Messaging app Slack on track for a quick IPO, if needed

Slack, the messaging app the Prime Minister likes, could go public in as little as 18 months.

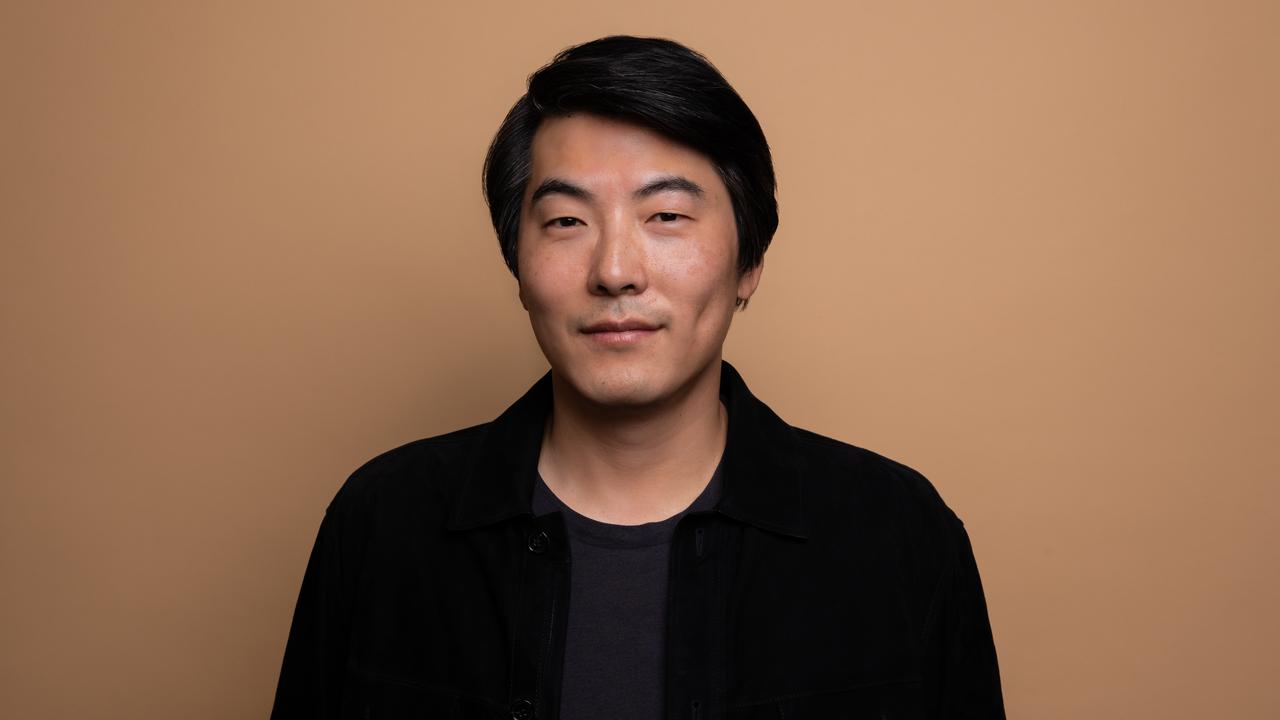

Slack, the messaging app that Malcolm Turnbull wants cabinet to use, could go public in as little as 18 months, according to founder Stewart Butterfield.

“About three to four months ago we started an internal campaign for IPO readiness because we want to have the option in the future and there’s quite a bit of work that goes into it,” Butterfield told The Australian.

“We’ve done our first external audit and we’ve put in place a lot of controls and security practices. There’s a lot of predictability that needs to be evident in the business, so we’re spending a lot on analysis and data infrastructure,” he said.

Sydney-based Atlassian, whose app HipChat competes against Slack, is one IPO Butterfield will be watching closely. Atlassian this month filed for an IPO on the US Nasdaq exchange.

“Atlassian is very similar in terms of the sales and growth model. We have slightly different but heavily overlapping markets and to the extent that they’re successful, and we hope they are — that will be a good omen for us.”

But he sees little threat from Atlassian’s team messaging app HipChat because of the market’s huge growth potential.

“Both us and HipChat could be 50 or 100 times bigger than we are now before we would have to compete with each other in order to be successful. There’s just so much room for growth.”

Despite taking the first steps to getting the company IPO-ready, Butterfield says “the absolute earliest that we could IPO, if everything came together right, would be 18 months from now.

“One of the things public investors look for is predictability and when you’re growing as fast as we are it’s impossible to predict where we’re going to be six months from now.”

The company behind the workplace messaging app trying to kill off email is currently valued at $US2.8 billion ($3.9bn) after raising $US340 million in private funding over the past two years. And yet, most of that money is still sitting in the bank.

“Part of it is a hedge against a change in market conditions,” Butterfield says.

“Things won’t always be rosy and if market conditions shift and we have a giant pile of cash we’ll be in a great position because suddenly the competition for engineering talent is less, the lease rate on office space comes down, advertising becomes cheaper and especially companies that we might want to acquire become cheaper.”

While Slack is interested in opportunistic deals, current valuations would make it a difficult market to buy on the cheap. At the same time, Mr Butterfield isn’t convinced we’re in a tech bubble, despite the growing herd of unicorns — companies valued at $1bn or more — in Silicon Valley. “I don’t know if we should expect a change in the market in the short term.

“There’s definitely a lot more hesitancy than there was a few months ago but it’s not something that would have an impact on us unless there was a large macro change like a sustained bear market.”

Slack has seen rapid growth since launching in February 2014 and currently has 1.7 million daily active users, including 480,000 paid users. Butterfield estimates the potential market at up to 200 million people.

Like many tech start-ups, Slack isn’t yet profitable, but Butterfield isn’t worried.

“Because we’ve had such an easy time raising cash and because growth and capturing market share in the early days is more important than profitability — because the profits wouldn’t be very big if we wanted to be profitable — I think we’re doing the right thing.”

Butterfield said Slack had received many “friendly overtures to see if (a sale) is something we would be interested in pursuing and so far we have not been interested”.

There is no magic number he would sell for, he says, comparing a sale of Slack to someone asking “how much would I have to pay you to divorce your spouse”.

Instead, he’s focused on positioning the company to be front and centre of the coming revolution in the workplace.

“There’s been so much change on the consumer side.

“The amount of information available to us now would be incomprehensible to someone 30 years ago. But we haven’t seen that transformation yet in our ability to access information on the business side.

“Over the next decade or so I expect to see something that’s like the Google Maps for work information — something that gives you as much facility (as Google Maps) with internal documentation and data. We don’t have that yet on the work side and I think we need it.”

Slack is investing a lot in search and relevancy and retrieval techniques to ensure it plays a major role in this transformation.

“It’s in the very early stages of getting started but we have a unique opportunity that is going to be very powerful.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout