Microchip crisis hitting gaming, phones and cars

The global chip crunch will only worsen with new technology that we use in our daily lives impacted.

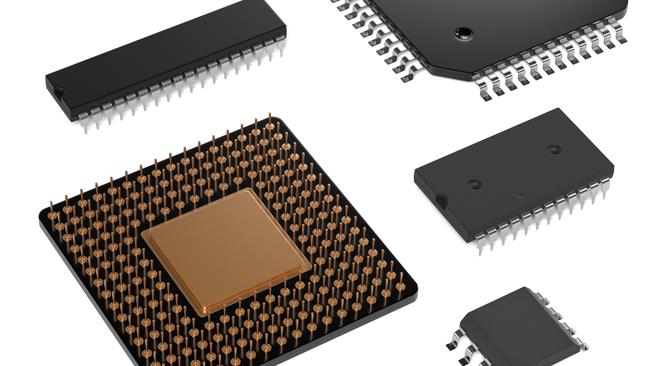

The international computer chip shortage is reaching a crisis point with cars, TVs, cameras, smartphones, 5G equipment and gaming consoles among goods in diminished supply.

It is predicted the situation will worsen until at least June with the prospect of a return to relative normality by the second quarter 2022. Intel CEO Pat Gelsinger says normality won’t return until beyond 2022.

The instability in the South China Sea and China’s threats to invade Taiwan could cause another massive global crisis in chip supplies.

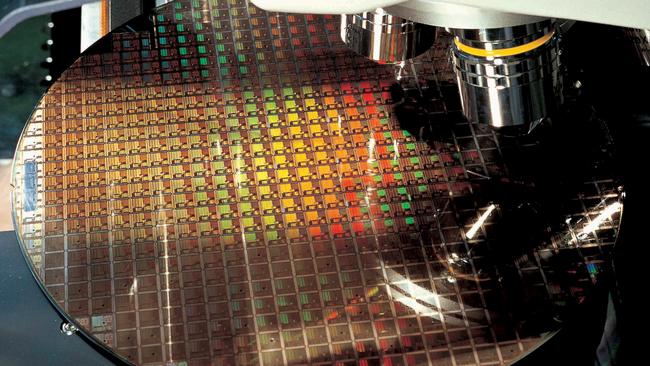

Taiwan is the location of chip foundries run by Taiwan Semiconductor Manufacturing Company (TSMC) and United Microelectronic Corp (UMC), which produce more than 40 per cent of the world’s microprocessors. TSMC dominates the world market with 28 per cent market share according to Counterpoints Research. Apple, Qualcomm, Nvidia, Broadcom and AMD are among its biggest customers.

Speaking with The Australian, Gartner’s Taiwan-based semiconductor analyst Ben Lee painted a perfect storm of reasons for the shortage.

The storm’s first wave was former US president Donald Trump’s inclusion of Huawei, ZTE and Shanghai-based chipmaker SMIC on a blacklist of companies banned from trading with US ones. Huawei was banned from even getting its chips from SMIC. With no source of chips and a window between the announcement and the ban taking effect, Huawei undertook a massive chip spending spree.

Mr Lee estimates Huawei may have snapped up as many as five billion chips — around half a year’s supply. Other China phone makers such as Xiaomi and Oppo also stockpiled chips from TSMC as they jostled for position in the smartphone market. “That causes a second wave after September,” Mr Lee said.

These companies needed western-produced chips as China’s chipmaker SMIC cannot yet make the 5-nanometer advanced chips that TSMC, Samsung and to some extent Intel do, although China is reportedly spending $US9bn to match western foundries.

2020 may have been a pandemic year but revenue from chip sales skyrocketed 10.4 per cent to $US466.2bn, says Gartner.

The next wave in the fourth quarter last year was when car makers began running out of chips. This coincided with factories and assembly lines lowering spending and slowing production due to COVID-19.

Mr Lee said car makers used older-style (legacy) chips, and had underestimated car sales due to the pandemic. They had lowered their inventory of chips in early 2020 and foundry capacity was booked by other industries.

Their cause wasn’t aided by a fire at the Renesas Electronics semiconductor factory in Japan earlier this year which has impeded production there by at least three months.

Peter Griffin, spokesman for the Federal Chamber of Automotive Industries, said most modern new cars used between 50 and 200 chips with hybrid and electric cars requiring up to 3500.

Instead of an expected decline, there was increased demand for cars in Australia for trips away and by those seeking to avoid public transport. “Transport and hygiene have driven the demand in vehicle markets and new cars and used cars,” he said.

He said a combination of fewer chips, fewer cars and a bigger demand exacerbated the shortage. Purchasers could be waiting up to eight months for delivery, depending on the car. The second hand car market also saw an increased demand and price increases.

Mr Griffin said there was now indications of new car sales improving. FCAI March quarter new car sales figures were 268,538 (2019), 233,361 (2020) and 263,648 (2021).

This showed a 30,000 increase in 2021 compared to 2020, and sales in 2021 being not far behind 2019 figures so far.

“The market is recovering but there is demand and there will be delays and each of the car makers are managing it according to their own market profile,” Mr Griffin said.

NRMA spokesman Peter Khoury said the chip shortage had also impacted the rental car market. NRMA-owned Thrifty Car Rental found it hard to buy cars as had other car rental firms. There had been an increase in consumers hiring cars for road trips.

However, the international automotive crisis is far from over, with car makers halting or reducing production. Some of these new cutbacks began only recently which is a worry for longer term new car availability.

In the US this has impacted Toyota, Honda, General Motors, Ford and Fiat Chrysler while in Asia, manufacturers such as with Hyundai, Kia, Toyota, and Renault Samsung have recently warned of cutbacks. Cutbacks are also expected in China-based car production.

In the US, President Joe Biden has stepped in to deal with the chip shortages, while Intel plans to make computer chips for the US car industry within the country, but this will take time.

Telecommunications including 5G have been impacted but Australian telcos say not here. Telstra didn’t offer any comment.

“To date, there has been no impact to our 5G rollout in relation to equipment delivery,” an Optus spokesperson said.

Nevertheless, 5G equipment shortages are playing out in the US. Gogo, which supplies in-flight internet in the US, has said it will push back its rollout of 5G in the sky to next year. Cisco chief executive Chuck Robbins told the BBC that the expansion of 5G, cloud computing, the internet of things and artificial intelligence were vulnerable areas. He said chip shortages would last for most of this year.

The shortages has affected NBN’s rollout of hybrid coaxial (HFC) connections. NBN said it had paused the connection of most new customers via HFC technology.

It received the first of the new deliveries of HFC modems last month, and limited stocks in its warehouses for reconnection orders.

Huawei and other China companies also went on a buying spree of HFC modems last year before the ban.

The chip shortage has also impacted the availability of gaming consoles and components in Australia. The next generation PlayStation 5 and Xbox Series X/S consoles are still in limited supply and there’s no clear indication of when the situation will end.

AMD, which manufactures the processing units for the PlayStation 5 and X/S consoles, expects chip set supply issues will continue at least until mid-year.

There’s another factor impacting chip makers in Taiwan — drought. Semiconductor manufacturing requires lots of water. TSMC reportedly uses 150,000 tones of water daily.

Mr Lee said Taiwan missed its 2020 typhoon and had experienced unprecedented drought since January. This had impacted efforts to scale up production.

TSMC had been forced to truck water into its foundries. It resorted to purifying sea water, and recycling water three times to keep production going.

The drought appeared to be breaking with rain this week, so there are hopes of a normal typhoon season starting about May.

There is also regional instability. A paper by the Australian Strategic Policy Institute puts the fate of TSMC, which has provided chips to China and the west, central in the conflict. It says the foundry’s existence might act as a deterrent to China annexing Taiwan.

The possible loss of the world’s most advanced chip foundry and its technology to China would be a catastrophe for the west including militarily, and a reason the US might aggressively defend Taiwan.

TSMC’s operation also depends on US-made software and machinery, so China has much to lose too. An industry source said some would prefer to raze the TSMC foundry than have it fall into China’s hands.

This week, after Apple announced record revenue in the March quarter, CEO Tim Cook warned of a looming shortage of iPad Pros and iMacs. He said it was too hard to predict when things will turn around.

Taiwan meanwhile has forbidden Taiwanese workers at Taiwan’s foundries from taking jobs at China foundries. China is understood to have poached hundreds of Taiwanese workers by offering them sizeable salaries in its bid to catch up with the west in chip production and other industries.

Additional reporting: Royce Wilson

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout