‘Tech wreck’: Xero takes $37m hit, axes up to 800 jobs

The software giant is the latest to succumb to challenges within the sector, shedding 15pc of its workforce and exiting its cloud-based lending platform.

Shares in software giant Xero have jumped after the company announced it is “reshaping” its operations by cutting between 700 and 800 roles and exiting its cloud-based lending platform Waddle, taking a hit of between $NZ30m and $NZ40m ($27m-$37m) on the business it bought in 2020.

The cloud accounting outfit,, which has around 5000 employees, is the latest to shed headcount amid a deepening ‘tech wreck’ with Atlassian announcing it would lay off 5 per cent of it staff this week.

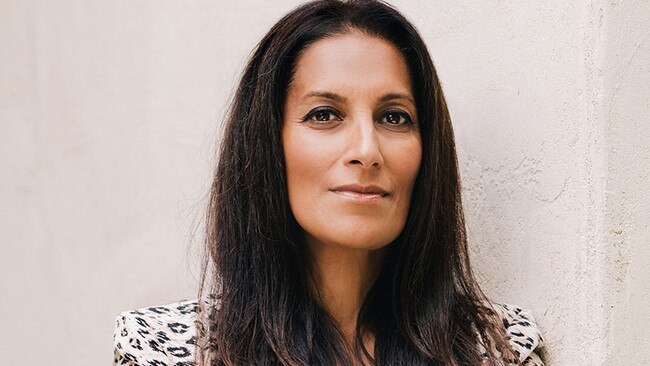

“We have made strong progress in executing our strategy,” Xero’s US-based CEO Sukhinder Singh Cassidy said on Thursday.

“However as we aspire to build a higher performing global SaaS [software-as-a-service] company and to enable Xeroʼs next phase of growth and drive better customer outcomes, we need to streamline and simplify our organisation. These changes, and our decision to reinvest in key strategic areas, will adjust our operating cost base as we balance growth and profitability, while taking a robust approach to capital allocation that supports long term value creation.”

Xero, which opened its new Melbourne headquarters last year, has not detailed which roles will be affected but said the cuts were across “all markets” including Australia.

“I will note of course that proportionally we have higher headcounts in some regions and some areas, so you can expect that there’ll be some proportionality there,” Ms Singh Cassidy said on an investor call.

Impacted employees will be give a minimum of 12 weeks’ pay, early share vesting, career transition support and will be able to keep their laptops.

Investors welcomed the cost-cutting, sending shares up 11 per cent to $87.

“I am deeply sorry to be taking this step. I want to make it clear to all Xeros that, as a leadership team and Board, we are responsible for the decisions that led us here,” Ms Singh Cassidy said in a letter to employees.

“Today’s news affects everyone at Xero, but most of all it affects the many talented colleagues and friends who have contributed so much to Xero and whose roles are potentially impacted.”

Ms Singh Cassidy, a former Google and Stubhub executive, took over from former Xero CEO Steve Vamos on February 1.

She said in the employee letter that in recent years Xero had grown its headcount and cost base at a faster rate than revenue. It has around 3.5 million subscribers, with around 350,000 of those in the US.

“Externally the broader tech landscape favoured high growth in this period; internally, we were less clear and measured in the rate of our hiring and investments,” she said.

“In FY23 we made the decision to slow the rate of incremental headcount growth significantly which has helped, but not enough. On my CEO listening tour, I also heard from many Xeros about how we can improve our focus and prioritisation of resources to become more effective.

“We aspire to build a higher performing global SaaS company; to do so, we must deliver better for our customers and execute against a disciplined growth framework. This is why we are streamlining and reshaping our organisation.”

Xero also said it would exit cloud-based lending platform Waddle, which it acquired in 2020 for $NZ80m.

“These are difficult but necessary steps as we work to further strengthen Xero for the future, while carefully balancing the interests of all our stakeholders,” Ms Singh Cassidy said.

“We don’t take these decisions lightly and we recognise today is a very hard day for our people. Todayʼs announcement does not take away from the significant contributions from everyone at Xero. We take our purpose and values seriously, and are committed to working closely with each impacted employee and providing them with the right level of support.”

The company is expected to give more detail on the cuts at its full-year financial results in May.

E&P Financial technology analyst Paul Mason said he expects the lay-offs to lead to a cost base reduction of between 7 and 8 per cent for eXero.

“Xero employee costs in the last half were $374.3m, so in dollar terms this works out to probably something like $100m annualized cost savings,” he said in a research note.

Wilsons analysts Ross Barrows, Cameron Halkett and Lachlan Woods said that the announcement is the “first externally visible sign of material operational change from recently appointed CEO Sukhinder Singh Cassidy”.

“We note that the pandemic period gave us some insight into the operational leverage in Xero, specifically 1H21, when EBITDA margins expanded materially from 24 per cent in 1H20 to 35 per cent in 1H21, following pandemic-induced, and unrepeatable, cost reductions, which saw, for example, travel-related costs fall -99 per cent from $8m to $90k,” they said in a research note. “Given the meaningful operating leverage inherent in Xero, it appears this upside is looking to be captured again.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout