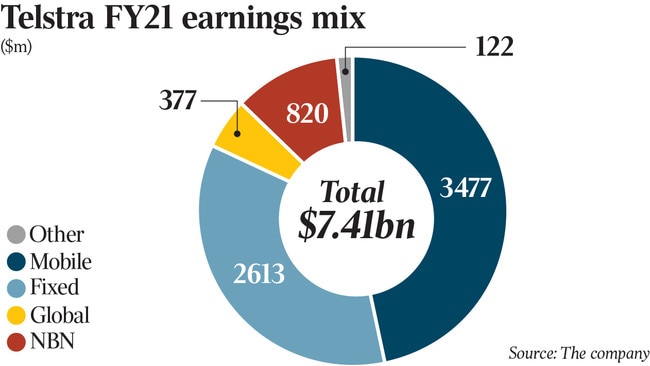

Telstra on Thursday posted a net profit after tax of $1.9bn – up 3.4 per cent – but total income fell 11.6 per cent year-on-year for the 2021 financial year and earnings before interest, taxation, depreciation and amortisation (EBITDA) slid 14.2 per cent.

The telco, which is among the widest held stock among Australians, will pay a fully-franked final dividend of 8c, including an ordinary dividend of 5c and a special dividend of 3c.

The company also announced it will return up to $1.35bn to shareholders as part of an on-market share buyback relating to the recent InfraCo Towers deal.

The latest results come amid a backdrop of Telstra’s traditional fixed line business being eroded as more switch to mobiles. At the same time the telco faces a steep investment cycle as it rolls out its 5G mobile network.

Investors backed the results, sending shares up 4.8 per cent to $4, before dipping slightly to close at $3.83 a gain of 3.7 per cent on the session.

“2021 was a really significant year for Telstra. We delivered results in line with guidance and we are seeing the focus and discipline on T22 pay off,” Mr Penn said of the company’s multi-year restructuring program.

“It represents a turning point in our financial trajectory. Our second half underlying EBITDA was up on the first half, and our guidance for FY22 underlying EBITDA is $7bn-$7.3bn, which represents mid to high single digit growth. FY21 net profit and earnings per share were up 3.4 per cent and 2 per cent respectively”.

“We are clearly building financial momentum and I am very pleased to be able to say that our underlying business will return to full-year growth in FY22.

“We have confidence because we see strong performance in our mobile business, continued discipline on our cost reduction target, green shoots in some of our growth businesses and a diminishing impact from the NBN.”

Mr Penn said the shareholder buyback would likely commence after September 16 and would be conducted in the ordinary course of trading 12 months, with the exact timing to be dependent on market conditions.

“When we launched T22, we committed to establishing a stand-alone infrastructure business unit for three reasons: to give transparency of those assets, to bring a harder commercial edge to how we operationalise them, and to create optionality with a view to maximising shareholder value,” he said.

“This share buyback is a clear demonstration of how we are creating additional long-term value for our shareholders.”

Mr Penn added that three years into its four-year “T22” strategy Telstra, had completed or was on track to deliver around 80 per cent of its T22 scorecard metrics. The telco said it would return to growth for FY22, and is expecting total income of between $21.6bn and $23.6bn, while underlying EBITDA is expected to be between $7bn and $7.3bn.

Telstra owns a 35 per cent stake in Foxtel, and amid persistent market talk of a potential Foxtel stock market listing, Mr Penn said that while he’s had ‘lots of helpful pieces of advice’ about the entertainment and streaming company, his strategy has ‘never changed.’

Foxtel, which is majority owned by News Corp, publisher of The Australian, last week reported record subscriber numbers.

“Telstra is doing a lot behind the scenes obviously supporting that distribution as well which is super exciting. Whether Foxtel IPOs or not, obviously that‘s a matter for Foxtel, but if that’s a decision that also helps further supports the further growth of the best media company in the country, then we will certainly be supportive of facilitating that. But to be clear, we continue to be a keen and happy, and supportive investor in Foxtel and that’s where we’d like to continue.”

Aberdeen Standard investment director Natalie Tam said Thursday’s result was a validation of Telstra’s T22 strategy under Mr Penn’s stewardship.

“It was a good result,” she said. “Management have invested a significant amount of time and effort into T22, and we as shareholders are now reaping the rewards.

“Telstra by next year will have been vastly simplified, and the business is just more innovative, nimble and future-facing than it has been in the past. Andy Penn has done a really good job on T22, and it hasn’t been easy, he’s had unexpected events happen like Covid which have been a drag on earnings, and he’s delivered incremental cost savings to offset that as well.

“This is following quite a number of dark years so it’s good to see the turnaround gathering momentum.”

Moody’s analyst Ian Chitterer said that the 2021 financial year should be the turning point for Telstra’s credit profile.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout