Buy now pay later firms will sink or swim in competition deluge

Afterpay shares could ‘potentially halve in value’ as the likes of Mastercard and Visa start to flex their muscle.

Australian buy now pay later darling Afterpay could soon see its wings cut, with one tech pundit predicting the buy now pay later (BNPL) disrupters will run out of steam.

According to Scott Galloway, professor of marketing at NYU Stern School of Business, Afterpay shares could potentially halve in value as the likes of Mastercard and Visa start to flex their muscle.

Professor Galloway recently shot to limelight for taking apart the business model of US office space company WeWork. Hailed as the latest tech ‘unicorn”, Professor Galloway’s scathing critique of WeWork’s prospects has been cited as one factor behind its failed IPO.

With WeWork out of the way Professor Galloway’s focus has now shifted to the BNPL sector and he said that Afterpay’s valuation of over $8 billion, 37 times its revenue, was difficult to reconcile.

Mastercard and Visa are valued at 18 times and 19 times revenue respectively.

“It’s suspect that Afterpay, whose clientele is Mastercard and Visa reject, should trade at twice the multiple of the credit cards.” he said in a YouTube video released last Friday.

“These stocks will likely be halved in the next 12 months as Visa rolls out its product and the entire market begins to shudder with yet another duopoly firm crushing competition.”

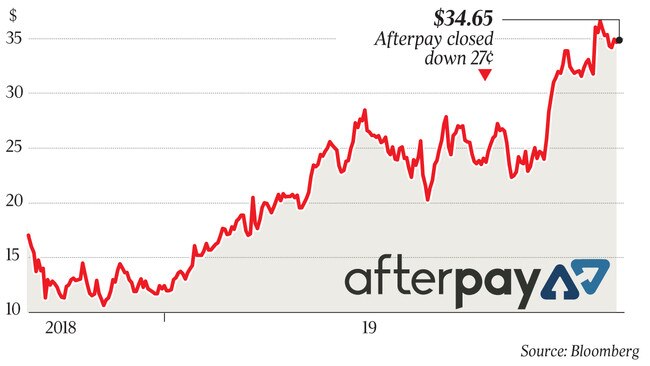

Afterpay shares, which last month hit a record high of $36.57, closed the session on Tuesday 0.7 per cent weaker at $34.65.

The company on Tuesday also announced the departure of director, former group head and co-founder David Hancock from Afterpay’s board. The move was flagged in July and Mr Hancock will remain with the company as a consultant

Mr Hancock was appointed group head at Afterpay in July 2017 and presided over two years of rapid growth for the company. The group head position was made redundant in June this year after a management reshuffle saw his fellow co-founders Anthony Eisen and Nick Molnar take on new roles.

Under the reshuffle, Mr Eisen would take on a combined CEO and managing director role, with Mr Molnar transitioning from the chief executive role to that of global chief revenue officer.

While Afterpay and its peers - Affirm and Klarna (backed by Commonwealth Bank) have seen strong adoption from consumers and retailers, Professor Galloway warned that traditional credit card companies can overtake with relative ease.

“Affirm, Afterpay and Klarna have smart businesses that capitalise on key consumer trends but they have one major problem – a lack of moats,” he said.

“An economic moat is a competitive advantage that allows companies to keep their competitors at bay for an extended period of time, examples include patents, proprietary technology or network effects.”

“But these (BNPL) disrupters have puddles rather than moats that credit card companies can likely breach and step over.”

According to Professor Galloway, the BNPL format is not necessarily new, with credit cards outside if the US already offering instalment payment options.

“In Brazil, 50 per cent of card payments are paid over instalments.”

In June, Afterpay shares slumped 15 per cent after Visa revealed it was testing its own BNPL offer and Professor Galloway said it was only a matter of time before Mastercard also decides to enter the fray.

He added that once the incumbents launch their products the likes of Afterpay and Klarna will no longer be able to rely on their savvy marketing to Millennials for continued growth.

“The key lesson here is that a smart product reformat, no interest payments and strong marketing aren’t enough to sustain companies against biggest incumbents.”

“They are trading at exceptional multiples, they should be making acquisitions and massively reinvesting in their businesses.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout