Amazon workers earn cash bonuses

Amazon’s local staff members will receive cash payments of up to $2000 for their work during the pandemic.

Hello and welcome to The Download, The Australian’s technology blog for the latest tech news.

1.30pm: Amazon workers to receive cash bonuses

Amazon Australia said on Friday it would reward its front-line employees and partners with a ‘Thank You bonus’ for their work during the COVID-19 pandemic.

“Those who have been preparing orders in one of Amazon Australia’s fulfillment centres, delivering order to customers’ homes, or one of the many roles in between will receive a bonus of up to $2,000,” a spokesman told The Australian.

Amazon Australia Director of Operations Craig Fuller said, “I’m proud of our team of Amazon Associates and Amazon Flex delivery partners who have remained dedicated to serving our customers so they can stay home and stay safe during this unprecedented time. Thank you for your ongoing commitment.”

Earlier today Amazon posted the biggest profit in its 26-year history as online sales and its lucrative business supporting third-party merchants surged during the pandemic.

9.30am: Amazon and Facebook post big profits, Alphabet sales drop

The pandemic has had a big impact on tech stocks. Facebook and Amazon did incredibly well in the second quarter, but Google’s parent Alphabet experienced a drop in sales for the first time, due to Google ad cutbacks in the pandemic.

Amazon posted the biggest profit in its 26-year history as online sales and its lucrative business supporting third-party merchants surged during the pandemic. Shares of Amazon rose 5pc in after-hours trade.

While rival brick-and-mortar retailers have had to shut stores during government-imposed lockdowns, Amazon hired 175,000 people in recent months and saw demand for its services soar. The company said revenue jumped 40pc from a year earlier to $US88.9bn ($123.56bn).

Amazon had forecast it might lose money in the just-ended second quarter because it expected to spend some $4 billion on protective equipment for staff and other expenses related to COVID-19. It did just that – and still earned $5.2 billion – double its net income from a year prior.

Facebook meanwhile smashed estimates for its quarterly revenue. The surge was due to businesses using its digital advertising tools to tap a spike in online traffic during the pandemic. Shares jumped 7pc in extended trading.

Ad sales, which contribute nearly all of Facebook’s revenue, rose 10pc to $US18.3bn in the second quarter. Monthly active users rose to 2.7 billion, ahead of estimates of 2.6 billion.

Facebook projected that ad revenue for the third quarter is likewise expected to grow faster than Wall Street estimates.

Although it would have lost some revenue, Facebook’s fortunes were not dented, at this stage, by the 1100 companies taking part in a boycott to force Facebook to take action against hate speech and misinformation online.

Alphabet/Google Was not so lucky, with quarterly sales falling for the first time in 16 years as a public company. However it’s 2pc slide was less than expected, with advertisers sticking with the online search engine during the pandemic.

Its advertisers suffered mass lay-offs and other cutbacks during the pandemic, and marketing budgets are often the first to get slashed especially by big clients like travel search engines, airlines and hotels.

Reuters

9.10am: TikTok sued by rival Triller

TikTok, the popular short-form video app, has been sued by rival Triller, which accused it of infringing its patent for stitching together multiple music videos with a single audio track.

Triller said in a complaint filed this week that TikTok and its Chinese-owned parent ByteDance Ltd wilfully infringed the June 2017 patent by importing and selling its app for iPhones and Android-based smartphones.

The complaint was filed with the US District Court for the Western District of Texas, which includes Austin. It focuses on “Green Screen Video,” a feature TikTok rolled out last December that lets users shoot multiple videos and synchronise them with an audio track.

Triller is based in Los Angeles, and became known for its focus on hip-hop music.

It is seeking an injunction against further infringements plus unspecified damages from TikTok, which has offices in Austin.

TikTok did not immediately respond to requests for comment.

TikTok’s Chinese ownership has drawn attention from the White House and US lawmakers, raising privacy and national security concerns including whether user data might be shared with the Chinese government.

The company has said it has never given user data to China, and would not if asked.

TikTok downloads have surpassed 2 billion worldwide.

Reuters

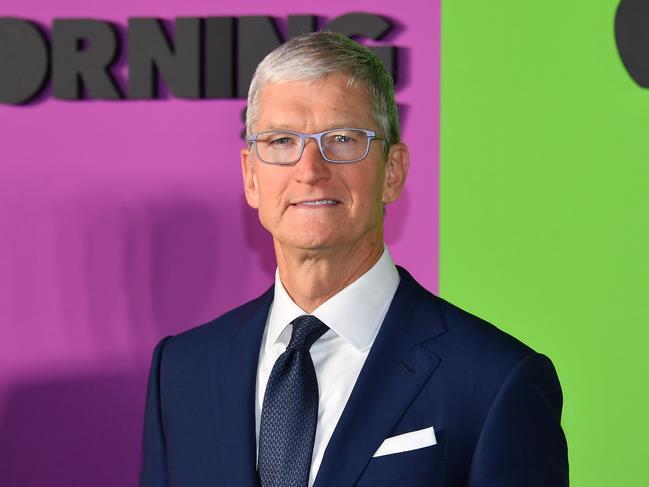

8.50am: Apple earnings surge

Apple showed the technology industry’s resilience amid the pandemic, reporting a better-than-expected 11pc increase in quarterly sales from a year earlier as it benefited from strong demand for apps and work-from-home devices and avoided a downturn in its iPhone business.

The tech giant posted revenue in its fiscal third quarter of $US59.69bn ($82.97bn), even as a new wave of coronavirus outbreaks across the U.S. led the company to again close stores. Profit rose about 12pc to $US11.25bn, or $2.58 a share.

Tech giants Amazon, Facebook and Google also reported earnings.

The results exceeded analysts’ expectations of $US52.24bn in revenue for the three months ended June 27. Apple and its tech peers have outperformed other industries up-ended by the pandemic because of their roles providing the goods and services people have turned to as they work remotely and spent less time venturing outside the home.

Apple officials said demand across all of the company’s products exceeded expectations in May and June. Chief Executive Tim Cook credited the showing to a strong launch of the iPhone SE in April, economic stimulus measures from countries worldwide and the lifting of stay-at-home restrictions.

“There were a lot of things going in the right direction,” Mr. Cook said.

Apple will delay its annual September update to its iPhone line-up by a few weeks, finance chief Luca Maestri said, pushing the release into October from late September. The company has faced manufacturing challenges stemming from plant closures and travel restrictions to China that have delayed a ramp-up in iPhone production.

Apple also said its board approved a four-for-one stock split, aiming to make the stock more accessible to a wider investor base. On Thursday, before the financial report, shares closed at $US384.76.

Shares rose 6pc in after-hours trading. The company’s stock price has gained more than 31pc since the start of the year, adding more than $350 billion in market value.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout