Are we finally bored of Bored Ape Yacht Club, which sold a NFT monkey to Justin Bieber for $1.7m

ApeCoin has fallen sharply, raising concerns over the future of the world’s hottest NFT project and its smug-looking monkeys that caught Justin Bieber’s eye.

The world’s hottest non-fungible token project has delivered its NFT holders a low, with its new cryptocurrency sinking as much as 15 per cent from its peak price.

ApeCoin, a cryptocurrency on the ethereum blockchain launched by APE DAO (decentralised autonomous organisation) and linked to the Bored Ape Yacht Club NFT series, fell from a high of $US39.40 ($52) to a low of $US6.20, sitting around $US11.90 at the time of writing.

While the Web3 space has long been likened to the wild west, those in the industry know the space bears a better resemblance to something out of Planet Of The Apes thanks to Bored Ape Yacht Club.

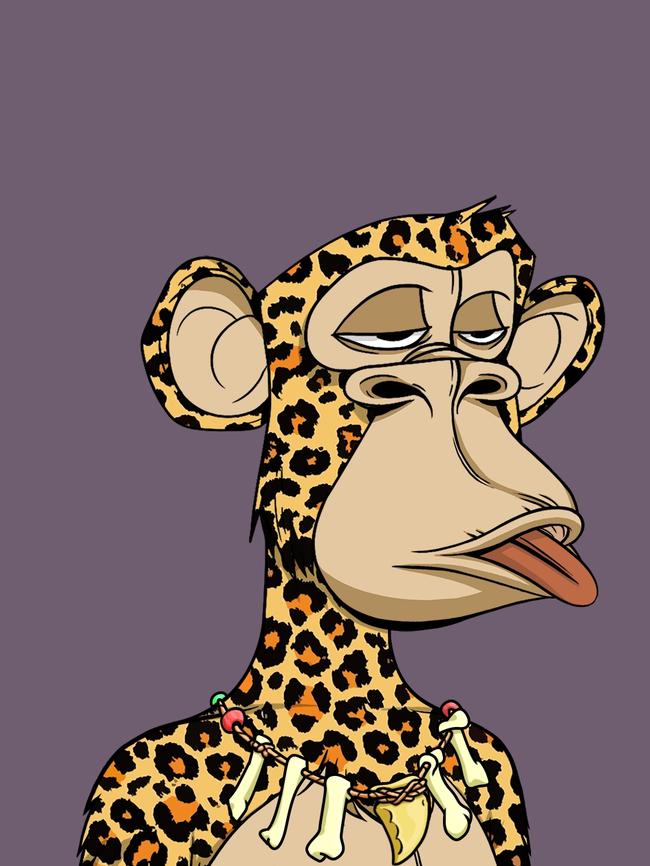

The NFT project, a collection of 10,000 computer-generated ape NFTs designed by Yuga Labs which draw from 170 individual characteristics, has drawn interest from some of the world’s highest-profile investors and celebrities including Justin Bieber who bought Bored Ape number #3001 for a reported $US1.3m.

Sold on the NFT marketplace OpenSea, home of The Australian’s own NFT series based on its annual 250 Rich List, BAYC has long dominated the NFT market and today has a starting price of 111 Ethereum ($491,782).

So when ApeCoin launch last month, BAYC NFT holders had high expectations for the coin which is expected to power a metaverse project Yuga Labs is set to launch later this year. The board of APE DAO includes high profile Web3 personnel including Reddit co-founder Alexis Ohanian and the chief financial officer of cryptocurrency exchange FTX Amy Wu.

But the future of the BAYC series has been plagued by doubt caused over the drop in value of the ApeCoin, phishing scams and the project’s Discord chat being hacked.

Last week Taiwanese pop icon Jay Chou reported his BAYC NFT being stolen via a phishing scam. The NFT was reportedly later sold for $US500,000. Chou’s theft follows a hacking attack on the OpenSea platform in February which saw 254 NFTs valued at $US1.7m stolen.

UNSW Business School technology lecturer Eric Lim said the price of ApeCoin would no doubt effect the value of BAYC NFTs.

“The ApeCoin is meant to be a governance token to manage the DAO of the BAYC project. It will definitely affect the valuation of the project that it is meant to govern,” Dr Lim said.

Dr Lim remained confident about BAYC, despite ApeCoin’s value. “It is still a very exclusive club and many people will want to be in it.

“It is possible the cause of the price drop could be from the recent hack of the smart contract of the BAYC project leading to the theft of at least one ape. But I doubt that is the cause of the price drop. The weakness of the Ape tokens and the speculation around surrounding it is not healthy for the BAYC community.”

STAY SAFE. Do not mint anything from any Discord right now. A webhook in our Discord was briefly compromised. We caught it immediately but please know: we are not doing any April Fools stealth mints / airdrops etc. Other Discords are also being attacked right now.

— Bored Ape Yacht Club (@BoredApeYC) April 1, 2022

When ApeCoin was released, owners of its NFT series BAYC as well as its spin-off series Mutant Ape Yacht Club received a healthy sum of the new coin, earning 10,000 ApeCoin per BAYC NFT and 2000 per MAYC NFT.

Australian NFT collector Joan Westenberg, who owns hundreds of NFTs and admits “most of them are worth not much at all”, received $20,000 worth of ApeCoin in the drop.

Ms Westenberg said she was optimistic that the NFT series would remain strong and the price of the coin should pick back up.

“I think the price drop has nothing to do with the hacking scandals, rather people speculating in other areas,” she said. “Ethereum has had strong growth and some people may have been cashing out of ApeCoin. With any token there’s always going to be spikes.”

Dr Lim said the future of ApeCoin will depend on its community.

“We know that 42 per cent of the success of ventures can be attributed to timing,” Dr Lim said.

“The valuation of the ape coin is a reflection of how involved the community wants to be in deciding how the project will evolve in the future. If there is little interest in doing the hard work of evolving the project, it is a signal that the project’s success will be transient. This could create selling pressure from speculators of the NFTs who see this as a signal to offload their assets for a profit.”

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout