GetSwift in ‘multiple breaches’ of Australian Corporations Act

Logistics software company GetSwift and its directors contravened the Australian Corporations Act dozens of times, the Federal Court has found.

Logistics software company GetSwift and its directors including former AFL star Joel Macdonald contravened the Australian Corporations Act dozens of times, the Federal Court has found, capping a stunning fall for what was once one of the ASX’s brightest stars.

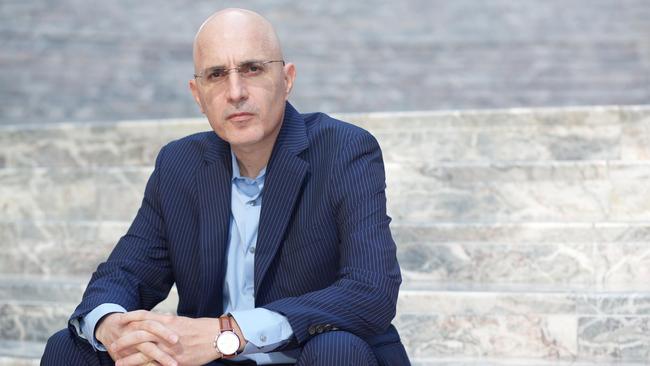

Describing director and CEO Bane Hunter as having a “management style littered with the influence of the late Dale Carnegie” who was “demanding, forceful” and would ”regularly bruise to the point of weakness”, Federal Court Justice Michael Lee found in a hearing on Wednesday that GetSwift executives broke the law numerous times in making misleading statements to the ASX. The Australian Securities and Investments Commission had been pursuing GetSwift since 2019.

“GetSwift took a public relations-driven approach to corporate disclosure, motivated by a desire to make regular announcements of successful agreements with national and multinational enterprise clients,” Justice Lee said.

GetSwift was once one of the ASX’s fastest-growing companies but delisted last year after multiple class-action suits, and is now listed on Canada’s NEO exchange, where it has a market cap of about $C30m ($32.7m).

An email from Mr Hunter to co-founder Joel Macdonald, quoted by Justice Lee, had said “no rest until we’re north of $1bn”.

“I made you a promise, do or die on my part,” Mr Hunter said.

ASIC had attempted to block GetSwift’s move to Canada, lobbying Treasurer Josh Frydenberg who said such a move would be “contrary to the national interest” due to the company’s ongoing legal matters.

It received Federal Court approval to relist in Canada in January this year, with the provision that the holding company ensure the payment of any legal penalties levied against GetSwift by Australian courts.

The root of GetSwift’s problems came from disclosures it made to the ASX, in which it said it had landed contracts with global giants like Amazon and Yum! Foods, the operator of KFC and Pizza Hut in Australia.

It also said it had entered into partnerships with Fantastic Furniture, The Fruit Box Group, and Commonwealth Bank. Those companies later said they had entered trial agreements, rather than commercial partnerships.

In July 2021 GetSwift and Mr MacDonald settled a class-action suit with aggrieved creditor Raffaele Webb.

The conditional agreement was made without any admission of liability by GetSwift or Mr MacDonald, and will see Mr Webb benefit if and when the company receives funding.

That class action was one of three filed against the company in 2018. In 2019, it announced that ongoing legal expenses of more than $2m had prevented it from forecasting when it would reach profitability.

The ASIC case has progressed to a case management hearing on November 19 to discuss penalties.

Mr Hunter said in announcing the ASX delisting late year that US and Canadian customers made up the majority of GetSwift’s new customers and shareholders, and that a move overseas would better position the company to take on its global ambitions.

“We have made no secret of the fact that our customers and shareholders across North America have supported our focus on the region with increased business and continued investor support,” Mr Hunter said in announcing the move.

“Our focus on the world’s leading markets as we continue seeking growth in all regions is simply good business.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout