Apple’s bid to kill payments terminals

The world’s largest tech company is increasingly looking like a fintech, launching its own credit card and now an offering aimed at Australian small businesses.

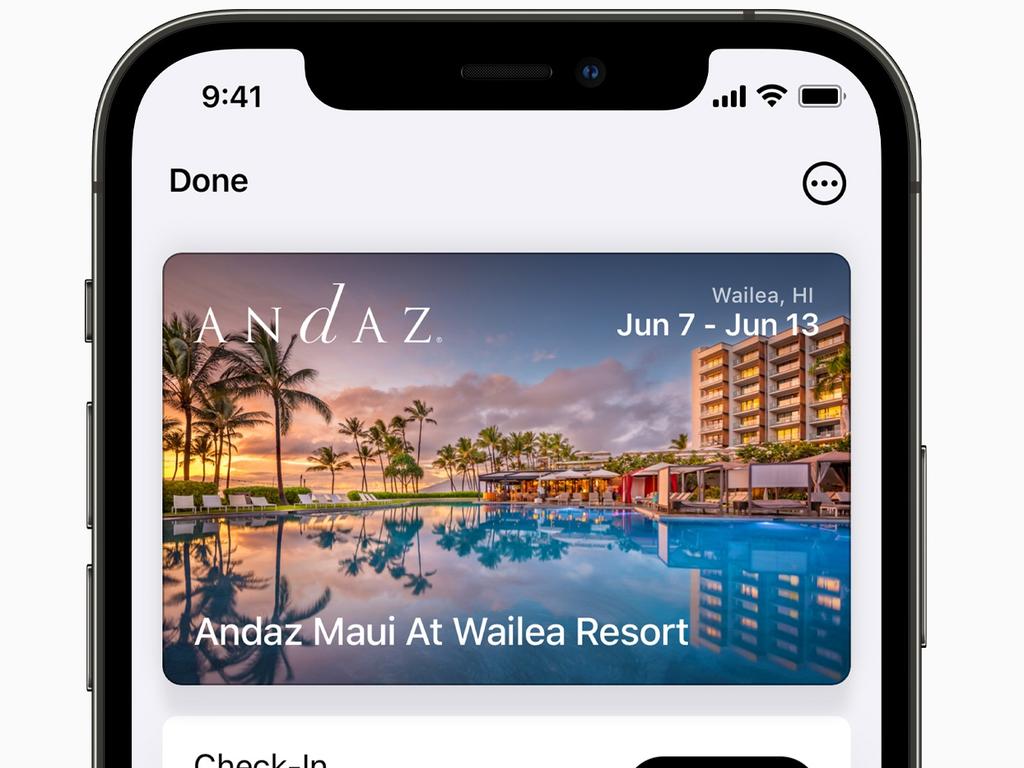

Tech giant Apple on Wednesday switched on new functionality allowing businesses to accept contactless payments using just an iPhone, partnering initially with Westpac and Tyro with other partners including ANZ, Till Payments and Zeller to come.

The new feature, dubbed Tap to Pay on iPhone, lets businesses including tradies, market stall holders and delivery drivers use their iPhone to accept payments from digital wallets including Apple Pay as well as contactless debit and credit cards without needing additional hardware or payment terminals.

Businesses need a compatible iPhone running iOS 16.4 or later, along with a compatible payment platform which at this stage is either Westpac or Tyro.

Australia has become one of the top markets globally for Apple Pay since its launch in 2015, the company says, and is now supported on more than 99 per cent of terminals nationally. The company says that small and medium-sized businesses in particular have complained about needing extra hardware to be able to accept payments, and now instead can use the iPhone they likely already have.

Westpac’s consumer and business banking boss Chris de Bruin said that the partnership meant any business could be accepting contactless payments in minutes.

“The advantage for us being a bank rather than a tech provider is we don’t have to settle payments through a bank overnight, we just settle with ourselves in real-time, and the partnership with Apple is really about getting this functionality live with customers across the country so people can use it,” he said.

“Apple are tough negotiators so we had a good arm wrestle around the terms, but we’re very happy that we’ve arrived at a point where we can offer really good value for customers with a with a simple price point. That is good for our customers.

“We’ve been testing this and have had some very good feedback from customers whether they’re at stores in the market, or traders who are meeting their clients and want to be mobile. They’ve said it’s excellent for them because they don’t want to rent an extra device or carry around two devices all the time.”

Apple made waves when it announced a savings account with a 4.15 per cent interest rate last month, in partnership with investment bank Goldman Sachs, leading to questions whether the world’s largest tech company is now a fintech.

Apple has not yet announced any plans for releasing its Apple Card credit card or the linked savings account in Australia, and The Australian understands the company has no plans to bring those products Down Under.

A spokeswoman said additional payment platforms and apps for ‘Tap to Pay’ including ANZ Worldline Payment Solutions, Stripe, Till Payments, and Zeller will become available for businesses in coming months.

Banks including the Commonwealth Bank have called for new regulatory powers to regulate Apple, given Apple Pay’s popularity in Australia, amid a Senate economics committee probe into the market power of Big Tech. The banks have said that Apple Pay restricts their own apps from making contactless payments directly, and they’re also concerned about the growing level of fees they pay to Apple.

Estimates suggest Apple makes more than $110m in annual fees from Australian banks.

The Labor government announced in December it would make changes to the Payment Systems (Regulation) Act so the Reserve Bank could regulate digital wallets and other payment systems including cryptocurrency.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout