Blockchain technology: an explainer

Financial institutions have been experimenting with it for years, but what exactly is blockchain?

The ASX delivered a big vote of confidence for the relatively new technology which should lead to substantial cost and time savings, and perhaps usher in an era of closer co-operation for global exchanges.

But what exactly is blockchain?

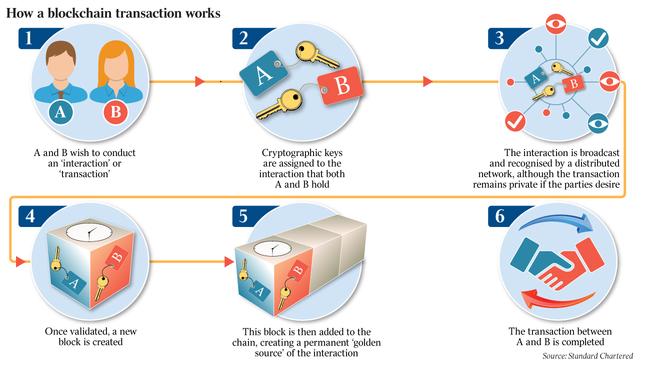

The technology, first conceptualised in 2008 by an anonymous person or persons known as Satoshi Nakamoto, is used most widely as the technology underpinning bitcoin, the wildly popular cryptocurrency that is now worth north almost $20,000 each. Blockchain is global online database that anyone with an internet connection can use, but it doesn’t belong to anyone. It’s a decentralised, fully digital and public record of records, known as blocks.

Each block contains transaction data, a timestamp, and a hash pointer as a link to a previous block. Importantly, the data in blockchains is impossible to be modified — it’s inherently secure.

Every record in the blockchain can be verified by the entire community, as opposed to being owned by a centralised authority. Effectively the data becomes transparent to everyone involved.The banks have been experimenting with the technology for years now, as the efficiencies outweigh any fears institutions have about implementing something still nascent.

CommBank for example has been looking at how it can use blockchain for years, and has appointed a head of blockchain, Sophie Gilder, to lead a team experimenting with how the bank can best use it.

“The bond market today is relatively inefficient. There’s many, many intermediaries in the middle, and there’s a lot of time, cost, and error. We decided that we would look at how blockchain could change this market,” Ms Gilder told a conference this week.

“If we could put (shares and bonds) on a blockchain so they’re more readily transferable, programmable and there’s less intermediaries, we can make it market faster, cheaper, more efficient.”

And, earlier this year ANZ and Westpac successfully used blockchain instead of paper for bank guarantees on commercial property leasing. They said using blockchain resulted in a single source of information, meaning reduced potential for fraud and increased efficiency.

The move to blockchain came after the ASX was affected by a massive hardware failure in 2016, which saw trading halt for most a full day.

The ASX’s managing director and Dominic Stevens said replacing the ageing CHESS system — developed in the 1990s — with blockchain made sense, and was the culmination of a two and a half year process.

“We believe that using DLT (distributed ledger technology) to replace CHESS will enable our customers to develop new services and reduce their costs, and it will put Australia at the forefront of innovation in financial markets,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout