Australian phone sales dive due to over-the-top prices: Telsyte

The spiralling cost of premium units is being blamed for a dive in smartphone sales in Australia.

The spiralling cost of premium phones has been blamed for a dive in smartphone sales in Australia in the second half of 2019.

Emerging technology analyst firm Telsyte says smartphone sales dropped to 4.3m units during the period; 5 per cent less when compared to the same period in 2018.

It says it is evidence that the cost of premium handsets is continuing to weigh on buyers.

Its Australian Smartphone & Wearable Devices Market Study 2020 found that both Apple (-3 per cent) and Android (-6 per cent) sales fell during the six month period.

The larger drop in Android sales saw Apple’s market share against Android increase marginally by 0.7pc to 42.2pc, compared to Android 57.6pc.

Telsyte found the iPhone 11 and iPhone 8 were the two most popular models among Apple buyers due to affordability, making up around 40 per cent of iPhone sales.

Replacement cycles is another factor affecting sales. Telsyte says the average replacement cycles for smartphones has reached three years, up from 2.8 years 12 months ago. The figure is even higher (3.3. years, up from 2.9 years) among mid-range ($300-$599) smartphone owners.

In the past, consumers often bought new phones every two years. However in 2020, it seems the phones of 2018 still have more than enough features for many users.

Top sellers

Telsyte’s top three Android vendors in the second half of 2019 remained Samsung, OPPO and Huawei, with sales driven by continued demand of devices priced between $300 and $1,000, and heavy discounts during Black Friday and holiday sales on premium models such as the Samsung Note 10.

However Telsyte said sales of Huawei smartphones in 2H19 declined by more than 20 per cent when compared to the same period in 2018.

Telsyte expects a continued downturn for Huawei in Australia as new models such as the Huawei Mate 30 Pro are not expected to support Google Mobile Services.

Telsyte said more Australians were buying second hand and refurbished smartphones, given the high cost of new handsets.

It said the percentage of consumers buying second hand and refurbished smartphones had more than doubled to around 10 per cent in 2019, from less than 5 per cent in 2016. This was especially the case for Apple, with more than 15 per cent of iPhones purchased in 2019 second-hand or refurbished.

It says the rising demand of used or second-hand iPhones highlights a gap in the market, after the “budget” iPhone SE stopped being sold at Apple stores in September 2018.

Telsyte Managing Director, Foad Fadaghi, says there is a gap in the Apple line up which it needs to address to continue to grow iCloud, Apple Music, Apple TV+, and other services sales.

“Apple needs to revisit its lower-end smartphone strategy, given the importance to its services-based income,” Fadaghi says.

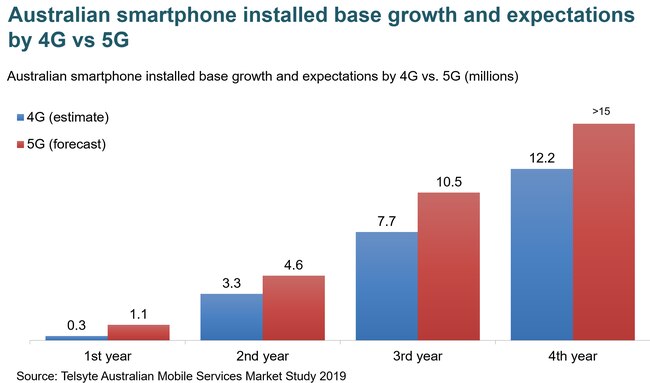

There is some good news for handset vendors. Telsyte estimates annual sales of smartphones could potentially reach peak 2017 levels if more sub-$1,000 5G devices become available and Apple releases at least one 5G iPhone model.

“Apple is primed to have a strong year similar to when it first released its plus-sized handset, if it delivers a 5G model” says Telsyte Senior analyst Alvin Lee.

The research body found that consumers regard 5G coverage as important when choosing their next smartphone. It says two thirds (66pc) of Australians aged over 16 who plan to buy a smartphone in 2020, want to purchase a 5G handset.

It says about 20pc of smartphones in use are at least five years old, showing that the market is ripe for upgrades.

Telsyte says it believes consumer 5G motivations are primarily based on “future-proofing” and being ready to use new apps such as cloud gaming.

But of those likely to buy a 5G smartphone as their next handset, an overwhelming 71 per cent are not willing to spend more than $1,000.

The survey also found that smart wearable and wrist technologies are becoming more sought after, and that consumers are increasingly comfortable with wearables given the benefit of convenience alongside their health and fitness features.

Telsyte’s study found that 1.2 million smart wrist wearables (smartwatches and smart wristbands combined) were sold in the second half of 2019, up 15 per cent from just over a million a year ago.

More than 900,000 units were sold during the measured six months, an increase of 29 per cent.

It says the increase is mainly driven by the adoption of smartwatches with more than one-in-five smartphone owners now pairing one to their phone.

Apple remains the leader in the smartwatch market with around half share of total smartwatches sold during the 6 months period.

Telsyte research found that Apple Watch series 3 (including all variations of series 3) rather than the current series 5 was the most popular choice, mainly due to the attractive price point for many first-time users.

Samsung was the second clear winner in the smartwatches market with sales increasing by more than 150 per cent in a year. Telsyte puts that down to the promotional giveaways of Galaxy Buds when the Galaxy Watch Active2 was released in October 2019.

The survey found that the new category of “smart hearables” has been growing strongly since 2017.

Smart hearables are wireless earbuds and headphones that include smart features such as supporting digital assistants, voice activation, and deeper integration with smartphone and smartwatch apps.

The study found that 16pc of smartphone users were using smart hearable devices at the end of December 2019.

Playing tag

Meanwhile, Telsyte said it had identified an emerging market in location tracking tags, which help consumers find their property using smartphone apps. It said at least 30 per cent of Australians had lost, or had difficulties finding, their personal belongings such as keys, wallets, and remote controls.

Telsyte estimated that at the end of 2019, almost a million Australians were already using location tracking tags such as Tile Mate and Telstra Locator tags

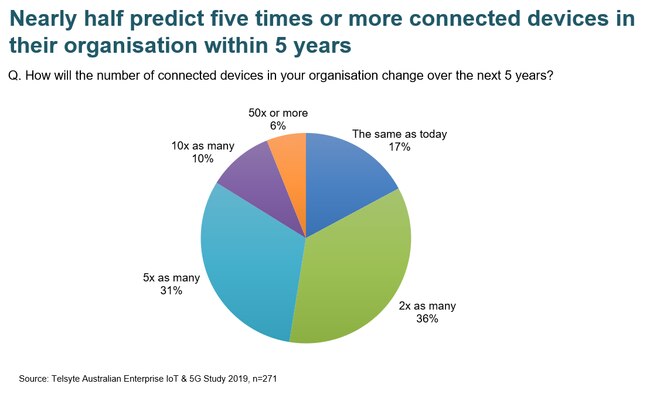

It said tracking technology would also strongly appeal to businesses, as organisations of all sizes address their asset security and management challenges.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout