Tech bloodbath: big four-backed fintech Slyp axes 30pc of staff

‘Smart receipt’ provider Slyp has joined the growing tech wreck, laying off nearly a third of its workforce.

Slyp, which boasts Australia’s top four banks as shareholders, has axed 30 per cent of its staff, with the fintech start-up the latest victim of the ‘tech wreck’ tearing through private start-up valuations and driving mounting lay-offs throughout the nation’s technology sector.

The company raised $25m in its latest funding round last February, and had backing from Commonwealth Bank, National Australia Bank, ANZ Bank and Westpac’s Reinventure for its smart receipt platform.

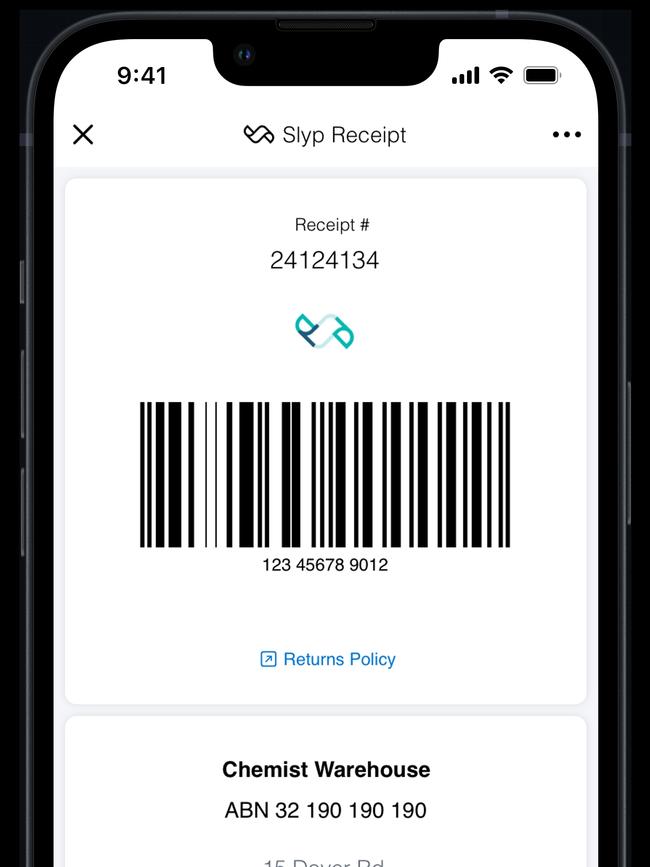

Co-founded by former local PayPal executives Paul Weingarth and Spiro Rokos and former ANZ group data officer Mike Boyd, Slyp’s technology allows receipts to be sent – or ‘slypped’ – directly into a customer’s banking app in real-time.

Despite signing up big-name clients including Chemist Warehouse, Mitre 10, JD Sports and Harris Farm, the start-up has axed a third of its staff – 15 people – blaming macroeconomic conditions.

Slyp chief executive and founder Paul Weingarth confirmed the cuts.

“I can confirm that redundancies took place at Slyp back in May, with around 30 per cent of roles impacted,” Mr Weingarth told The Australian.

“Due to the macro environment and increased business focus on long-term growth trajectory, we had to make the difficult decision to restructure the business, which resulted in some roles being redeployed and others made redundant.

“While this was an incredibly difficult decision, the new team structure better reflects and supports our business strategy as we go from strength to strength and continue to make our technology available to more consumers and merchants via a multichannel model.”

The executive said the cuts were a result of poor conditions rather than a reflection of any individual performances.

“The decision to make redundancies earlier this year was one of the most difficult decisions of my career and one that hurt deeply – a feeling I know has been shared by many start-up founders and CEOs in the past 12 months,” he said.

“As we said to those impacted on the day, this was not a reflection on individual performances, but rather an unfortunate consequence of the market challenges and business restructure we needed to undertake.”

Mr Weingarth added that his top priority following the redundancy round was helping those impacted with severance packages, mental health support services and help with finding another role.

“We firmly believe they possess the remarkable abilities to contribute to the success of other companies and wish them all the best.”

Slyp joins a growing list of Australian technology start-ups to shed staff in the past 12 months including Bardee, Centr, Linktree, Culture Amp and Mr Yum.

The idea for Slyp dates back to a department store in 2016, when Mr Weingarth received a 50 centimetre-long paper receipt. The company’s technology lets its customers pay as normal, and they can immediately view and interact with their smart receipts in their mobile banking app any time.

Mr Weingarth told The Australian in a 2019 interview announcing a partnership with NAB that his product’s speed and accuracy had helped drive fast adoption.

“Our founders recognised that while payments and digital wallets had come a long way, receipts had been left behind,” he said. ”It seems crazy that you can tap a watch to make a payment, but you still get handed a paper receipt. They came together to find a better solution for customers and retailers,” Mr Weingarth said at the time.

“Slyp’s mission is to ‘eliminate paper receipts for good’ which means getting rid of paper altogether. Slyp’s ‘smart receipt’ solution is the next product to be released which will enable customers to pay with their bank card as normal and automatically receive an itemised tax receipt inside their banking app — without the need to scan.

“Slyp has already tested this solution with NAB customers and the feedback was extremely compelling.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout