‘Kiwi invasion’: NZ start-ups say they can save Australian farmers and households a fortune

Blackbird says it has unearthed the ’Nvidia of agriculture’ after investing almost $70m into a New Zealand start-up that is producing smart collars for cattle.

Blackbird says it has unearthed the “Nvidia of agriculture” after it has invested almost $70m into a New Zealand start-up that is producing smart collars for cattle and changing the way farmers grow our food.

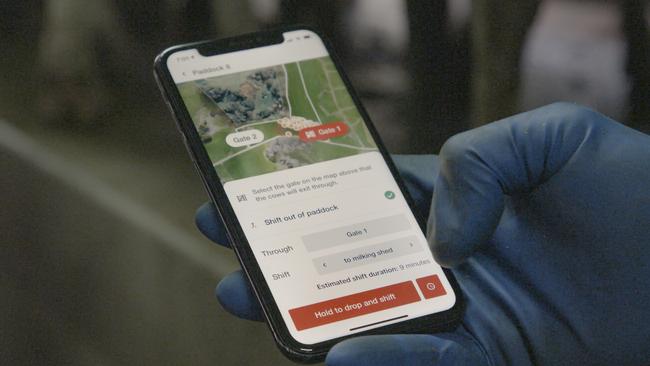

Mechanical engineer Craig Piggott – who grew up on a farm – developed the solar-powered smart collars, which create virtual fences and allow farmers to better monitor their pasture and shift livestock with the swipe of a finger on a smartphone.

Mr Piggott watched his parents work 90-plus hour weeks, and knew there had to be a better way to earn a living from the land. So he combined his engineering degree and career at Rocket Lab to develop Halter’s proprietary technology, which he said can boost a farmer’s revenue by up to 30 per cent.

This is mainly achieved via savings on labour, imported feed, and fuel and has propelled Halter to a valuation of around $330m, according to dealroom.co.

His aim is to shake up Australia’s $33.8bn livestock market.

“If it starts to rain in the middle of the night, you can pull the cows off automatically,” Mr Piggott said. “You’re not constrained by having to ask a worker at 2am – rightfully – and say, ‘Hey, get the cows off, it’s a bit wet, shift them up top of The Hill’. But that’s all stuff that you can do when Halter’s collars are doing it.”

It comes as New Zealand’s tech start-up sector is emerging from under the long white cloud.

Auckland-based Basis has completed a Series A fundraising, totalling $US16m from New Zealand-based VC firm GD1 (Global From Day One). It has developed a smart panel for homes that it says can slash up to 25 per cent off power bills, and is preparing for a launch in Australia after partnering with a local energy retailer.

“There are not that many interesting start-ups in New Zealand, so it’s a small pool,” Mr Piggott said.

He is being modest, at least according to Blackbird partner Samantha Wong, who says he has developed revolutionary technology – hence the “Nvidia of agriculture” moniker.

“Like, I mean, there are other companies making graphics chips, but really, Nvidia is the player, and that is kind of the similar thing for Halter,” Ms Wong said, adding that Mr Piggott was a “special founder”.

“He combines that life’s work, incredible vision for how an industry should change, first principles, product thinker … so much empathy, obviously lived experience … and customer obsession, working on a really, really hard problem in what actually is a really big market.”

Transmission towers send data between the collars and an app, meaning no mobile coverage is needed. The collars work by emitting a low-volume sound when a cow begins straying closer to a virtually fenced off area.

“We train them to respond to cues. So cows today are trained with fences. They see electric fences, the primary cue’s vision. Once they learn what a fence is, they don’t go around walking into fences,” Mr Piggott said.

“For us, our primary cue is sound. So they don’t see our fence, they hear it much like when you back your car into a wall. It’s a very quiet sound as well. Like, if, if you were 2m from a cow, you probably wouldn’t hear it.”

The company has already exported its collars to Australia and the US and is eventually targeting Europe.

Basis also has big plans for its “Leo” smart panel, which allows homeowners to monitor their energy consumption – saving money via what is known as load shifting and better use of power – as well as optimising batteries such as Tesla’s Powerwall.

Co-founder Danny Purcell said it had generated $US100m in partnership opportunities and direct business-to-business sales and would soon launch in Australia. He said the panel aimed to empower consumers by having more oversight of their data rather than it flowing to an energy company.

“There is a world in which smart meters are not necessary anymore, but probably the big point of difference is that for us, customers own the data,” Mr Purcell said.

“Customers take control of that information.

“We’re working with a smart meter company that operates in Australia at the moment, and we’re working with a large electrical electricity retailer that crosses into Australia, and the product can be a smart meter in and of itself.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout