Has Amazon – and Jeff Bezos – become too big in a new era of Donald Trump

It’s no secret Amazon founder Jeff Bezos and Donald Trump don’t get along. Will the US president-elect call for Amazon to be broken up or will the tech giant be ‘too good’ to face a split?

If ever there was a city that highlights the decay of America’s once-great manufacturing industry and the meteoric rise of its technology companies, it’s Seattle.

At one end of the success divide is Boeing, one of the world’s top two commercial aircraft manufacturers. “If it ain’t Boeing I ain’t going,” used to be the saying because of its incredible safety record.

Not so much now. The company was responsible for two aircraft crashes in 2019-20 that killed 346 people; it just suffered a seven-week worker strike; and it posted a $US6bn loss for the last quarter.

Workers believe Boeing’s leadership team lost touch when they relocated head office away from the firm’s manufacturing hub of Seattle, and then paid themselves massive wages – the former CEO took home more than US$30m while the company lurched from one crisis to the next.

At the other end of the divide is Amazon. A company on the opposite trajectory.

Just a week after Boeing announced its latest loss, Amazon rounded out October by posting a $US15.3bn third quarter profit.

The company that made chairman Jeff Bezos one of the richest men in the world started as a book seller and is now the world’s biggest e-retailer, and perhaps more importantly the world’s biggest cloud services operator.

Its 18-year old Amazon Web Services (AWS) unit accounted for 60 per cent of earnings, with net income rising 50 per cent from the previous year off a whopping 38 per cent margin.

“It surprised everybody when they first went public that AWS was the profit generator and also generating a lot of cash and top line revenue,” says Patrick Moorhead, CEO and founder of Moor Insights & Strategy.

So far so good. But a problem in the making for Bezos is that he and US president-elect Donald Trump don’t get along.

Trump is not viewed as a fan of Big Tech altogether – which makes Elon Musk’s outspoken support and financial backing of the president-elect somewhat unusual (and many believe their current friendship will be short-lived.)

But Bezos may be feeling the glare of the spotlight more than other tech billionaires because he is the owner of The Washington Post. At this year’s election, The Post didn’t endorse a candidate, but the left-leaning paper has been frequently critical of Trump.

The question now is will Trump seek revenge on Bezos by trying to break up Amazon?

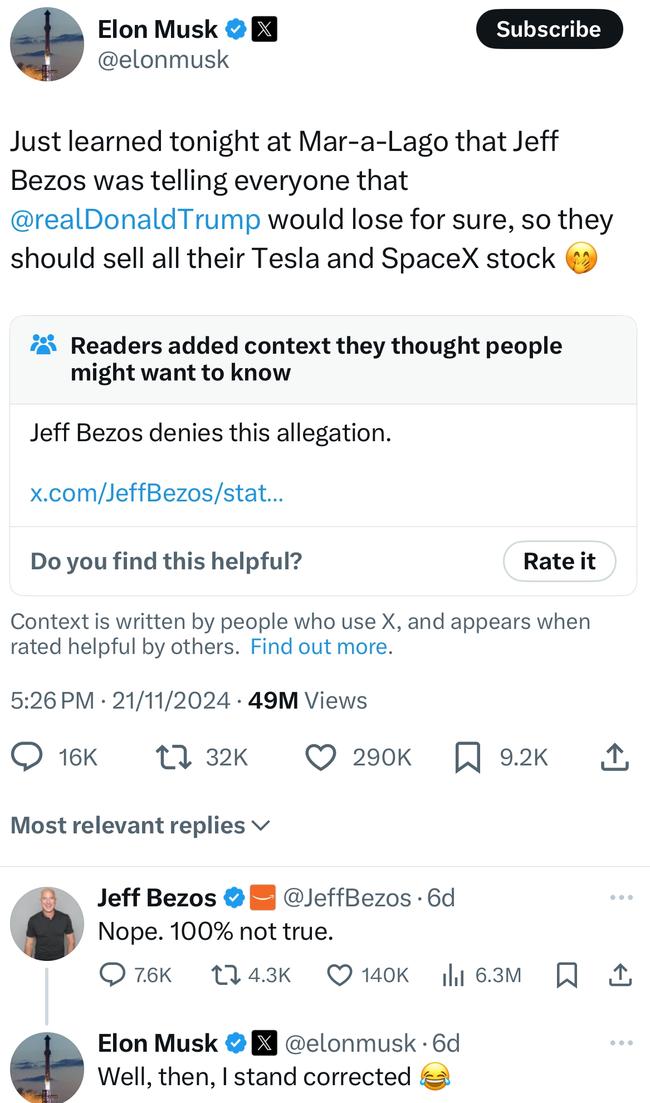

Speculation was fuelled last week by a spat between Bezos and Musk on the latter’s social media company X.

“Just learned tonight at Mar-a-Lago that Jeff Bezos was telling everyone that @realDonaldTrump would lose for sure, so they should sell all their Tesla and SpaceX stock,” wrote Musk on X in a post viewed 49 million times, adding an embarrassed laugh emoji.

“Nope. 100% not true,” Bezos wrote back.

“Well, then, I stand corrected,” Mr. Musk responded with an emoji that suggested otherwise.

Under outgoing US president Joe Biden, the murmurs had become louder that the Amazon retail business should be forced to split because of its market dominance. It accounts for “only” 10 per cent of US domestic retail spend but almost half of online spend.

“There are people who want to do that in the current administration … split the companies,” Moorhead says.

The Federal Trade Commission chair Lina Khan – who stands to be replaced under Trump – wrote a book while still at university entitled Amazon’s Antitrust Paradox, which used the company as an example of monopolistic behaviour at big tech. She launched action against Amazon last year, accusing it of maintaining illegal monopolies, which was partially dismissed two months ago. The details weren’t released and the FTC is still free to proceed with other parts of the claim.

The FTC launched action on Thursday against Microsoft’s cloud and software offerings, in news first reported by Bloomberg. What happens with this investigation and any others Khan is expected to start between now and when Trump takes over is unclear.

According to the New York Times, Trump has previously alleged Amazon had an “unfair” deal with the US postal service and there was a legal battle about whether he, during his last reign as president, had prevented Amazon winning a US$10bn military cloud computing contract.

Moorhead is of the view that the incoming president’s business sense will win over an emotional response, when it comes to considering a break-up.

“I think that even though Trump despises big tech, he’ll look at this and get advice that it doesn’t necessarily move the country forward economically,” Moorhead says.

In the meantime, presumably Amazon will remain focused on being the best of corporate citizens.

It certainly seems to be winning the support of its staff.

It was hard not to notice the stark contrast between the workers on the picket line at Boeing’s manufacturing base in Seattle with the peachy keen Amazonians, as they are known.

The company employs about 1 million people in the US and many are unskilled. Yet only one of its 100 plus warehouses has voted to have a union at all.

Moorhead says unions “pop up all over the place” in the US and the fact that workers have voted against unionising in all but one warehouse in the US speaks to the culture of the company.

“If enough workers feel that they’re not being treated well, they will unionise. That happens. Amazon pays well and their benefits are really good,” Moorhead says.

In total Amazon employs a staggering 1.5m people across the world, and to be sure, it does face worker issues, such as a strike in the US last year by external contract drivers – who drive Amazon trucks and are monitored by the firm – and a warehouse worker strike across several non-US countries.

But it is still fair to say that the vast majority of its enormous workforce are enjoying even just a happy slither of the riches the company is pulling in.

Amazon was the first to see value in storing data in internet servers – aka the cloud – instead of computer hard drives.

Now AWS wants to be number one in generative artificial intelligence, known as Gen AI.

After leading the pack in the early days of AI, the company is considered by some to have fallen behind the likes of Google, Microsoft and Meta in the mad scramble toward Gen AI.

Moorhead believes AWS was slow to launch because it wanted to be able to offer different sized models to its mostly corporate customers and be confident that its Bedrock system, which is the platform customers can use to build out their Gen AI needs, could easily sync with prior customer data.

“From a scale and optionality perspective, it’s impressive,” he says.

Bedrock has allowed existing customers an easier step into the opaque world of Gen AI and AWS was also the first cloud provider to design its own super fast chips to process the information needed. While not as good an all-rounder as market leader Nvidia, the specialist chips AWS designed serve a narrow function well and are significantly cheaper for customers.

“All of the major hyper scalers are designing their own chips, the Metas, Google, AWS and Microsoft, but AWS was the first and has the most comprehensive set of chips out there. They don’t disclose exactly the percentage of costs, but they are talking about 10s of 1000s of customers using these chips, and they’re very expensive,” Moorhead says.

AWS chief executive Matt Garman says the chip strategy is important to the AWS business because of the ease of integration it gives customers.

“They get a chip that operates on one platform and they don’t have to worry about integration and testing … if you know your chip is always going to be in this one server,” Garman says. “And we get a benefit from that because we can move a little more quickly. We also do all our chip design in the cloud, which allows us to be more flexible.”

As for talk that AWS was slow to launch, Garman says his company does a “good job” of listening to what customers want.

“This is a world where you just have to keep executing and you have to keep moving rapidly, and we’ve done that so far, but we also can’t take it for granted.”

Last month, Amazon announced a number of new AWS Gen AI initiatives including an expert shopping assistant (not yet available in Australia) known as Rufus, named in honour of a dog owned by one the company’s first staffers. The company also launched AI Shopping Guides which will use Gen AI to pair product information for customer needs. Corporations selling through Amazon will have access to Amelia, an AI assistant who will assess business insights to try boost sales, and video generation and live images to build better onsite advertising.

As it stands, Amazon is AWS’s biggest customer and the tech arm is able to test much of technology out on the retailing giant.

An AWS spokesperson said the latest AI and automation technology will speed up the customer order process by 25 per cent and cut costs by the same figure.

“To achieve these results, we are fusing the latest in generative AI and robotics,” the spokesperson said.

“As inventory and packages move through our next generation facility, Robin, Cardinal, and Sparrow — an AI-powered trio of robotic arms — sort, stack, and consolidate millions of items and customer orders with remarkable precision. Sparrow can handle over 200 million unique products of all different shapes, sizes, and weights. It uses advanced computer vision and AI systems to make it the most versatile and reliable robotic arm in the industry we’ve seen.”

Listening to the CEOs of Boeing and AWS talk their outlooks during third quarter results, it was hard not to bring it all back to their Seattle bones. To be clear, Microsoft and Starbucks also started out in this city of 4 million people.

Boeing, once considered the best of the best in aircraft engineering, was founded in Seattle in 1916 by William Boeing. So important was the company that during WWII the city built ‘Boeing Wonderland’ a fake miniature town atop one its manufacturing bases to confuse potential Japanese bombers as workers built critical aircraft such as the P-51 Mustang.

Now, Amazon appears to be the home team.

The company has 55,000 workers in the Puget Sound area alone (covering 100 miles around Seattle) and has 40 buildings in and around the Seattle area.

It’s hard to imagine Boeing won’t eventually pull itself back together and shift its balance back towards the manufacturing excellence it was once known for.

But in the meantime, the 18-year old technology upstart at Amazon, AWS is galloping toward the future at light speed. Perhaps some of its Gen AI might eventually help Boeing (a client) regain its mantle at the top of the aircraft building industry.

And perhaps for Amazon, in a Trump world it will need to remain focused on being too “good” to fail.

The writer travelled to Seattle as guest of Amazon

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout