Netflix’s 40 per cent share slide a warning for Meta, Amazon and Apple

The surprising loss underlines the crucial point facing so-called Big Tech, whose companies are now facing increasingly existential questions over the sustainability of their growth, their long-term profitability and their identity.

In news that came as a shock to both investors and analysts, Netflix reported on Wednesday it had dropped 200,000 subscribers in the first three months of the year, and it expects to lose another 2 million in the current quarter.

The streaming company said revenue growth has slowed considerably after years of 20 per cent-plus gains. Revenue in the first quarter rose roughly 10 per cent to $US7.87bn ($A10.64bn), below analysts’ projections of $US7.93bn.

Its share price has tumbled by more than 40 per cent this year, and the company now faces the unenviable task of either introducing a lower-price advertising tier, or forcing users who share their accounts with other households to pay more, or both.

It’s fair to say then that Netflix is stuck, and it’s a position shared by many of the formerly unassailable ‘FAANG’ stocks – Meta (formerly Facebook), Amazon, Apple, Netflix and Alphabet, which have in recent years been the darlings of the investor community and made many millionaires in the process.

Each of those tech giants for years climbed in valuation and enjoyed consistent growth, and were buoyed further still by the pandemic over the past two years as cities locked down and forced their citizens onto streaming services and food delivery apps en masse.

As small businesses shuttered, Big Tech soared.

No longer. We’re now at an inflection point, with executives forced to rethink their plans and what they want their companies to become, while their investors are being forced to ween off their addictions to double-digit growth figures.

Netflix was once the scrappy upstart that took down Blockbuster, but is now facing similar challenges to what the video rental giant did, in terms of ballooning costs (media production, rather than real estate) and consumers who are keen to axe superfluous costs in the face of rising inflation and stagnant wages.

Meta has had the most public identity crisis of any big company in recent years, announcing its name change in a widely-panned keynote from Mark Zuckerberg who is now caught between building a ‘metaverse’ that may still be up to a decade away, and tying together disparate apps like Facebook, Instagram and WhatsApp that are increasingly in the firing line of regulators globally.

Its share price is down more than 35 per cent over the year to date.

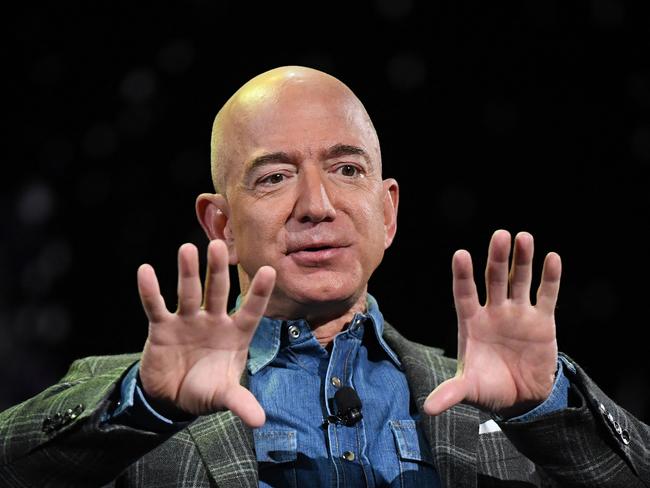

Amazon chief executive Andy Jassy meanwhile has been in the top job for more than a year but it’s still founder Jeff Bezos who dominates headlines and is seen externally as the company’s figurehead.

Like other tech giants Amazon is trying to do everything, from selling books to grocery delivery to providing the backbone of the internet.

Shares in Alphabet meanwhile have fallen by more than 10 per cent in the year to date ahead of a stock split in July, while Apple is reportedly working on a fully autonomous electric car, a secret project years in the making that is surely stretching the tech giant’s engineering resources and attention.

Twitter is not a ‘FAANG’ member but is also uniquely vulnerable, given Elon Musk’s posturing and now the ongoing threat of multiple buyout offers.

Morale inside the company is reportedly at a low ebb, as is the case at other decade-old tech companies that are no longer the hot new place to work.

The ‘FAANG’ stocks were once an easy and clear delineation of the hottest and most influential companies building the future, but that’s not the case any more.

In their place are fast-growing Australian start-ups – Canva is now worth more than Telstra for example – alongside heady Web3 and crypto projects that will take years to come to fruition but are where some of the world’s best developers are now focusing their efforts.

Elon Musk, despite the often emptiness of his bluster, is also shaping new industries in terms of space exploration and satellite internet.

What it amounts to is a wide open lane for the next generation of companies to come in and leave their mark – hopefully for the better – and a lot of soul searching required for the current crop of has-beens.

Netflix’s shares are in free fall, losing $54bn in value with the company posting a drop in subscribers for the first time in a decade.