Samsara Eco strikes recycling ‘breakthrough’, turning more plastics into clothes

A climate tech start-up has developed another enzyme to break down a common type of nylon allowing it to be recycled indefinitely.

Climate technology start-up Samsara Eco has developed another enzyme to break down a common type of nylon, allowing it to be recycled indefinitely, as it intensifies its war on waste in the fashion industry.

The Canberra-based company, which has partnered with activewear brand Lululemon and others to turn discarded plastics into clothes, has raised more than $150m since its founding in 2021 to accelerate the shift towards a circular economy.

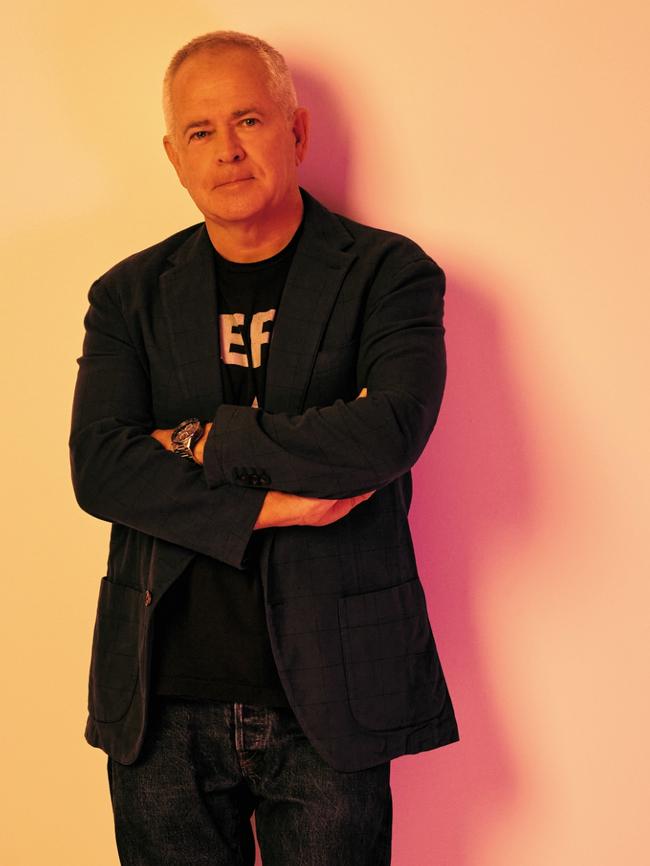

Samsara has developed a process with Australian National University to break down plastic to its original molecule, which allows it to be recycled indefinitely. This is unlike conventional plastics recycling, which has a limited lifespan before the plastic becomes degraded and unusable. Founder and chief executive Paul Riley says the technology is critical in curbing the “take-make-waste economy” which is “incredibly damaging to our planet”. It is estimated of the 100 billion garments produced each year, 92 million tonnes ends in landfill or incineration.

“We represent what I call true recycling,” Riley says.

“We can take a footy jersey, a bottle, put it through our process, and in about 90 to 120 minutes you end up with the original building blocks of that plastic in a form that slots straight into the supply chain and displaces fossil fuels from that supply chain.

“So you can take coloured bottles, coloured polyester garments, mixed garments. And because the enzyme has been designed only to address a single plastic, you can separate out polymers and end up with just the original building blocks, the monomers of that particular plastic. Because you go back to the molecule and it’s pure in its form, and you get to reuse it. It’s not degraded in any way.”

The latest enzyme Samsara has developed targets nylon 6, a synthetic fibre commonly used in apparel, hosiery and the automotive industry. Riley says the company is using a machine learning algorithm to develop more enzymes to recycle more plastics.

He says a key difference with Samsara’s technology is that it can perform mixed recycling.

“When plastic is mixed, and the majority of plastics are mixed, it’s very challenging to have any recycling technology that’s going to work economically. If you need 98 per cent pure polyester for your advanced recycling technology, there’s a very limited amount of garments that are 98 per cent polyester – most of them are mixed with cotton or nylon, and they’re coloured.

“We deliver infinite recycling at a price that the market is comfortable with and it’s the only technology that can deliver infinite recycling across a breadth of plastics.

“Our latest breakthrough makes it possible to believe future textiles will be made from waste and excess, not fossil fuels.”

Samsara is now expanding operations into Europe and North America.

But former US Environmental Protection Agency official Judith Enck – who founded Beyond Plastics – has criticised chemical recycling, saying it is a distraction from proven waste reduction methods such as using less packaging.

Riley agrees “you shouldn’t recycle for recycling’s sake”.

“We firmly believe that you should only recycle where the carbon footprint of your recycling is less than virgin. There is little point in recycling if you’re going to generate more carbon than what virgin would.

“So it’s a dual problem that needs to be addressed, and that’s what our focus is. Is not just on the waste. Circularity is incredibly important to us as well.”

Samsara is building an innovation hub in Canberra and looking to develop commercial recycling plants with joint venture partners that can produce 20,000 to 50,000 tonnes of polymers a year.

Riley says the company is “well funded, well supported”, with backers including Main Sequence, Woolworths, Temasek, Lululemon, Titanium Ventures, Hitachi Ventures and others. But commercial facilities cost $80m-$100m to build, so Samsara will need more funding and support as it scales.

“There’s little doubt that this is capital-intensive. Everything in the plastics industry is capital-intensive. And if you’re building 20 to 50,000 tonne facilities, they will be not inexpensive.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout