CBA backs Apate AI pilot program with bot developed to turn tables on scammers

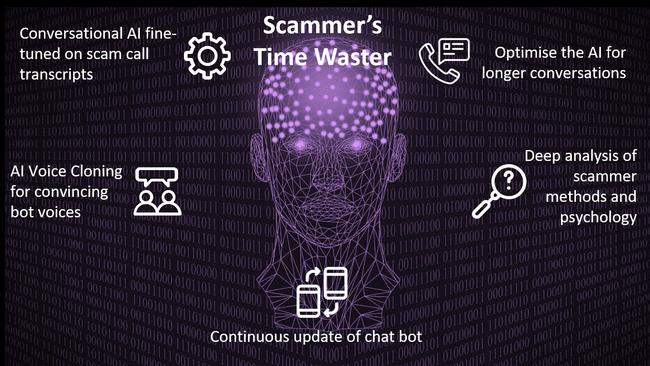

Commonwealth Bank is backing a pilot program developed by Apate AI that uses a bot to chase down scammers, retrieving their banking details and other identifiable information.

An Australian start-up might just change the way scammers are dealt with the world over, launching a service that not only wastes a scammer’s time but flips the transaction on its head.

Apate AI has launched several pilot programs that are intercepting scammer calls and slowly extracting information from them to collate and send back to financial institutions and national intelligence agencies, which are chasing them down.

This week, the Commonwealth Bank jumped on board to spearhead a local pilot, which the federal government has given $500,000 from the Department of Education’s Australian Economic Accelerator Ignite program.

The pilot will feed information from scammers back to CBA, which will use its own cybersecurity and intelligence teams to look for early threats and the beginning of new campaigns targeting its customers.

It is not only keywords or titles but the likes of bank details and other key identifiable information that the Apate AI bot will collect and provide to CBA.

James Roberts, the bank’s general manager of group fraud, said CBA was keen to test “how this AI solution could help bolster real-time scam intelligence sharing to disrupt scammers”.

“Most scams originate outside of the regulated banking system, and phone calls are a popular way that scammers make contact to steal people’s money,” he said.

“CommBank remains focused on collaborating across industries, ultimately to help make Australia less attractive to scammers.”

The pilot is one of the first major commercial offerings from Apate AI, which was founded a little over 12 months ago after a family picnic, when Macquarie University professor Dali Kaafar sought to toy with a scammer over speakerphone to make his children laugh.

That idea soon turned into a platform that could generate 102 personalities on the fly that sounded like humans of different ages and personalities to speak with scammers and prevent them from reaching real people.

The start-up’s initial premise was based around the fact that blocking a scammer’s call only led to them dialling another number and perhaps the best way to beat a scammer was to answer their call.

While humans weren’t the best at juggling scammers’ demands or fending off their threats, AI-powered bots could be, and they could refine their contact methods while doing so.

However, it’s the intelligence piece, with the bot able to learn about scammers during calls, that is providing an even larger commercial opportunity.

The pilot comes after Apate AI earlier this year discovered that scammers had begun a new type of campaign, impersonating lower-level staff from banks and other institutions to scam people.

Its campaign turned heads globally, with financial, insurance and telecommunications companies from Europe and the Middle East beginning to reach out.

One pilot running in the Middle East was intercepting as many six million calls a month, Professor Kaafar said.

To increase its reach, Professor Kaafar now has Apate’s AI agents able to speak with scammers in several languages, including Mandarin, Spanish, German, French, Polish, three English accents and 18 dialects of Arabic.

“Every single time a connection is made between a scammer and our bots, they’ll chat to a completely unique persona,” Professor Kaafar said.

“The only considerations that we’re having is just geographical, making sure that the bots speak the local language and are linked to the country the scammer is targeting.”

Comparatively, the CBA pilot was smaller, intercepting about 10,000 calls a day that telcos had blocked and redirected to a new platform that Apate AI would connect into, Professor Kaafar said.

The new pilot will leverage new parts of the platform that had been trained to identify campaigns and collate data from those calls.

“They would have been blocked and thrown away, but the whole idea is to adopt a different approach,” Professor Kaafar said. “We want them to waste their resources and time.”

Since it began last year, Apate AI has raised almost $1.5m, including $500,00 from the government and just under $600,000 in funding from the Office of National Intelligence.

One of its next areas is in social media, with an upcoming product being designed to work with WhatsApp messages and calls.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout