Coinbase calls for a new approach to cryptocurrency as government mulls its reforms

Australia’s laws should be rewritten to recognise crypto platforms rather than reinterpreted from existing frameworks, says Coinbase.

Australia’s laws should be rewritten to recognise cryptocurrency platforms and assets, rather than reinterpreted to cover the sector, industry heavyweight Coinbase says.

The federal government is currently considering whether to introduce laws that regulate cryptocurrency platforms, after Treasury wrapped up a consultation period late last year.

This would likely require platform providers to hold an Australian Financial Services Licence to operate.

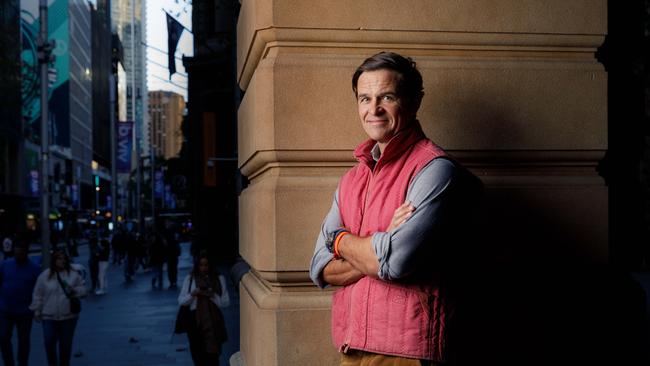

But Coinbase Asia Pacific managing director John O’Loghlen said new laws should treat cryptocurrency assets and infrastructure differently to existing financial services.

Mr O’Loghlen said there were “20 or so terms” which should be incorporated into the legislation, which could be introduced in the coming months.

The Coinbase boss and board member of industry group Blockchain Australia said it was critical to preserve existing arrangements around custody of digital assets, and that any attempt to force exchanges to hold assets locally was a “game breaker”.

Mr O’Loghlen said a local custody arrangement would reduce liquidity and “potentially be a security threat”.

“The entire raison d’etre of digital assets and decentralised money is around there being no single point of failure and no single point of weakness because of these global distribution networks and nodes,” he said.

Coinbase has pushed this point for years, particularly in its submissions in 2022.

But Mr O’Loghlen said although the underlying points of Coinbase’s messages had not changed, the audience had.

“I don’t think we’re making a comment on the quality of those public servants in a previous regime, but I do believe that they are very much better prepared for taking a hard look at this,” he said.

Federal Assistant Treasurer Stephen Jones said the government would bring crypto platforms “inside Australia’s financial services laws”, and that the government would mandate “specific obligations which take into account the nature of the platforms, of tokens, and their risks”.

“The existing AFSL framework will continue to apply to digital assets that are financial products,” he said.

“In addition, a new type of financial product will be created that covers the riskiest products in the digital asset space, including trading products and managed wallet products.”

Mr Jones said crypto providers would be “subject to the existing baseline requirements as financial service providers, together with a suite of obligations tailored specifically for digital asset businesses”.

Mr O’Loghlen said Coinbase believed regulators and Treasury were increasingly open to a dialogue about cryptocurrency and digital assets, but noted the pace of consultations was slower than 24 months ago.

“But I think now we’re seeing digital asset regulation coming back into the mainstream,” he said.

Mr O’Loghlen said the Australian Securities and Investments Commission had recently unveiled new leadership in its cryptocurrency team, and that the regulator was showing a “pretty significant change, at least in attitude and communication” to the crypto industry.

Speaking in March, ASIC commissioner Alan Kirkland said the regulator was keen about a “clear set of rules that maintain market integrity and mitigate the risks to consumers”.

But Mr O’Loghlen said the uncertainty surrounding the cryptocurrency sector was undesirable, and that the outcome of the rounds of regulation and consultation was now unlikely to land this year.

“It’s probably more likely early next year and I think most of the industry, including Blockchain Australia, would have liked that to have been completed already,” he said.

In addition to awaiting the outcome of the government’s law reform, the crypto industry is also watching closely the outcome of several court cases brought by ASIC against crypto players.

This includes Block Earner, which the Federal Court found was engaging in unlicensed financial services. Meanwhile ASIC is appealing against a finding that Finder Earn’s crypto saver product was not a financial product.

Bit Trade, which provides the Kraken crypto exchange, will also face court later this year after ASIC took aim over the company’s alleged failure to make a target market determination for customers, after providing a margin trading product.

Mr O’Loghlen said the crypto industry took the threat of legal action very seriously, but that the spectre of legal action amid a lack of regulatory bounds created uncertainty.

“It takes away a lot of resources and a lot of attention from what those companies are trying to do in their day job,” he said.

Mr O’Loghlen, who previously held senior roles at Chinese finance giant Ant Group and Alibaba, said the crypto industry was moving on from the poor behaviour that had been exposed in recent years, including the collapse of rival exchange FTX from massive fraud.

He said the industry faced “bad apples” but the recent spate of problems showed its evolution playing out over a “compressed” time and was leading to a cleaner sector.

“People continually say all crypto exchanges are fraudulent and have huge amounts of inherent risk. That’s just not a fair assessment,” Mr O’Loghlen said.

During the so-called crypto winter several exchanges collapsed and the price of some crypto assets plummeted.

But Mr O’Loghlen said there were “a bunch of green shoots” with a reinvigoration of the sector over the past 12 months.

Coinbase recently added two more staff to its local team, taking its total headcount to four.

“I would say all platform businesses, and particularly digital currency exchanges, are taking a more kind of sustainable approach to hiring,” Mr O’Loghlen said.

However, the industry faced a hardening approach from Australia’s banking sector, which has put in place blocks and go-slows on transactions to and from crypto platforms due to concerns over their use by fraudsters and scammers.

Mr O’Loghlen said crypto companies could play a role in the fight against scams, and that the planned $145.5m Digital ID scheme outlined by the Albanese government in the most recent budget could be built around the blockchain.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout