Telstra drops supply chain scheme, reconsiders payment plans

Telstra will dump its supply chain financing scheme and is reconsidering plans to push payment terms to 62 days.

Telstra has dumped its supplier payday lending scheme and is reconsidering its decision to push out payment terms to 62 days in the face of mounting community and supplier outrage.

The Australian revealed on Wednesday that Telstra spent more than a year plotting a radical shift to its payment terms, designed to move its smaller and medium-sized suppliers on to supply-chain financing, before informing them of the change.

The decision by Telstra comes a day after Rio Tinto dumped its controversial “dynamic discounting” scheme — a practice that urged suppliers to cut their invoices in exchange for prompt payment.

The telco had partnered with Taulia, a company registered in the low-tax US state of Delaware, to pay their suppliers more promptly in exchange for taking a haircut on their invoices.

The move also has potential financial implications for the telco major. Telstra’s general manager of procurement, George Papanikolopoulos, said in January last year — two months before the company notified its smaller and medium-sized suppliers — that the financing scheme would release more $500m in cash flow.

But late on Thursday, the company tore up the scheme and said it was now considering its payment terms, which it extended from 45 to 62 days last year.

The decision came in the aftermath of a series of questions from The Australian.

The Australian was preparing to publish a report that revealed Telstra had been exploiting a loophole in a voluntary code of conduct to avoid paying small companies on time.

“We have made the decision to stop enabling a supply chain financing option and are working through how that will occur in a way that doesn’t disadvantage our suppliers,” a Telstra spokesman said on Wednesday.

“Telstra did not receive any fees or commissions when suppliers chose to use the supply chain financing option. Financing arrangements were negotiated between the supplier and a funding provider, with suppliers able to take advantage of Telstra’s strong credit rating to receive interest rates well below the average cost of borrowing.”

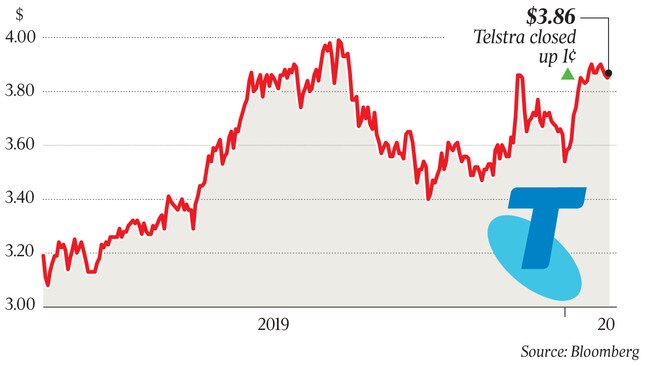

Telstra has been battling declining earnings and last year posted a 40 per cent drop in full year net profit. The telco is also in the middle of a strategic makeover aimed at cutting billions of dollars off its books.

The company’s former chief financial officer John Stanhope, who was also Australia Post’s chairman before stepping down last November, hit out at Telstra’s financing scheme and pushing out payment times, saying it was eroding corporate trust.

Mr Stanhope, who supervised 30 day payment terms for all suppliers during his time at the telco, said he saw no reason why payment times should be longer than that and a company needed to be fair to all stakeholders — investors, customers and suppliers.

“In a world where corporate trust is low, the only way to improve corporate trust is to not only do things right but to do the right thing. And to do the right thing you don’t hurt relationships with all stakeholders — customers and suppliers,” Mr Stanhope told The Australian.

“I put this thing (invoice financing) in that category of not doing the right thing by your suppliers and that’s not the way to restore corporate trust.

“Yes, you’ve got to make money for your investors but not at the expense of other stakeholders. Corporate trust is to balance doing the right thing by all stakeholders, not just one set.”

The telco introduced the scheme, known as supply chain financing, to its smaller and medium-sized suppliers last February. At the same time it extended payment times from 45 to 62 days, giving suppliers no choice but to cut their invoices if they wanted prompt payment.

But Mr Stanhope said that came at a cost. Suppliers had to pay an annualised rate of more than 7 per cent if they wanted prompt payment.

“You’re going to have more cash for longer, make money, pay later. But the bad news is someone on the opposite side has got to pay for that. A supplier can still get their money in 30 days — bridging finance — but you have to pay for it to get cash flow,” Mr Stanhope said.

Earlier this week, a Telstra spokesman maintained the company was continuing to pay its small business suppliers within 30 days, in line with its commitments under the Business Council of Australia’s voluntary Australian Supplier Payment Code.

But the BCA scrapped its definition of a small business last year after a review from former Australian Competition & Consumer Commission chair Graeme Samuel. However, the changes only applied to new signatories, with companies such as Telstra, which signed up in 2017, allowed to adhere to the old conditions.

This means Telstra still defines a small business as a company employing fewer than 20 staff, which has attracted strong criticism from federal Small Business Ombudsman Kate Carnell and suppliers. Ms Carnell, who participated in the supplier code review, said the definition was not reasonable and difficult to measure, despite it being used by the Australian Bureau of Statistics.

She said the current definition of a business with annual turnover of less than $10m or invoices totalling less than $1m was more appropriate and it was unfortunate that it did not apply to all the code’s signatories.

“I thought when we did the review that there would be new requirements for the code and that would apply for all signatories — not just new ones.

“This means that companies like Telstra, who were existing signatories, can claim that they are compliant forever. Those are the BCA rules for the code and 20 employees (or less) is no longer compliant with the code.”

Ms Carnell said all suppliers — regardless of their size — should be paid promptly, with delays in payment costing the economy about $7b a year.

Late on Thursday the Telstra spokesman said the telco would also review how it defined a small business.

“We are also considering … what defines a small business. We use the ABS definition, which was also the original definition in the BCA code. We were at the forefront of moving corporate Australia to adopting 30-day payment terms for small businesses in 2017.”

Finance Minister Mathias Cormann urged big companies to follow the government’s lead of paying within five business days or be charged interest on any payment delays.

“The Australian government is setting the benchmark. We will pay e-invoices within five days or pay interest on any late payments. We urge bigger businesses to follow our lead,” Senator Cormann told The Australian.

Small Business Minister Michaelia Cash said the government would introduce legislation in coming months to require big businesses to disclose how and when they pay their suppliers.

The measure was recommended by the small business ombudsman in 2017, but the federal government declined to act at the time, saying it would prefer for “industry to self-regulate in the first instance” through the BCA's supplier conduct code.

The push towards supply chain financing by Telstra, Rio Tinto and others came in the face of that self-regulation, forcing the government to finally act.

“Since Scott Morrison became Prime Minister, the Morrison government has introduced 20 day payment times for small business commonwealth government contractors and has been actively pressuring the big business community to follow suit, with a large number of big businesses already reducing payment times to 30 days or less,” Senator Cash said.

“The Government is introducing legislation in the Autumn sittings of parliament that will require Australian businesses with an annual turnover of $100m or more to report how and when they pay their small business suppliers. Upon passage through parliament, this will come into force by 1 January 2021.”

Since the beginning of 2019 when Telstra extended payment terms and launched its financing scheme with its smaller and medium-sized suppliers, the telco has won 467 contracts with the federal government departments, worth $316.7m.

Next Thursday, Telstra chief executive Andy Penn will deliver his first public speech for the year, sharing his perspectives on “why even during an era of rapid technological change, businesses must still be built around trust and a commitment to doing business responsibly”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout