Facebook revenue falls short of expectations following privacy scandals

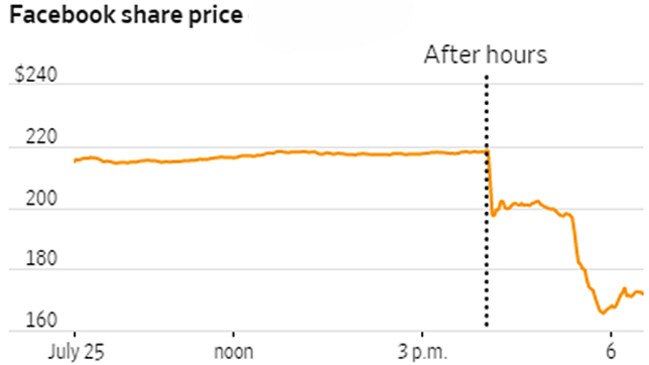

Facebook has pulled through all the negative headlines. Until today when its shares fell 23 per cent in after-hours trade, a plunge that would wipe $US130bn.

Facebook warned that its growth is slowing, sending its stock price plummeting as investors feared the social-media titan’s fortunes may not be immune to the multiple controversies it has faced this year.

After touching record highs earlier, Facebook shares dropped as much as 23 per cent in after-hours trading, a plunge that would wipe roughly $US130 billion from the company’s value if it holds when the markets open tonight. That would be more than the entire market value of McDonald’s although after-hours declines don’t always correspond to market prices the next day.

Facebook has shown few business effects from the negative headlines that have dogged it in recent months. But winding up a quarter during which its privacy practices stirred fresh controversy, the company late Wednesday reported slower-than-expected revenue growth for the period — albeit logging in at more than 40 per cent — and said it expected quarterly revenue growth to decline over the rest of the year.

The Menlo Park, California, firm also showed sluggish user trends in some of its most lucrative markets, including the US and Canada, in the second quarter.

Daily active users in the US and Canada measured at 185 million, flat with the first quarter and up slightly from a year earlier. Facebook’s daily user base in Europe edged down to 279 million accounts, from 282 million in the prior quarter. Facebook executives said that decline stemmed from a tough new European privacy law that went into effect in the second quarter.

Prior to Wednesday’s report, most analysts expected Facebook to continue its streak of impressive growth that seemed impervious to controversies about the platform’s operations.

For the second quarter, Facebook reported earnings per share of $US1.74, up from $US1.32 a year earlier. Revenue increased 42 per cent to $US13.23bn. Analysts, on average, expected earnings of $US1.72 a share on revenue of $US13.36bn, according to Thomson Reuters.

The last time Facebook missed analyst estimates for revenue was in the first quarter of 2015.

In a call with analysts, Facebook Chief Executive Officer Mark Zuckerberg called the results “another solid quarter” — but those comments were quickly overshadowed when other executives warned that tougher privacy laws, a shift toward less lucrative advertising products and currency headwinds would clip revenue growth.

They noted that revenue fell 7 per cent in the second quarter compared to the first three months of the year and said the company expected quarter-to-quarter revenue growth rates to decrease by “high single-digit percentages” in the second half of 2018.

The company also said its expenses would rise faster than revenue in 2019 and projected that its operating-margin percentages would be in the mid-30s over the next several years, due to higher spending on product and infrastructure. The second-quarter margin was 44 per cent.

The results “showed growth but geographically have pockets of softness,” said Daniel Ives, head of technology research at GBH Insights.

Facebook’s global reach and impact on the world have been under scrutiny since the 2016 US presidential election, when the social network attracted criticism for allowing fabricated news articles to flourish on the site.

Those issues intensified in March, when it suspended political analytics firm Cambridge Analytica for improperly accessing data from as many as 87 million Facebook users. That disclosure forced Mr Zuckerberg to testify in front of politicians on both sides of the Atlantic in early April.

On the call Wednesday, Mr Zuckerberg acknowledged that Facebook needed to invest more in security measures to prevent the platform from being manipulated. He also pledged that the company wouldn’t stop building new products “because that wouldn’t be the right way to serve our community and because we run this company for the long term, not for the next quarter.” Despite those controversies, advertisers broadly speaking have remained on the site, largely because there are few other outlets that can match its reach and ability to target narrow slices of consumers.

“It’s going to take a lot more than the scandals they have had to change to the way that advertisers are using their dollars,” said Aaron Goldman, chief marketing officer of marketing technology firm 4C Insights.

The support of advertisers was a key reason for continued investor enthusiasm for the stock. Before the after-hours plunge, Facebook’s share price was up 26 per cent since the Cambridge Analytica revelations in March.

Dow Jones Newswires